Last updated on

Sep 27, 2024

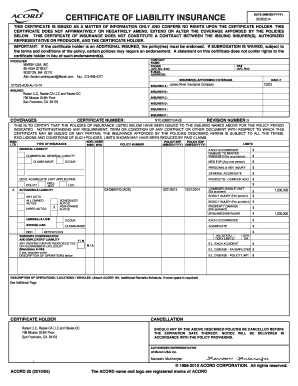

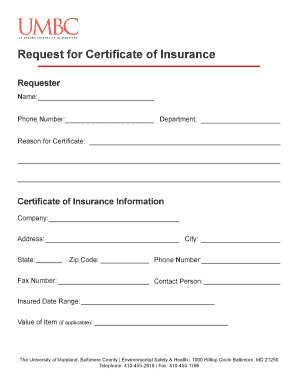

Customize and complete your essential Certeficate Of Insurance Request template

Prepare to streamline document creation using our fillable Certeficate Of Insurance Request template. Create exceptional documents effortlessly with just a few clicks.

Spend less time on PDF documents and forms with pdfFiller’s tools

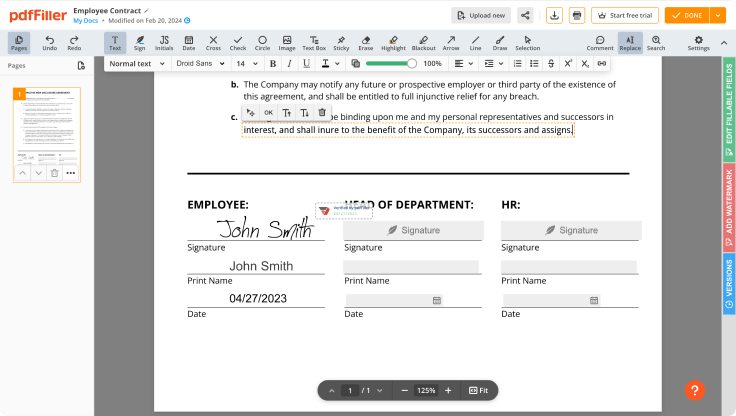

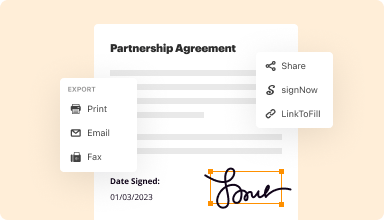

Comprehensive PDF editing

Build documents by adding text, images, watermarks, and other elements. A complete set of formatting tools will ensure a polished look of your PDFs.

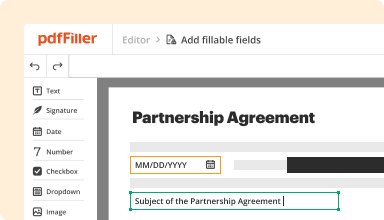

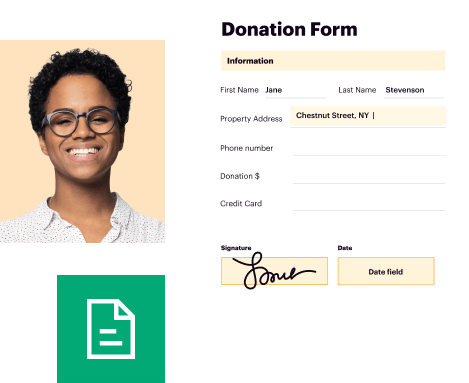

Fillable fields

Drag and drop fillable fields, checkboxes, and dropdowns on your PDFs, allowing users to add their data and signatures without hassle.

Templates for every use case

Speed up creating contracts, application forms, letters, resumes, and other documents by selecting a template and customizing it to your needs.

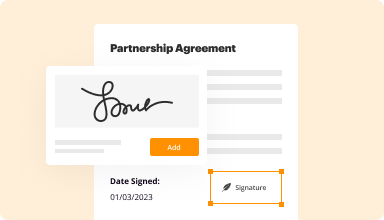

Electronic signature

Instantly sign any document and make it easy for others to sign your forms by adding signature fields, assigning roles, and setting a signing order.

