Last updated on

Sep 27, 2024

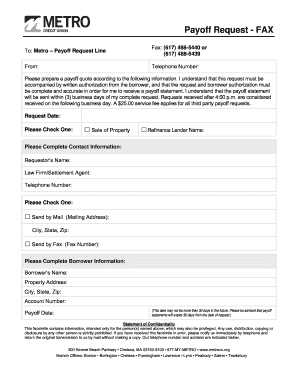

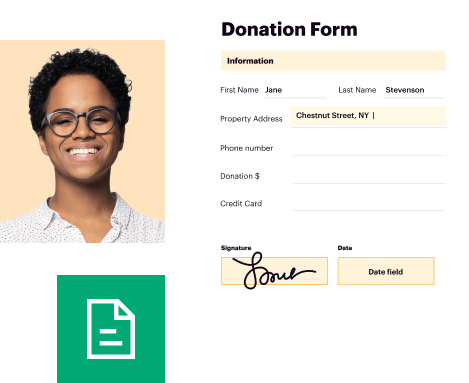

Customize and complete your essential Mortgage Quote Request template

Prepare to streamline document creation using our fillable Mortgage Quote Request template. Create exceptional documents effortlessly with just a few clicks.

Spend less time on PDF documents and forms with pdfFiller’s tools

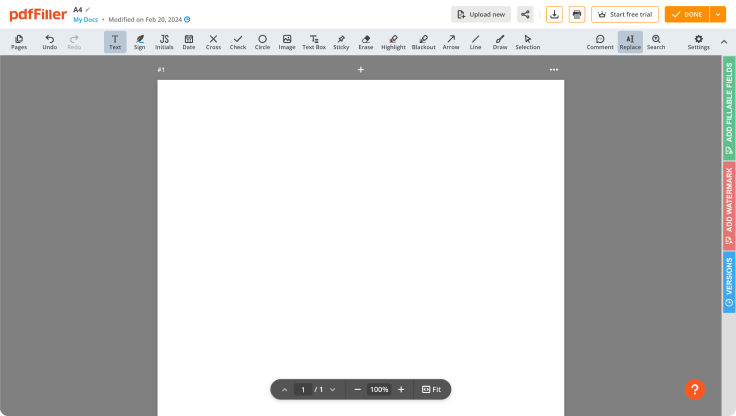

Comprehensive PDF editing

Build documents by adding text, images, watermarks, and other elements. A complete set of formatting tools will ensure a polished look of your PDFs.

