Last updated on

Jan 19, 2026

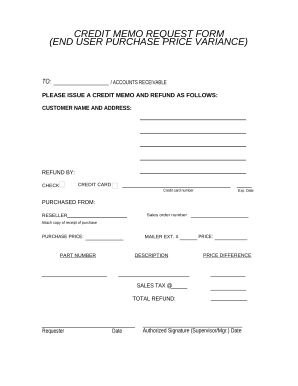

Customize and complete your essential Credit Memo template

Prepare to streamline document creation using our fillable Credit Memo template. Create exceptional documents effortlessly with just a few clicks.

Spend less time on PDF documents and forms with pdfFiller’s tools

Comprehensive PDF editing

Build documents by adding text, images, watermarks, and other elements. A complete set of formatting tools will ensure a polished look of your PDFs.

Fillable fields

Drag and drop fillable fields, checkboxes, and dropdowns on your PDFs, allowing users to add their data and signatures without hassle.

Templates for every use case

Speed up creating contracts, application forms, letters, resumes, and other documents by selecting a template and customizing it to your needs.

Electronic signature

Instantly sign any document and make it easy for others to sign your forms by adding signature fields, assigning roles, and setting a signing order.

Online forms

Publish fillable forms on your website or share them via a direct link to capture data, collect signatures, and request payments.

Easy collaboration

Work on documents together with your teammates. Exchange comments right inside the editor, leave sticky notes for your colleagues, highlight important information, and blackout sensitive details.

Millions of users trust pdfFiller to create, edit, and manage documents

64M+

million users worldwide

35M+

PDF forms available in the online library

53%

of documents created from templates

65.5K+

documents added daily

Customize Your Credit Memo Template

Enhance your financial communications with our customizable Credit Memo template. This feature allows you to tailor the layout and details to align perfectly with your business identity. It provides you with the tools needed to create professional and clear credit memos.

Key Features

Easy-to-use customization options for branding

Flexible fields for item descriptions and amounts

Option to include logos and company colors

Save as a template for future use

Printable and shareable formats available

Potential Use Cases and Benefits

Use for issuing refunds to customers

Provide clear records for accounting purposes

Improve professionalism in financial transactions

Streamline the invoicing process

Enhance customer trust with clear documentation

This feature addresses common challenges businesses face when issuing credit memos. By providing a customizable solution, your financial documents will maintain accuracy and professionalism. You will save time and reduce errors, which in turn can enhance customer satisfaction and loyalty.

Kickstart your document creation process

Browse a vast online library of documents and forms for any use case and industry.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Our user reviews speak for themselves

Your go-to guide on how to craft a Credit Memo

Crafting a Credit Memo has never been so easy with pdfFiller. Whether you need a professional document for business or personal use, pdfFiller provides an easy-to-use solution to generate, modify, and handle your documents efficiently. Utilize our versatile and editable templates that line up with your precise requirements.

Bid farewell to the hassle of formatting and manual editing. Employ pdfFiller to easily create polished documents with a simple click. your journey by following our comprehensive guidelines.

How to create and complete your Credit Memo:

01

Register your account. Access pdfFiller by signing in to your profile.

02

Search for your template. Browse our extensive catalog of document templates.

03

Open the PDF editor. Once you have the form you need, open it up in the editor and utilize the editing instruments at the top of the screen or on the left-hand sidebar.

04

Place fillable fields. You can select from a list of fillable fields (Text, Date, Signature, Formula, Dropdown, etc.).

05

Adjust your form. Include text, highlight areas, insert images, and make any necessary changes. The intuitive interface ensures the process remains smooth.

06

Save your edits. When you are happy with your edits, click the “Done” button to save them.

07

Share or store your document. You can send it to others to sign, download, or securely store it in the cloud.

To conclude, crafting your documents with pdfFiller templates is a smooth process that saves you time and ensures accuracy. Start using pdfFiller right now to make the most of its powerful capabilities and seamless paperwork management.

Ready to try the award-winning PDF editor in action?

Start creating your document in pdfFiller and experience firsthand how effortless it can be.

Questions & answers

Below is a list of the most common customer questions.If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is the difference between a credit memo and a refund receipt in QuickBooks?

When a credit memo is created, like a refund receipt, QuickBooks will debit (lower) the revenue tied to the items you are refunding. Unlike a refund receipt, the system will credit (lower in this case) your accounts receivable, not your undeposited funds account.

