Last updated on

Sep 27, 2024

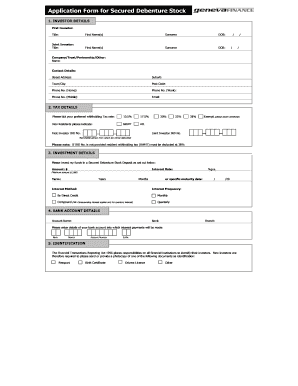

Customize and complete your essential Collateral Debenture template

Prepare to streamline document creation using our fillable Collateral Debenture template. Create exceptional documents effortlessly with just a few clicks.

Spend less time on PDF documents and forms with pdfFiller’s tools

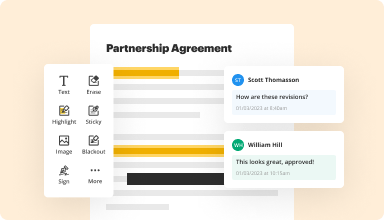

Comprehensive PDF editing

Build documents by adding text, images, watermarks, and other elements. A complete set of formatting tools will ensure a polished look of your PDFs.

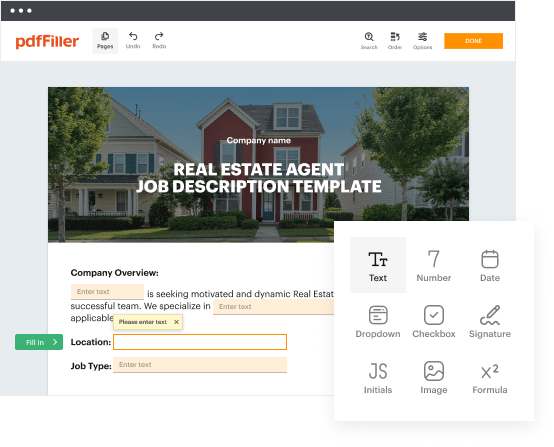

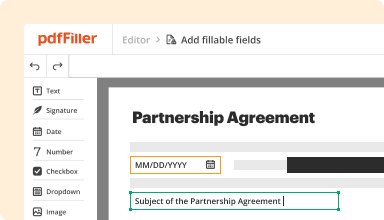

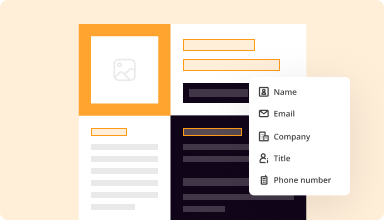

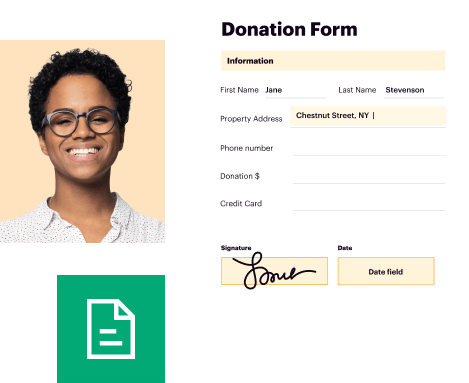

Fillable fields

Drag and drop fillable fields, checkboxes, and dropdowns on your PDFs, allowing users to add their data and signatures without hassle.

Templates for every use case

Speed up creating contracts, application forms, letters, resumes, and other documents by selecting a template and customizing it to your needs.

