Convert On Stamp Invoice Kostenlos

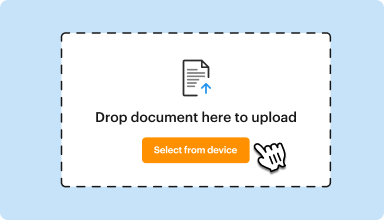

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

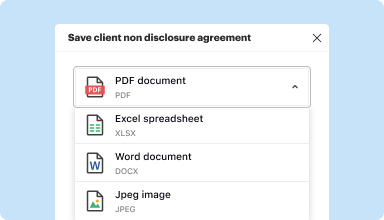

Edit, manage, and save documents in your preferred format

Convert documents with ease

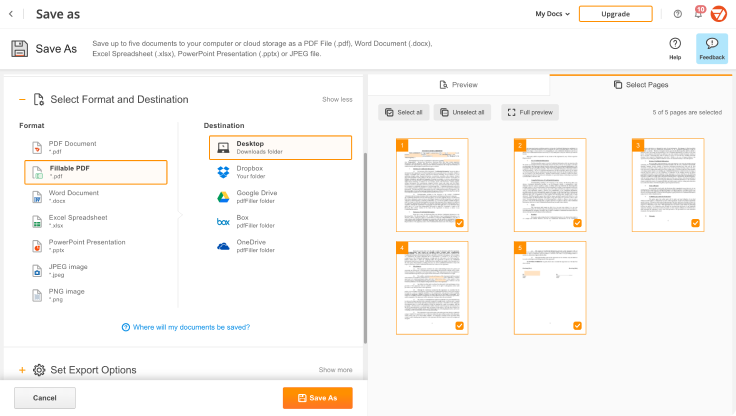

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

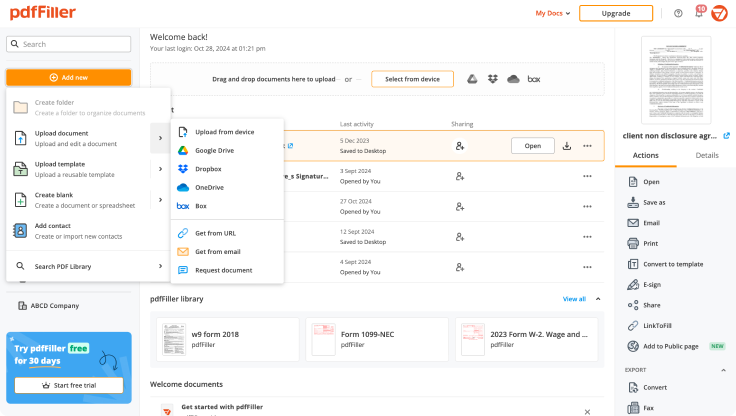

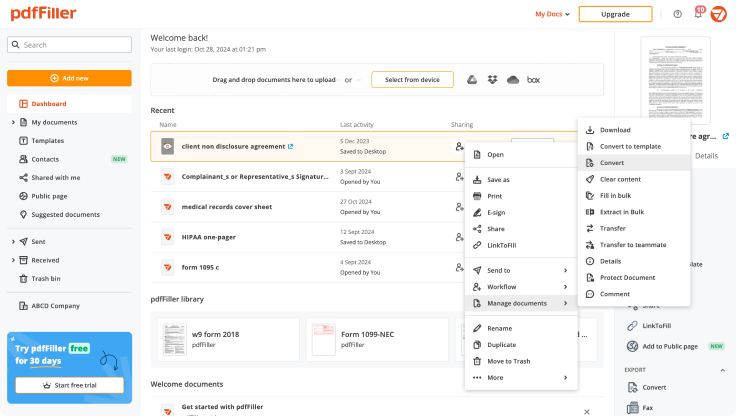

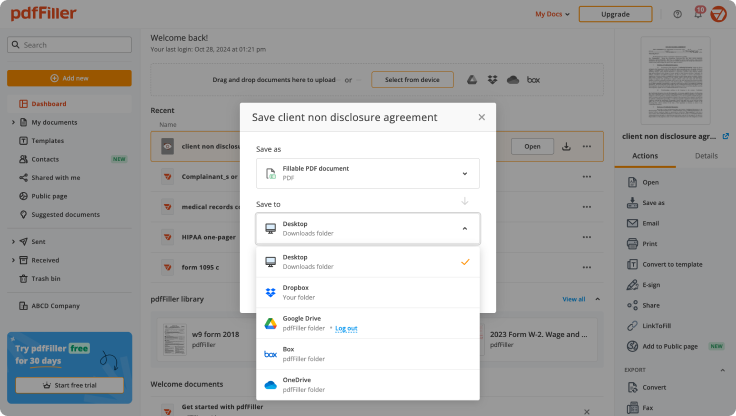

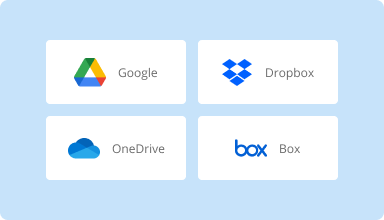

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

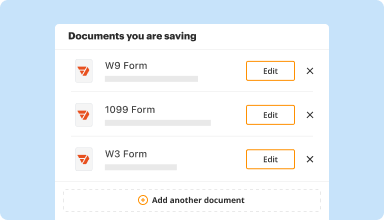

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

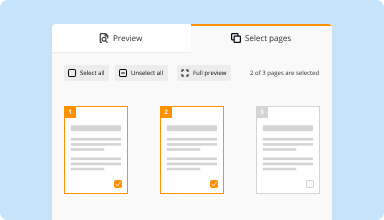

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

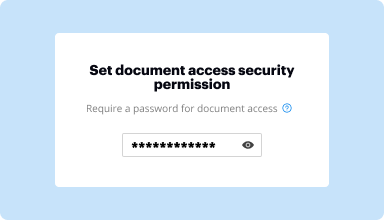

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I needed a form and you were able to supply it. The problem is that I only needed that one form and would be unlikely to use this service frequently enough for the fees to be worth it for me. I think this could be a very valuable service for those who would be in a place to make use of it.

