Comment VAT Invoice Template Kostenlos

Join the world’s largest companies

How to Send a PDF for eSignature

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Unlimited document storage

Widely recognized ease of use

Reusable templates & forms library

The benefits of electronic signatures

Efficiency

Accessibility

Cost savings

Security

Legality

Sustainability

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

SOC 2 Type II Certified

PCI DSS certification

HIPAA compliance

CCPA compliance

Comment VAT Invoice Template Feature

The Comment VAT Invoice Template feature simplifies the process of generating VAT-compliant invoices. It helps you maintain accuracy, save time, and enhance your business's professionalism. With this feature, you can focus on what matters most—growing your business.

Key Features

Potential Use Cases and Benefits

This feature addresses common invoicing challenges. By using the Comment VAT Invoice Template, you eliminate the guesswork in VAT calculations, reduce human error, and ensure compliance. You can produce professional-looking invoices that not only meet regulations but also enhance your credibility with clients, ultimately leading to better business relationships.

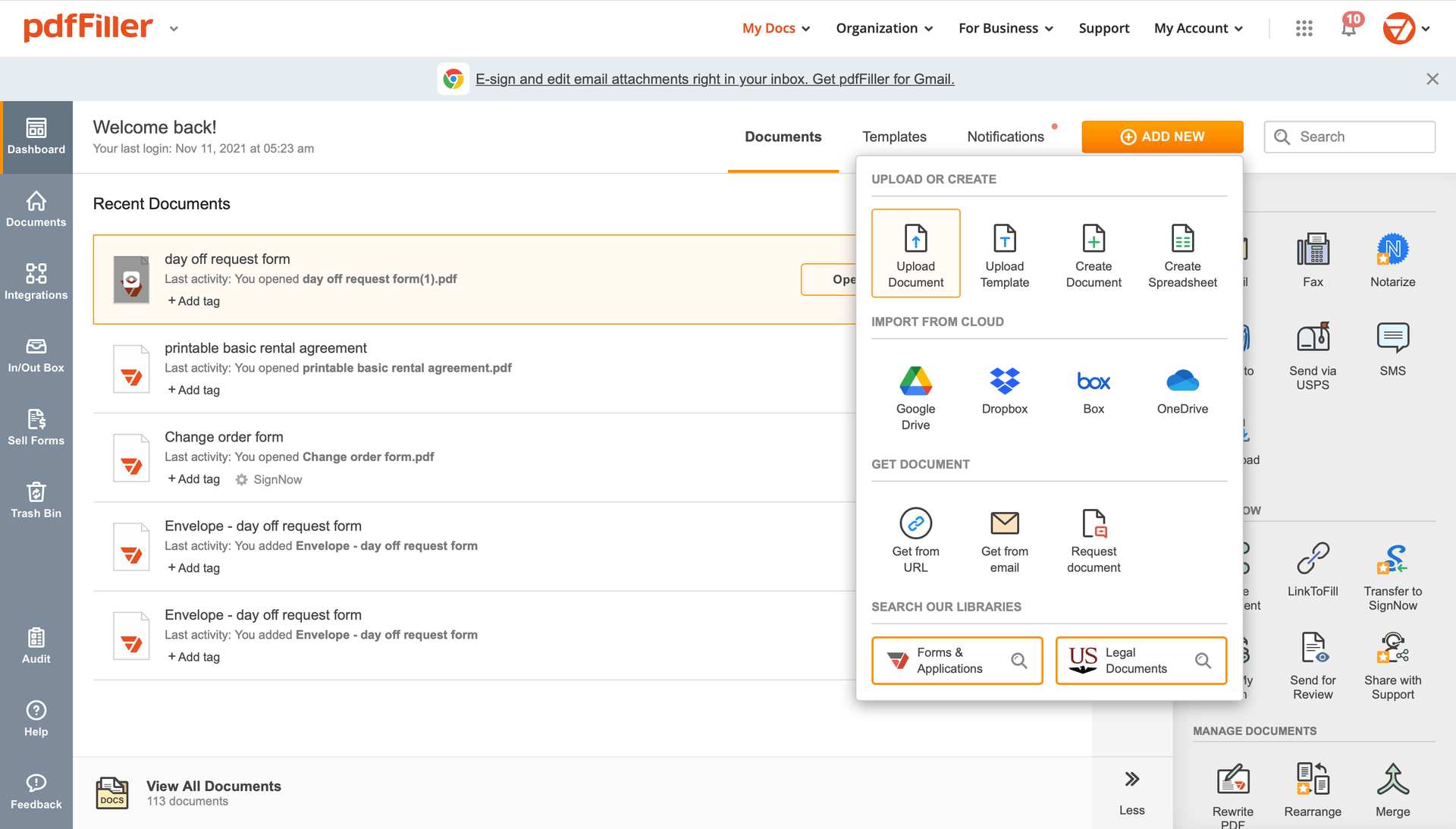

Comment VAT Invoice Template with the swift ease

pdfFiller allows you to Comment VAT Invoice Template quickly. The editor's convenient drag and drop interface allows for fast and intuitive signing on any device.

Signing PDFs electronically is a fast and secure way to validate documents at any time and anywhere, even while on the go.