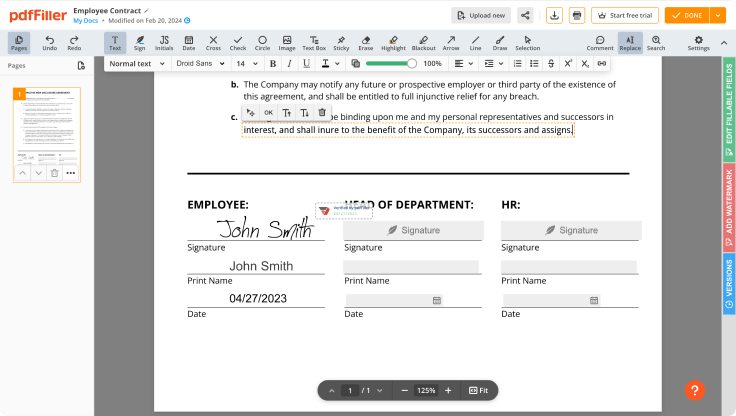

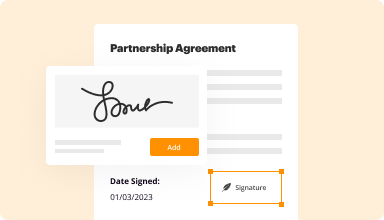

Electronic signature

Instantly sign any document and make it easy for others to sign your forms by adding signature fields, assigning roles, and setting a signing order.

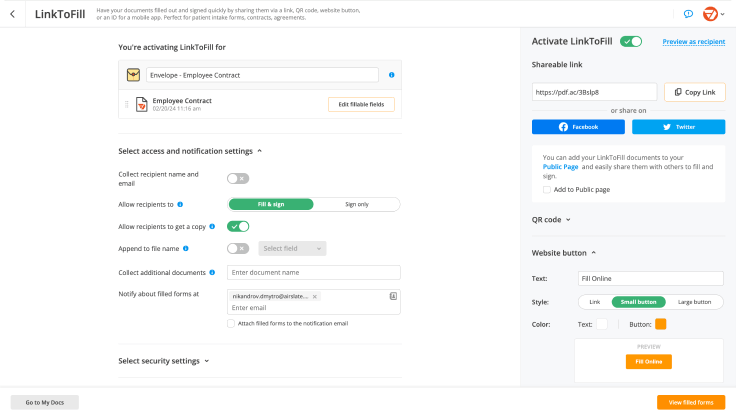

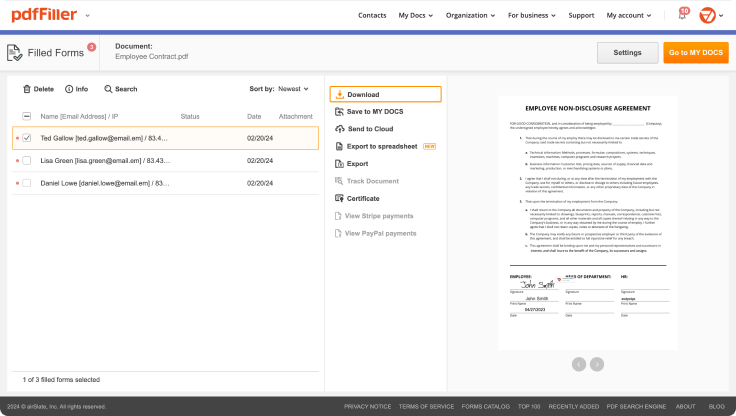

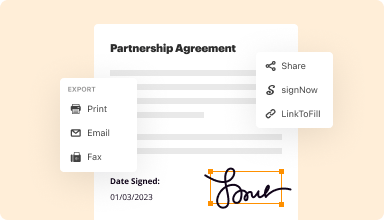

Online forms

Publish fillable forms on your website or share them via a direct link to capture data, collect signatures, and request payments.

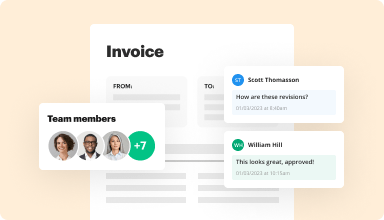

Easy collaboration

Work on documents together with your teammates. Exchange comments right inside the editor, leave sticky notes for your colleagues, highlight important information, and blackout sensitive details.