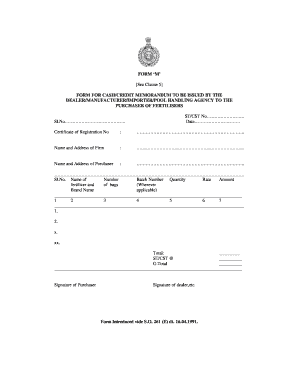

What is create credit memo in SAP?

Credit memos are used to correct the purchase order history if the quantity invoiced was too high, for example, if an invoice was too high or if part of the quantity was returned. When you post a credit memo, the total quantity in the purchase order history is reduced by the credit memo quantity.

How to fill a credit memo?

Indicate the credit memo's number, use the original invoice number, and the required mode of payment. The credit memo requires five columns for the following information: quantity of items, identification number or description, reason for the credit memo, cost of item and total cost.

How does a credit memo affect revenue?

Credit memos related to a return, damaged goods, or billing errors may decrease the seller's revenue. This adjustment reflects the reversal of previously recognized revenue associated with the goods or services covered by the credit memo.

What happens when you create a credit memo?

A credit memo, or credit memorandum, is sent to a buyer from a seller. This document is issued to a buyer after an invoice is sent out. A credit memo may reduce the price of an item purchased by a buyer or eliminate the entire cost of an item.

What does create credit memo mean?

A credit memo is an official written acknowledgement that money is owed back to a customer. When you need to create a refund for a client, you can create a credit memo, which is basically an invoice with a negative amount.

What happens when you create a credit memo in QuickBooks?

QuickBooks enters a negative amount in your Accounts Receivable (A/R) register for the credit memo. You can use this credit as payment for another transaction. If you chose to retain as available credit, you'll see the available credits in the customer payment window.

What does a credit memo do in QuickBooks?

If your customer wants to immediately reduce their current open balance, use a credit memo. Your customer can use their credit memo as payment for an invoice. They can use all of their credit memos or a portion of it. You can apply a credit memo when recording payment for a customer's invoice.

What is the purpose of a credit memo in SAP?

Credit memos are used to correct the purchase order history if the quantity invoiced was too high, for example, if an invoice was too high or if part of the quantity was returned. When you post a credit memo, the total quantity in the purchase order history is reduced by the credit memo quantity.

How do you create a credit memo in SAP transaction?

What is Credit Memo? Enter T-code VA01 in command field. Enter order type field value as credit memo request . Enter Sales Organization / Distribution Channel / Division in Organizational Data. Click on Create with References Button.

What is the difference between a credit memo and a debit memo?

A business issues a credit memo when it needs to reduce the amount a customer owes. This usually happens when there's been an overcharge, a product return, or a service issue. A business will use a debit memo when it needs to increase what a customer owes.

How do you fill out a credit note?

What Should Be Included on a Credit Note Seller's business information including name, address, phone number, and email address. Customer information including name, address, phone number, and email address. Date the credit memo was issued. Existing invoice number or reference number. The purchase order number. Credit Note: What Is It, Examples, And How To Process Them - Planergy Planergy blog credit-note Planergy blog credit-note

How to fill out a credit memo?

Now that you comprehend the importance and essential components of a credit memo, it's time to learn how to write one properly. Step 1: Date and customer information. Step 2: Reason for credit. Step 3: Amount and authorization. Step 4: Review and finalize. Guide to Credit Memo: Free PDF example/template Ramp Accountant Directory documents credit-mem Ramp Accountant Directory documents credit-mem

What is an example of a credit memo?

First example of a credit memo The seller issues a sales invoice for the 10 boxes priced at $20 each, or $200 total. However, before paying the invoice, the buyer finds that one of the boxes is damaged, and the containers inside are crushed. The seller issues a credit memo for $20. What is a Credit Memo? Definition and examples - LawDistrict LawDistrict legal-dictionary credit-m LawDistrict legal-dictionary credit-m

How to entry a credit memo?

A credit memo journal entry typically involves debiting your Sales Returns, and Allowances account and crediting your Accounts Receivable account. Here's an example: Debit: Sales Returns and Allowances ($X) Credit: Accounts Receivable ($X) Credit Memo — The Complete Guide [+3 Templates HighRadius resources Blog credit- HighRadius resources Blog credit-