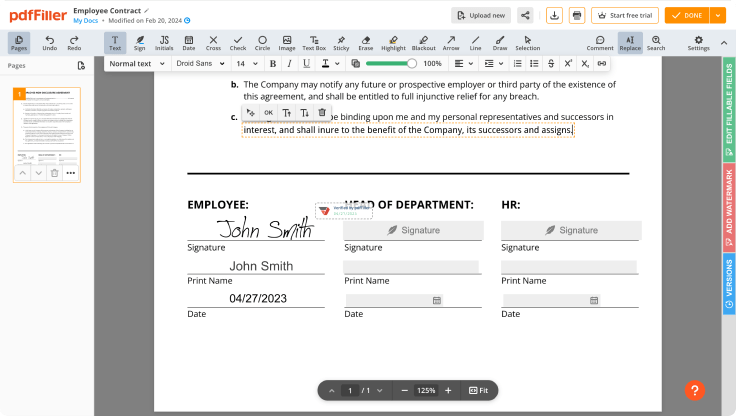

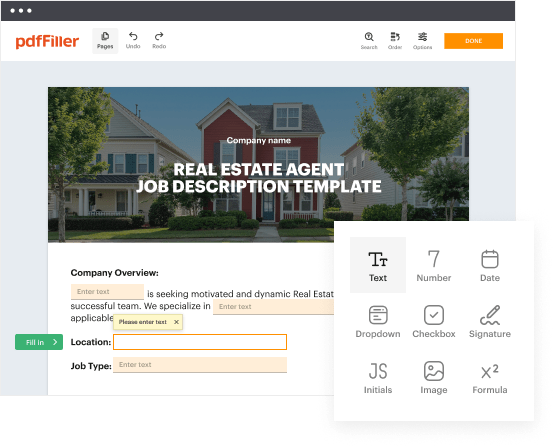

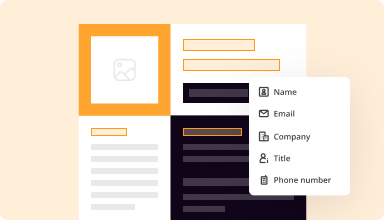

Fillable fields

Drag and drop fillable fields, checkboxes, and dropdowns on your PDFs, allowing users to add their data and signatures without hassle.

Templates for every use case

Speed up creating contracts, application forms, letters, resumes, and other documents by selecting a template and customizing it to your needs.

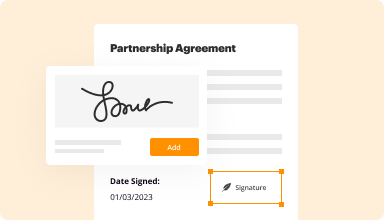

Electronic signature

Instantly sign any document and make it easy for others to sign your forms by adding signature fields, assigning roles, and setting a signing order.

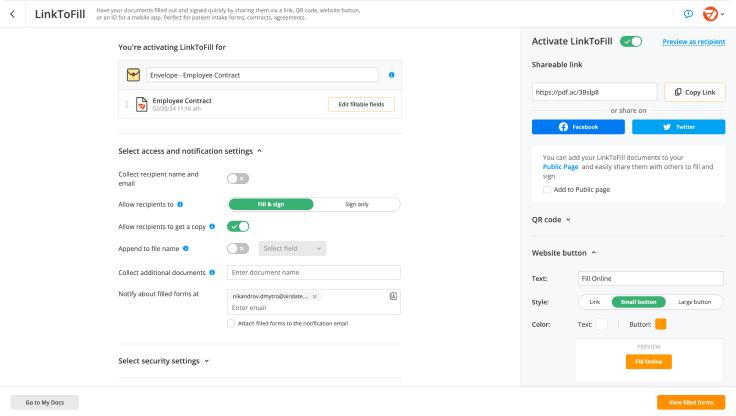

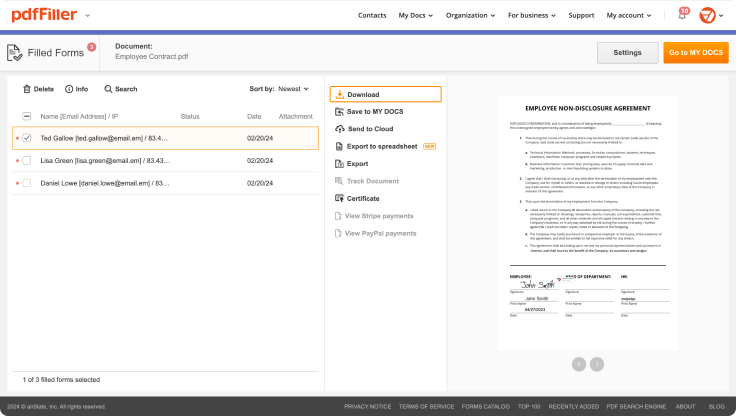

Online forms

Publish fillable forms on your website or share them via a direct link to capture data, collect signatures, and request payments.

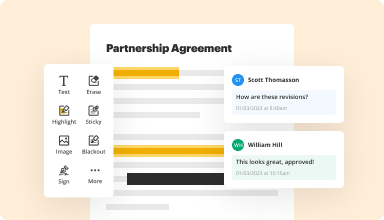

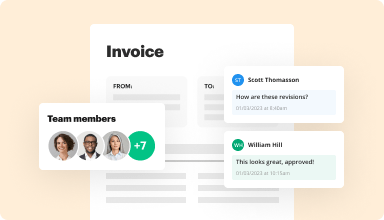

Easy collaboration

Work on documents together with your teammates. Exchange comments right inside the editor, leave sticky notes for your colleagues, highlight important information, and blackout sensitive details.