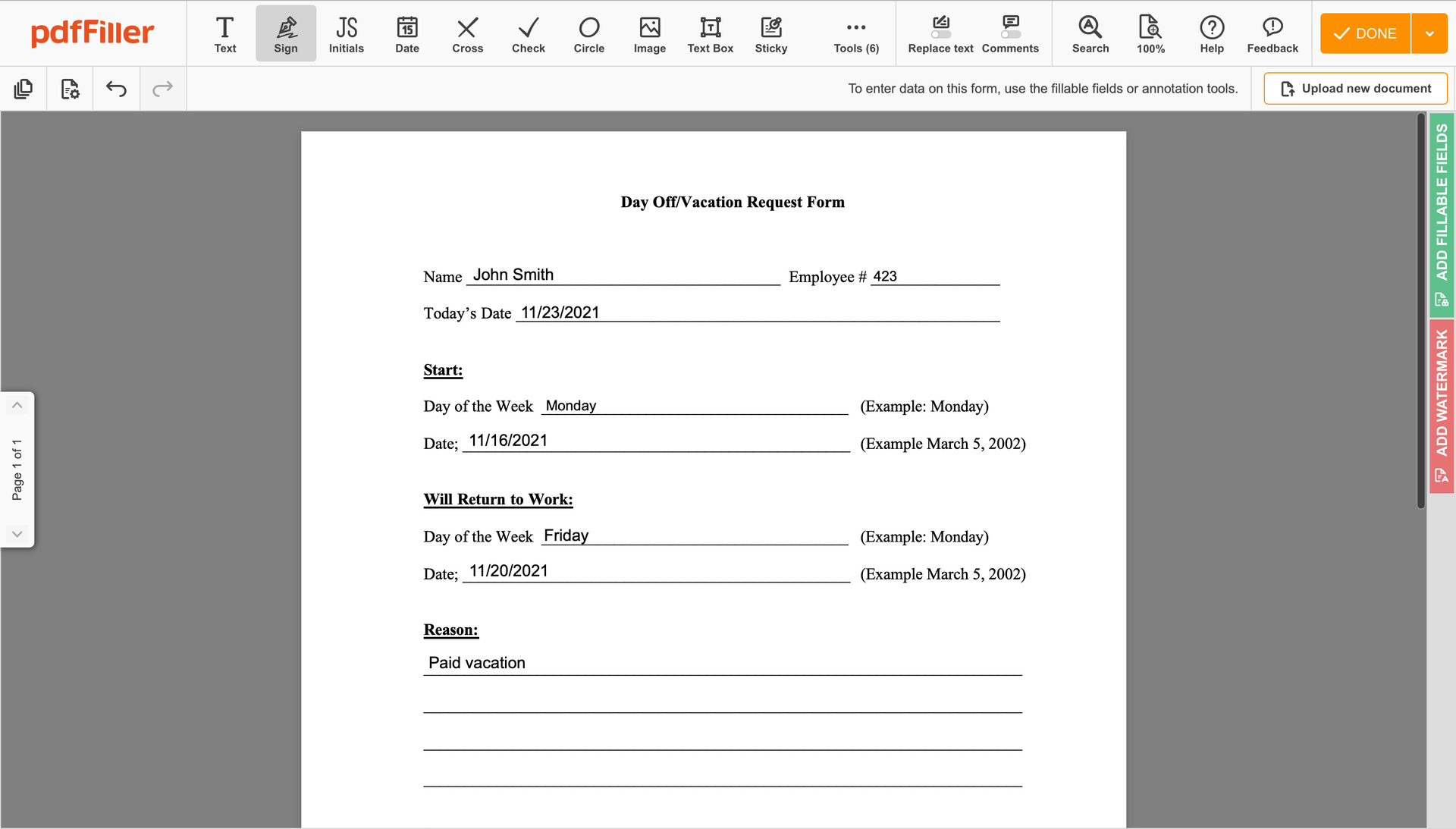

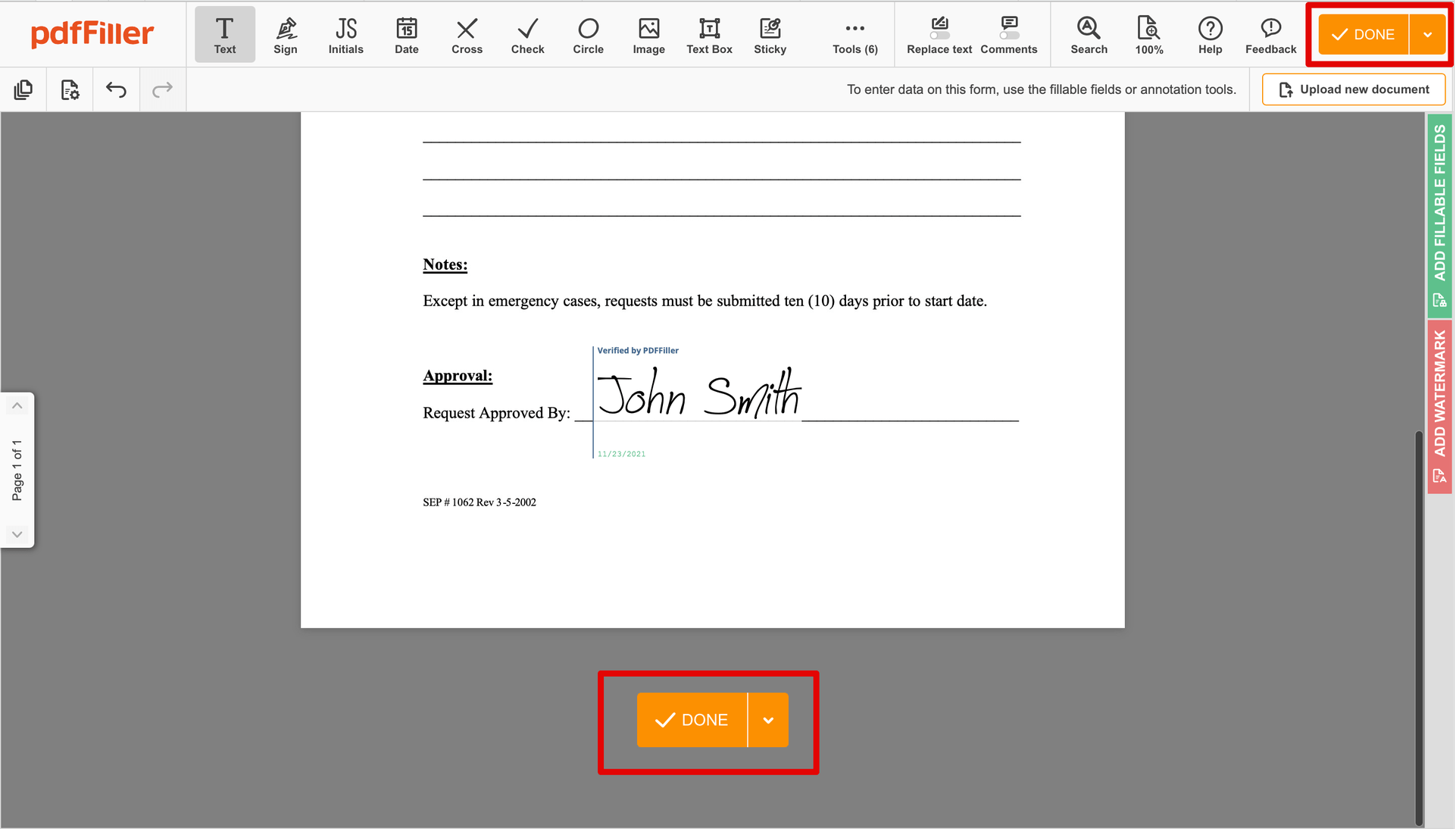

See the step-by-step guide on how to Comment VAT Invoice Template electronically with pdfFiller:

Upload the document you need to sign to pdfFiller from your device or cloud storage.