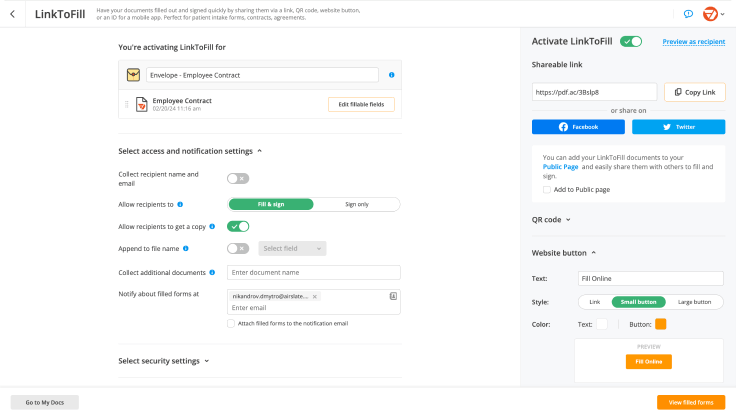

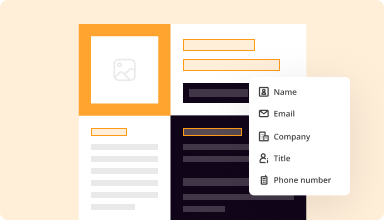

Online forms

Publish fillable forms on your website or share them via a direct link to capture data, collect signatures, and request payments.

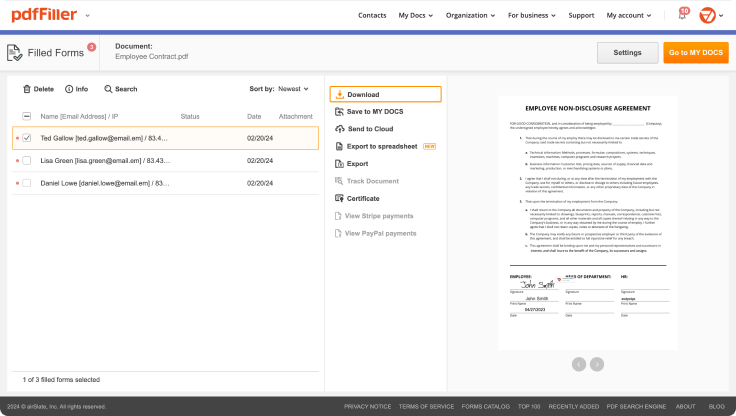

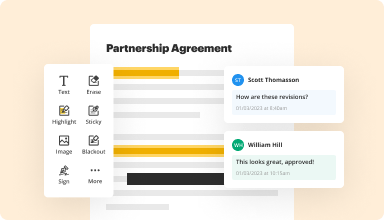

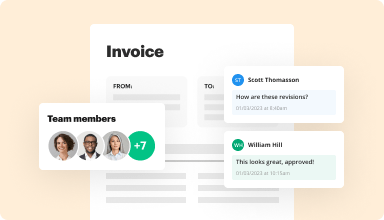

Easy collaboration

Work on documents together with your teammates. Exchange comments right inside the editor, leave sticky notes for your colleagues, highlight important information, and blackout sensitive details.