Millions of users trust pdfFiller to create, edit, and manage documents

64M+

million users worldwide

35M+

PDF forms available in the online library

53%

of documents created from templates

65.5K+

documents added daily

Customize Your Mortgage Quote Request Template

Take the guesswork out of securing your mortgage with our customizable Mortgage Quote Request template. This tool allows you to tailor your requests to fit your specific needs, ensuring you get the best mortgage options available.

Key Features

Fully customizable template to suit your mortgage requirements

User-friendly interface for easy modifications

Instant access to multiple lenders’ quotes

Option to save and reuse your templates for future requests

Guidance on best practices for mortgage quote submissions

Potential Use Cases and Benefits

Homebuyers looking to compare various mortgage quotes

Real estate agents assisting clients in securing financing

Individuals refinancing their existing mortgages for better rates

Investors seeking financing for new properties

By using our customizable Mortgage Quote Request template, you solve the problem of confusion and overwhelm in the mortgage process. This tool streamlines your efforts, saving you time and ensuring you receive accurate information tailored to your needs. Ultimately, it empowers you to make informed decisions about your mortgage.

Kickstart your document creation process

Browse a vast online library of documents and forms for any use case and industry.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Our user reviews speak for themselves

Your go-to guide on how to build a Mortgage Quote Request

Creating a Mortgage Quote Request has never been so easy with pdfFiller. Whether you need a professional forms for business or individual use, pdfFiller offers an intuitive platform to create, edit, and manage your documents effectively. Employ our versatile and fillable templates that line up with your specific requirements.

Bid farewell to the hassle of formatting and manual customization. Utilize pdfFiller to smoothly craft accurate documents with a simple click. Start your journey by following our comprehensive guidelines.

How to create and complete your Mortgage Quote Request:

01

Sign in to your account. Access pdfFiller by logging in to your profile.

02

Search for your template. Browse our comprehensive catalog of document templates.

03

Open the PDF editor. Once you have the form you need, open it in the editor and use the editing tools at the top of the screen or on the left-hand sidebar.

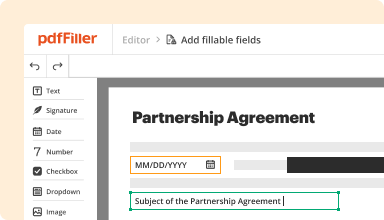

04

Add fillable fields. You can pick from a list of fillable fields (Text, Date, Signature, Formula, Dropdown, etc.).

05

Edit your form. Include text, highlight information, add images, and make any necessary modifications. The user-friendly interface ensures the process remains easy.

06

Save your edits. When you are happy with your edits, click the “Done” button to save them.

07

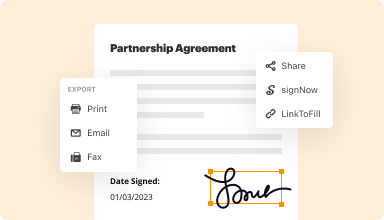

Submit or store your document. You can deliver it to others to eSign, download, or securely store it in the cloud.

To conclude, crafting your documents with pdfFiller templates is a straightforward process that saves you time and guarantees accuracy. Start using pdfFiller right now to make the most of its powerful features and effortless paperwork management.

Ready to try the award-winning PDF editor in action?

Start creating your document in pdfFiller and experience firsthand how effortless it can be.

Questions & answers

Below is a list of the most common customer questions.If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How to get quotes from lenders?

Requesting a Loan Estimate is simple, and no written documentation is required. Contact the lenders you are considering and tell them you are ready to request a Loan Estimate.

What bank is most likely to give me a mortgage?

Best Mortgage Lenders of 2024. Flagstar Bank: Best Mortgage Lender for Alternative Credit Data Eligibility. : Best Mortgage Lender for Nationwide Availability. Chase: Best Mortgage Lender for Relationship Discounts. Guaranteed Rate: Best Mortgage Lender for Fast Closing. Best Mortgage Lenders of July 2024 Forbes Advisor Forbes advisor mortgages best-m Forbes advisor mortgages best-m

What is a mortgage quote called?