Millions of users trust pdfFiller to create, edit, and manage documents

64M+

million users worldwide

35M+

PDF forms available in the online library

53%

of documents created from templates

65.5K+

documents added daily

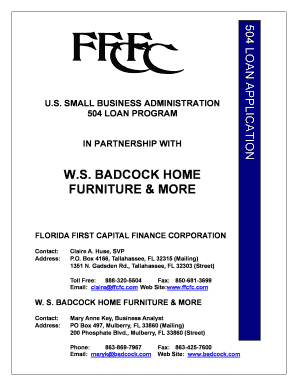

Customize Your Collateral Debenture Template

Create a tailored Collateral Debenture template that meets your needs. With our customizable feature, you gain the ability to design a document that reflects your specific requirements while ensuring compliance and clarity.

Key Features

User-friendly editing tools for easy customization

Pre-built clauses to save time and ensure completeness

Interactive templates that adapt to various scenarios

Comprehensive guidelines for each section

Export options in multiple formats for convenience

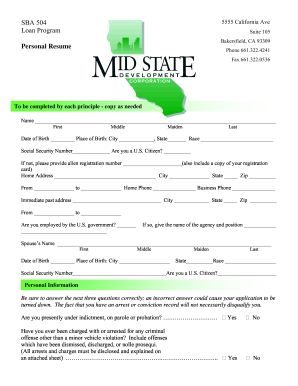

Potential Use Cases and Benefits

Use in securing loans by accurately detailing collateral

Simplify complexity in legal documents for startups and businesses

Provide clear terms to protect rights and interests

Facilitate efficient communication with stakeholders

Enhance professionalism in business dealings

This feature addresses common challenges in drafting financial documents. Instead of struggling with templates that don't fit your needs, you can create a precise Collateral Debenture document. This customization ensures that you communicate essential terms effectively, thereby reducing misunderstandings and enhancing trust with your partners.

Kickstart your document creation process

Browse a vast online library of documents and forms for any use case and industry.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Our user reviews speak for themselves

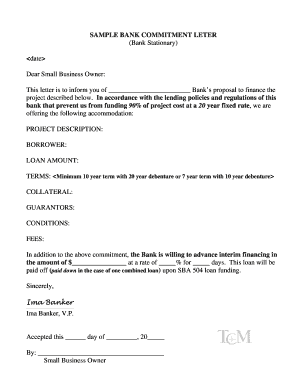

Your go-to guide on how to create a Collateral Debenture

Crafting a Collateral Debenture has never been easier with pdfFiller. Whether you need a professional forms for business or individual use, pdfFiller offers an easy-to-use platform to create, modify, and manage your documents effectively. Employ our versatile and fillable templates that line up with your precise needs.

Bid farewell to the hassle of formatting and manual customization. Utilize pdfFiller to effortlessly craft accurate forms with a simple click. Begin your journey by using our detailed instructions.

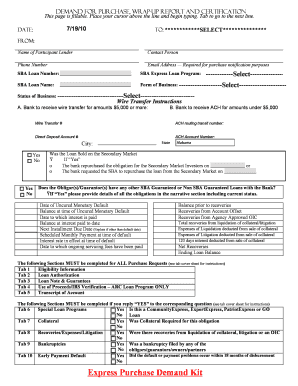

How to create and complete your Collateral Debenture:

01

Register your account. Access pdfFiller by logging in to your account.

02

Search for your template. Browse our comprehensive collection of document templates.

03

Open the PDF editor. When you have the form you need, open it in the editor and utilize the editing instruments at the top of the screen or on the left-hand sidebar.

04

Place fillable fields. You can select from a list of fillable fields (Text, Date, Signature, Formula, Dropdown, etc.).

05

Adjust your form. Add text, highlight areas, add images, and make any required modifications. The user-friendly interface ensures the procedure remains easy.

06

Save your edits. Once you are happy with your edits, click the “Done” button to save them.