Millions of users trust pdfFiller to create, edit, and manage documents

64M+

million users worldwide

35M+

PDF forms available in the online library

53%

of documents created from templates

65.5K+

documents added daily

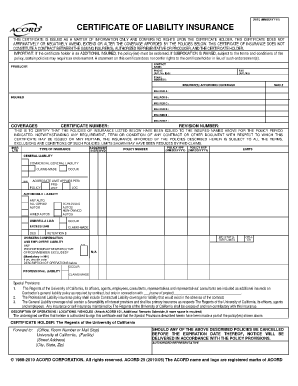

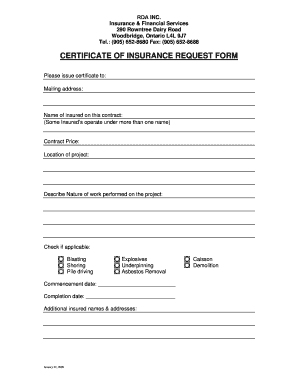

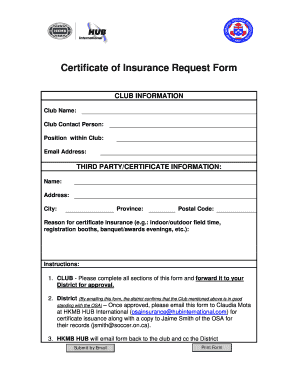

Customize Your Certificate of Insurance Request Template

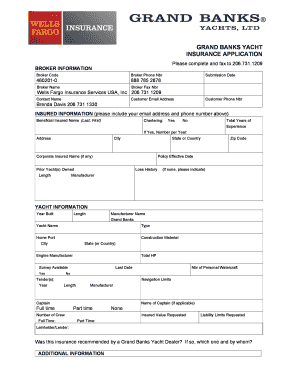

Create a tailored Certificate of Insurance (COI) request template that meets your business needs. This feature allows you to ensure that your insurance requests are clear, accurate, and professional, helping you streamline communication with clients and vendors.

Key Features

Easy-to-use template builder

Personalizable fields for various insurance details

Option to save and reuse templates

Integration with existing insurance management systems

Printable and shareable formats

Potential Use Cases and Benefits

Businesses can create customized requests for their insurance needs, promoting better clarity in communication.

Real estate agents may request COIs from contractors to ensure compliance and protect their interests.

Event organizers can collect COIs from vendors to secure venues and manage risks effectively.

Nonprofits can simplify the process of obtaining insurance coverage from multiple service providers.

This feature addresses common frustrations with generic COI requests, which often lack important details. By using a customized template, you can reduce misunderstandings, save time, and improve your overall efficiency. Embrace clarity and confidence in your insurance processes today.

Kickstart your document creation process

Browse a vast online library of documents and forms for any use case and industry.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Our user reviews speak for themselves

Your go-to guide on how to create a Certeficate Of Insurance Request

Creating a Certeficate Of Insurance Request has never been easier with pdfFiller. Whether you need a professional document for business or personal use, pdfFiller offers an intuitive platform to generate, modify, and manage your paperwork efficiently. Utilize our versatile and editable web templates that align with your precise demands.

Bid farewell to the hassle of formatting and manual editing. Employ pdfFiller to easily craft accurate forms with a simple click. Start your journey by following our comprehensive instructions.

How to create and complete your Certeficate Of Insurance Request:

01

Create your account. Access pdfFiller by signing in to your profile.

02

Search for your template. Browse our extensive library of document templates.

03

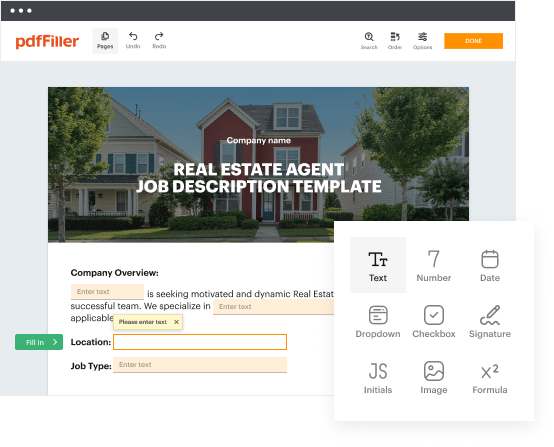

Open the PDF editor. When you have the form you need, open it up in the editor and utilize the editing instruments at the top of the screen or on the left-hand sidebar.

04

Place fillable fields. You can pick from a list of fillable fields (Text, Date, Signature, Formula, Dropdown, etc.).

05

Edit your form. Include text, highlight areas, add images, and make any required adjustments. The user-friendly interface ensures the process remains easy.

06

Save your changes. When you are happy with your edits, click the “Done” button to save them.

07

Submit or store your document. You can deliver it to others to eSign, download, or securely store it in the cloud.

To conclude, creating your documents with pdfFiller templates is a straightforward process that saves you efforts and ensures accuracy. Start using pdfFiller today to benefit from its robust features and seamless paperwork management.

Ready to try the award-winning PDF editor in action?