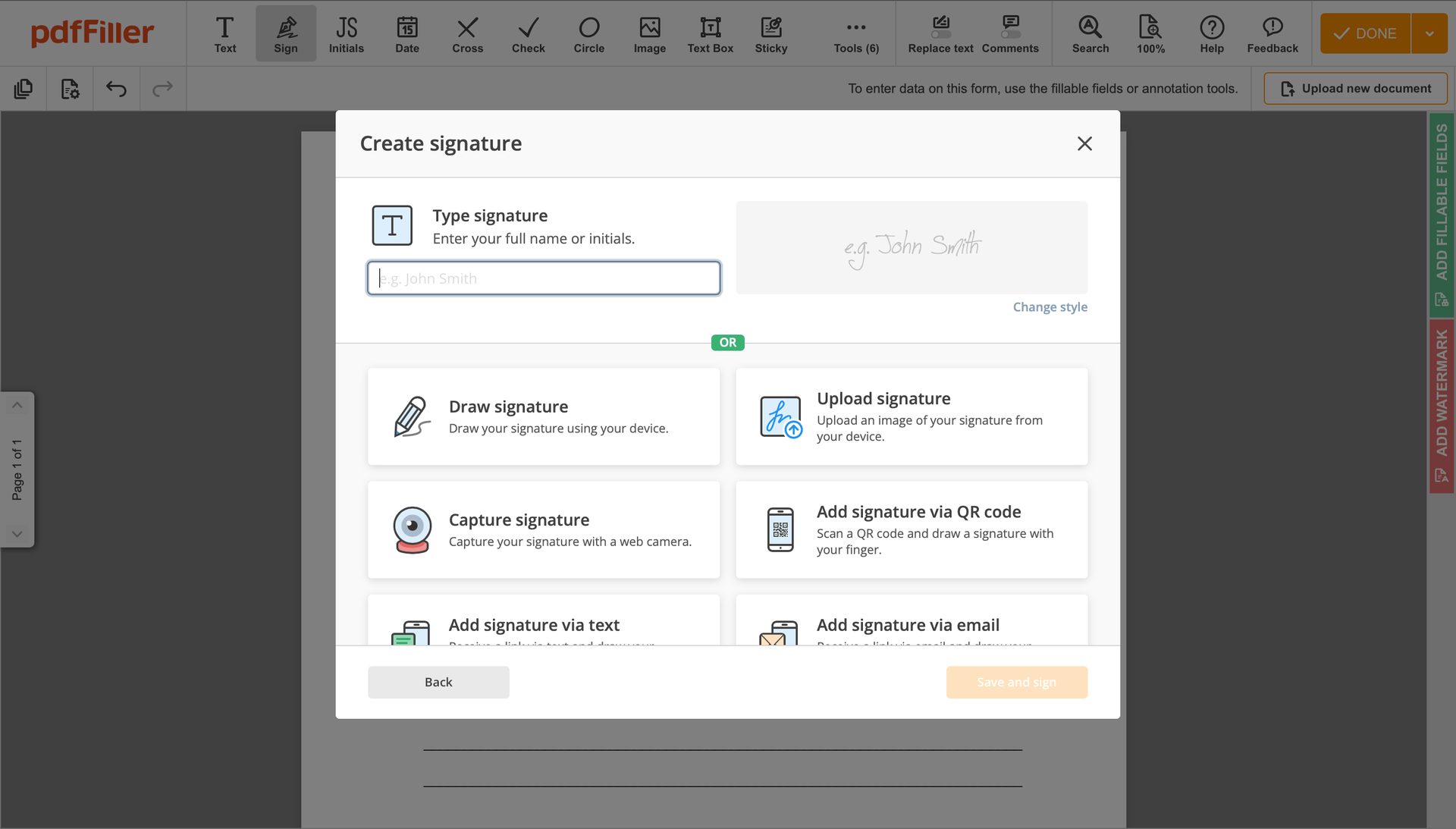

As soon as the file opens in the editor, click Sign in the top toolbar.

Generate your electronic signature by typing, drawing, or adding your handwritten signature's image from your laptop. Then, click Save and sign.