2014-08-12

Just started. Good so far. I wish it connected with our online storage so that completed forms could be automatically added to our storage instead of having to download them.

2018-02-03

Wish we had a phone number to speak to customer service directly. I am old school and like to get directions with a call otherwise you have a great service.

2019-02-20

Great value and product

Program was formatted well and easy to use for the most part. I was able to complete my revisions within no time and get it to our clients!

I had a few issues with figuring out how to use certain features and how to save the file in a certain format.

2018-03-13

I used the free trial to compile rent due ledgers for the ************** requirement. I did not cancel on time and was charged $180 dollars. I reached out to support and ****** returned my email within minutes. I provided my information to customer service specialist ****** and he fixed the problem. There wasn't any back and forth emails. It was straight to the point. Thank you ****** for being quick and professional.

2022-04-05

It takes me a while to understand

It takes me a while to understand, I had my problems trying to understand the samples of where to find things, I did not know what a hub icon was,

2022-03-11

Super good page and it works so well in…

Super good page and it works so well in the phone app as well! This is especially good if you have a Chromebook which you can't download Adobe on. I've filled in so many files without issues definitely recommend.

2022-02-24

Its been great, should be implimented into every office (I've interned for multiple senators) and if I would've had this in Rubio's office, I would have left two hours early eveyrday.

2022-02-10

I love the concept. This pdfFiller was extremely helpful with the form I needed to use. Much more than the IRS website. I would recommend this company working with them for more accuracy on the forms. I understood my document much better with the step by step process.

2021-05-03

Convert On Stamp Invoice Feature

The Convert On Stamp Invoice feature streamlines your invoicing process, allowing you to transform stamped documents into editable invoices with ease. This feature is designed for businesses that prioritize efficiency and accuracy in their billing operations.

Key Features

Easily convert stamped documents into professional invoices

Automatically extract key data from stamped invoices

Integrate with existing accounting systems

Maintain accurate records effortlessly

User-friendly interface for quick adoption

Potential Use Cases and Benefits

Ideal for small businesses facing high invoice volume

Helpful for freelance professionals needing fast billing solutions

Effective for organizations managing multiple payment types

Supports accurate record-keeping for audits

Enhances cash flow by speeding up the payment process

By implementing the Convert On Stamp Invoice feature, you can solve common invoicing challenges. It reduces errors, saves time, and ensures your billing is always up-to-date. Say goodbye to manual entry and confusion, and embrace a solution that works for you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do I show past due invoices in QuickBooks?

Open an invoice past its due. Select Formatting, then choose Manage Templates. Select the invoice template you want to use and select OK. From the “Company & Transaction Information” section, select Print Past Due Stamp. Select OK.

How do I print outstanding invoices in QuickBooks?

Go to Customers tab. Click on the Income Tracker. Choose Open Invoices, Overdue, or Paid Last 30 Days tab. Select all the invoices under each tab that you want to print. Click the Batch Actions drop-down and choose Print Selected.

How do I print invoices from QuickBooks desktop?

From the left menu, select Sales (or Invoicing). Click the Invoices tab at the top of the page. Scroll to the invoice you wish to email, in the Action column click the drop-down arrow and select Print. Click the Printer Icon in the top right-hand corner. Click Print.

How do I mark an invoice unpaid in QuickBooks?

Go to Sales in the left navigation menu. Go to Invoices tab, then open the invoice. Click on 1 payment link at the upper right hand above the PAID payment status. Click on the link for the date. On the Receive Payment window, click on More button at the bottom.

How do I change an invoice from paid to unpaid in QuickBooks?

Click Invoicing from the left menu. Choose Invoices, and click View/Edit to open the invoice transaction. Under Payment Status, click the 1 payment link and click on the Date hyperlink. Click the More tab and choose To delete. Click Yes to confirm.

How do I mark an invoice as paid in QuickBooks?

Launch your QuickBooks and from the support, click on “customer”. Choose to open the invoice you want to mark and at the bottom of the window select to apply for credit. The journal entry window will display, you can then apply it to the invoice.

How do I write off an unpaid invoice in QuickBooks online?

From the Customers menu, select Create Credit Memos/Refunds. From the Customer:Job drop-down, select the customer name. Enter the items, then select Save & Close. On the Available Credit window, select Apply to an invoice. Click OK. On the Apply Credit to Invoices window, select the transaction. Click Done.

How do I write off an unpaid invoice?

You cannot write off your entire unpaid invoice as a business bad debt, because you had not previously recognized the income. However, you can deduct your actual expenses related to the work you did for that client, assigning the expenses to their appropriate categories (research materials, copies, travel, etc.).

#1 usability according to G2

Try the PDF solution that respects your time.