Start creating your document in pdfFiller and experience firsthand how effortless it can be.

Questions & answers

Below is a list of the most common customer questions.If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

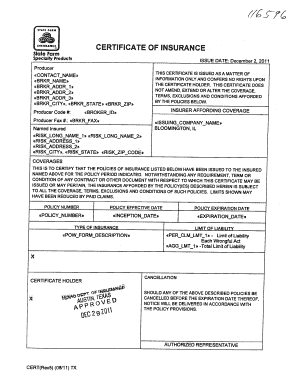

What is the purpose of the certificate of insurance?

A certificate of insurance (COI) is a document issued by an insurance company or broker. The COI verifies the existence of an insurance policy and summarizes the key aspects and conditions of the policy.

How to make a coi?

As such, you only have the power to obtain a COI from your agent or broker and submit it. You are not authorized to create or certify one. You can't even sign it. Your insurance agent should be the only person who supplies your COI.

Why would someone ask for a certificate of insurance?

Both businesses and individuals ask for certificates of insurance. They do so in order to verify that someone has an adequate amount of insurance coverage in place to protect their business and assets.

Why do vendors need a certificate of insurance?

Your business uses these to ensure that the insurance requirements in a contract are met; that the vendors are carrying protections that move any risk they generate off of your risk blotter and onto theirs.

Why are certificates of insurance requested?

It serves as verification that your business is indeed insured. Potential clients may request a COI as a condition of doing business with you.

Can I issue my own certificate of insurance?

Insureds don't have the authority to issue their own certificates. The agent, under contract with the carrier, issues a COI on behalf of the insurer. Talk to your companies…

Why do companies request a coi?

A COI is used to verify that a company has the appropriate insurance coverage in place. This can be especially important for businesses that work with government agencies or other organizations that require coverage verification. Peace of mind.

How do I generate a certificate of insurance?

Call your broker, explain to them what the minimum coverage amount is and that you need proof of insurance. If your policy already meets the requirements, then the broker will contact your carrier to secure the COI.

How do I get my coi?

A COI request form is relatively straightforward: most of the time, you can simply email or call the insurance company and ask for it. This COI will include a lot of important and confidential information, so the company will probably ask you a few questions to verify your identity.

How to get an insurance certificate?

In most cases, you can get your documents by contacting your insurer directly and asking them to send your insurance certificate either via email or post. You may also want to consider sending them an insurance questionnaire to fill out on your behalf.

What is a COI and how do I get one?

A COI is a statement of coverage issued by the company that insures your business. Usually no more than one page, a COI provides a summary of your business coverage. It serves as verification that your business is indeed insured. Potential clients may request a COI as a condition of doing business with you.

What constitutes a COI?

A conflict of interest (COI) exists when an individual or institution has two or more obligations or interests that may compete with each other. Conflicts can be financial or non-financial. For the purposes of this document COI refers to an individual's financial COI (institutional COI is briefly discussed in FAQ #5).

What is COI format?

The COI verifies the existence of an insurance policy and summarizes the key aspects and conditions of the policy. For example, a standard COI lists the policyholder's name, the policy's effective date, the type of coverage, policy limits, and other important details of the policy.

Who generates a certificate of insurance?

Certificates of insurance are typically issued by an agent or broker for the named insured and lay out the coverages (and importantly, any exclusions) written for the insured. They represent a specialized summary of policy information, and they change, based on the type of policy they are summarizing.

What is a certificate of insurance in Canada?

It's a document that verifies the existence of insurance coverage under specific conditions granted to listed individuals. When learning what a COI entails, it is important to note that a COI is not a formal contract between the two parties. It is an informational document showing proof of insurance. What is a Certificate of Insurance (COI)? - inews what-is-a-certificate-of-insurance inews what-is-a-certificate-of-insurance

What is insurance certificate when buying a house?

A Certificate of Insurance provides information about the types of insurance policies that the insured party holds. This information includes the insurance company's name, policy number, and policy effective dates. It also includes details of the coverage limits and the types of covered risks. Certificate of Insurance in Ontario | What is a COI? - ThinkInsure ThinkInsure insurance-help-centre ce ThinkInsure insurance-help-centre ce