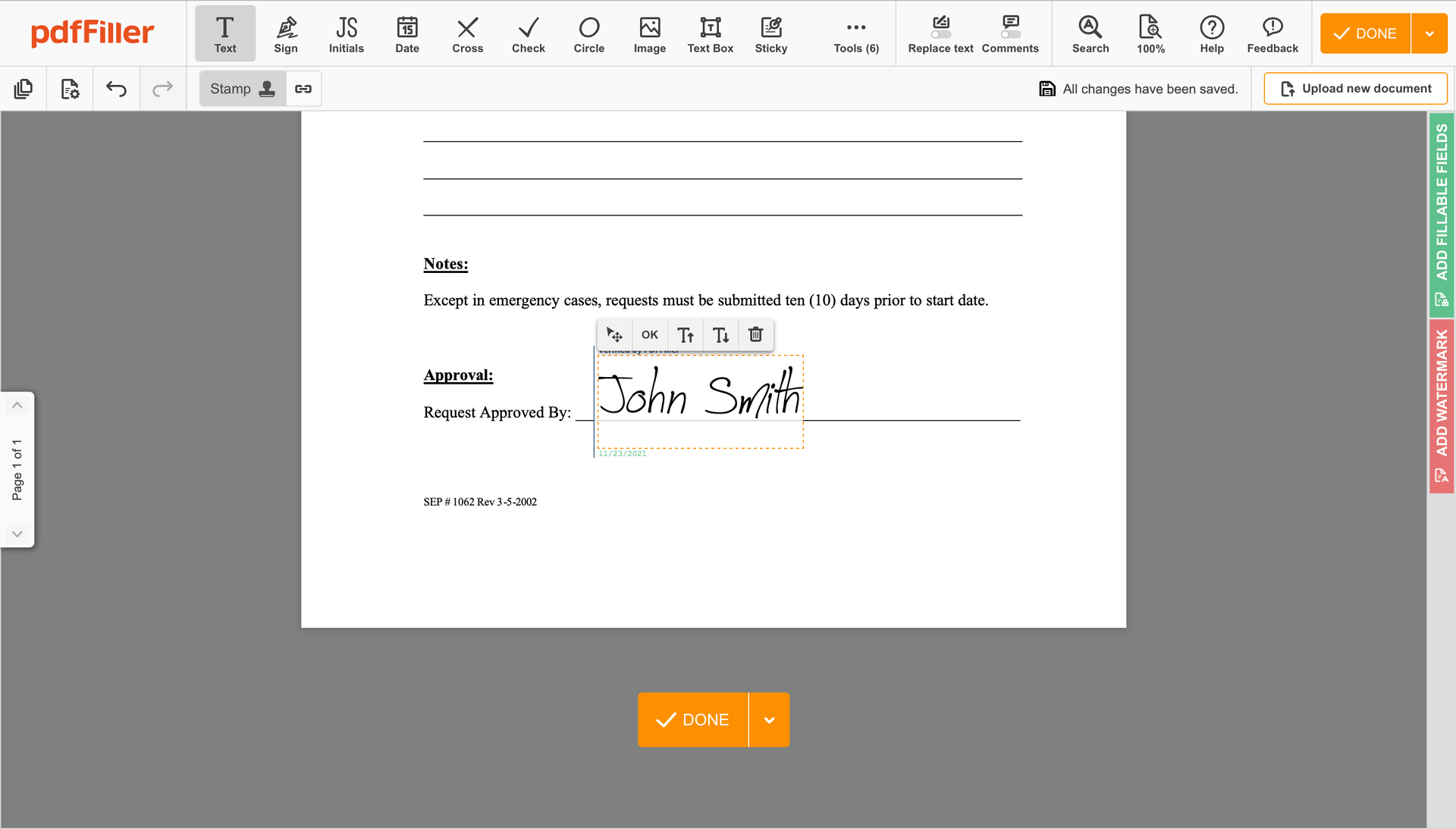

Click anywhere on a form to Comment VAT Invoice Template. You can drag it around or resize it using the controls in the hovering panel. To use your signature, hit OK.

Complete the signing process by hitting DONE below your form or in the top right corner.

After that, you'll return to the pdfFiller dashboard. From there, you can download a signed copy, print the document, or send it to other people for review or validation.

Are you stuck with numerous programs for editing and signing documents? Try this solution instead. Use our document editor to make the process simple. Create forms, contracts, make document templates, integrate cloud services and utilize more useful features within one browser tab. Plus, it enables you to use Comment VAT Invoice Template and add high-quality professional features like orders signing, alerts, attachment and payment requests, easier than ever. Pay as for a basic app, get the features as of a pro document management tools.

How to edit a PDF document using the pdfFiller editor:

For pdfFiller’s FAQs

Ready to try pdfFiller's? Comment VAT Invoice Template Kostenlos