07

Send or store your document. You can send out it to others to sign, download, or securely store it in the cloud.

To summarize, creating your documents with pdfFiller templates is a straightforward process that saves you efforts and ensures accuracy. Start using pdfFiller today to benefit from its robust features and seamless paperwork management.

Ready to try the award-winning PDF editor in action?

Start creating your document in pdfFiller and experience firsthand how effortless it can be.

Questions & answers

Below is a list of the most common customer questions.If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How is debenture treated in accounting?

Accounting Treatment of Issue of Debenture: The journal entries passed for issuing debentures are the same as in the case of shares. Only 'Debenture A/c' is used in place of 'Share Capital A/c'. The rate of interest is usually pre-fixed with Debenture A/c.

What is the difference between a debenture and a loan?

In summary, while both debentures and loans involve borrowing money, the key distinction lies in security: debentures lack collateral, whereas loans can be secured or unsecured.

How is debenture created?

To issue a debenture, a company issues a document called a debenture certificate, which is a promise to repay the borrowed sum. The certificate spells out terms such as the amount borrowed, the interest rate and other conditions of the loan.

How to record debentures in journal entry?

There are different journal entries in connection with the issue of debentures. On receipt of Application Money. Date. Particulars. On allotment, transfer to Debentures A/c. Date. Amount Due on Allotment. Date. Receipt of debenture allotment money. Date. Amount Due On First Call. Date. Receipt of Debentures first call money. Date.

How are debentures recorded?

Debentures don't typically appear as a separate item on a company's balance sheet or other financial statements. Debentures are included as part of long-term debt in the liabilities section of the balance sheet, within the subsection for non-current liabilities, that is debt with a maturity date greater than one year.

How to record debentures in accounting?

There are different journal entries in connection with the issue of debentures. On receipt of Application Money. Date. Particulars. On allotment, transfer to Debentures A/c. Date. Amount Due on Allotment. Date. Receipt of debenture allotment money. Date. Amount Due On First Call. Date. Receipt of Debentures first call money. Date.

Where do debentures go in a balance sheet?

Debentures are shown in the balance sheet of the company under the item Secured loans. Debentures are usually secured against the assets of the company. In case of debentures they are not secured by providing a collateral or security. These debentures have a charge on the assets.

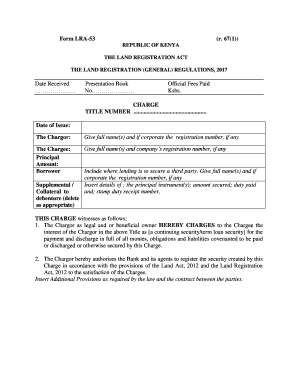

What is collateral debenture?

Issue of Debentures as Collateral. Debentures issued as collateral security is secondary or parallel security for the original loan taken by the company. The lender can realize the collateral security in case borrower fails to make the payment of the original loan.

What is the difference between a debenture and an unsecured loan?

An unsecured note is a loan that is not secured by the issuer's assets. Unsecured notes are similar to debentures but offer a higher rate of return. Unsecured notes provide less security than a debenture. Such notes are also often uninsured and subordinated.

Is debenture a bank loan?

A debenture is a loan agreement in writing between a borrower and a lender that is registered at Companies House. It gives the lender security over the borrower's assets. Typically, a debenture is used by a bank, factoring company or invoice discounter to take security for their loans.

What is a debenture in simple terms?

A debenture is a type of bond or other debt instrument that is unsecured by collateral. Since debentures have no collateral backing, they must rely on the creditworthiness and reputation of the issuer for support. Both corporations and governments frequently issue debentures to raise capital or funds.

What is the difference between a debt and debenture?

Bonds are debt financial instruments issued by financial institutions, big corporations, and government agencies having the backing of collaterals and physical assets. Debentures are debt financial instruments issued by private companies but are not backed by any collaterals or physical assets.