A Loan Estimate is a three-page form that you receive after applying for a mortgage. The Loan Estimate tells you important details about the loan you have requested. The lender must provide you a Loan Estimate within three business days of receiving your application.

Where is the easiest place to get a mortgage in Canada?

Otherwise, another option is to go with a smaller or alternative lender. Sometimes the big banks can be stricter when it comes to mortgage approvals. Smaller institutions like credit unions and online lenders can be easier to get mortgage approvals from, even if the interest rate is slightly higher. Best Bank in Canada to get a Mortgage - Spring Financial Spring Financial homeowner-finances Spring Financial homeowner-finances

Which bank is easiest to get a mortgage with in Canada?

Equitable Bank has more relaxed credit requirements than other big banks in Canada. You may be able to get a mortgage if you're self-employed, have a past bankruptcy or have bad credit, as long as you meet other eligibility criteria.

Which bank is easiest to get a mortgage with?

If your credit score is causing you problems, look at the mortgages offered by Barclays, Halifax, Masthaven Bank, Royal Bank of Scotland and Santander as all of these lenders will consider applicants with a poor credit history. If you've struggled to save up a deposit, 90 or 95% mortgages could help you out. Compare the Best Banks for Mortgages Deals | Quotezone money best-banks Quotezone money best-banks

What is the minimum credit score for a mortgage in Canada?

Credit scores of 600-649 While there is no absolute minimum credit score, it does vary between lenders. As of July 5, 2021, CMHC reduced the minimum credit score requirement from 680 to 600. This allows borrowers with a credit score of 600 or higher to qualify for a mortgage without mortgage insurance. How much does your credit score affect your mortgage rate? - resources does-your-credit-score-affec resources does-your-credit-score-affec

What is a request in mortgage?

A payoff request is a statement prepared by your lender which details the payoff amount for prepayment of your mortgage loan. The payoff statement will typically be the remaining balance on your mortgage loan, but it might also include any accrued interest or late charges/fees that could be owed.

How long does a mortgage payoff request take?

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions.

What is a verification of a mortgage request?

A verification of mortgage (VOM) is an official statement that verifies your existing loan terms and provides a rating of the payment history, including if the loan was current or delinquent for each month listed. It reflects only the most recent 12 months of your loan, excluding the current month.

What does it mean to request a payoff amount?

It's the exact sum of money needed to pay off your loan, and it's probably different from your current loan balance, as it may include interest and fees that you owe but have not yet paid. 2 What's more, some lenders may have certain penalties or fees associated with requesting a payoff statement.

What is a lender request?

Lenders' Request means an instrument signed in one or more counterparts by any of the Lenders holding not less than 50% in principal amount of Loans outstanding at that time requesting the Collateral Agent to take some action or proceeding set out in the instrument.

Can you ask your lender for a lower interest rate?

Are mortgage rates negotiable? Yes, to some degree, mortgage interest rates are negotiable. Mortgage lenders have some flexibility when it comes to the rates they offer. However, in many cases getting a lower rate on your loan will come with a price, such as paying “points” to get a lower rate.

How do I inquire about mortgage rates?

Don't go with the first lender you talk to. Instead, present your financial information and your credit report, and ask them what rate they can offer you. Get rates from several lenders—don't just go to your bank! Talk to a mortgage broker and ask them what they can find.

How to get more money from lenders?

How To Get Preapproved For A Larger Loan: 10 Helpful Tips Include All Sources Of Income. Make A 20% Down Payment. Increase Your Credit Score. Pay Off Existing Debt. Consider A Longer Loan Term. Add A Co-Borrower/Co-Signer. Save Up. Compare Lenders And Loan Types.

What is a lender quote?

The quote provides a rough idea of the interest rate you might qualify for, the type of loan (fixed or adjustable), and potential monthly payments. However, it's crucial to remember that a quote is not a guarantee or an offer from the lender.