Convert On Subsidize Certificate Kostenlos

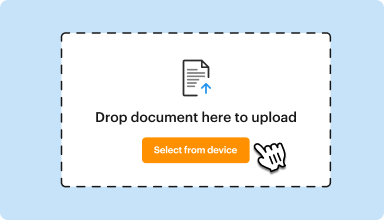

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

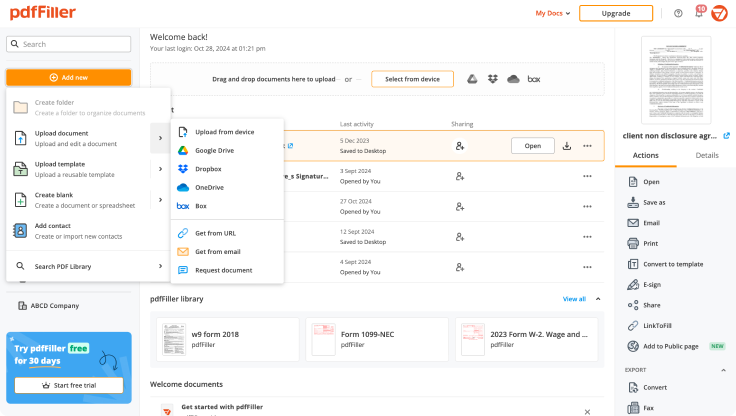

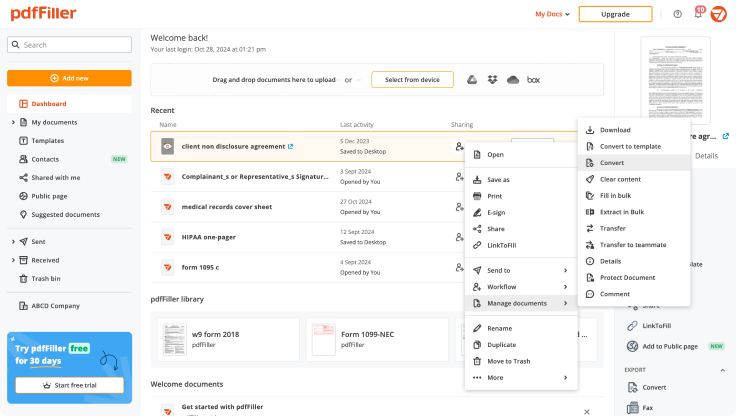

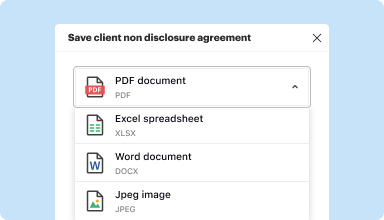

Edit, manage, and save documents in your preferred format

Convert documents with ease

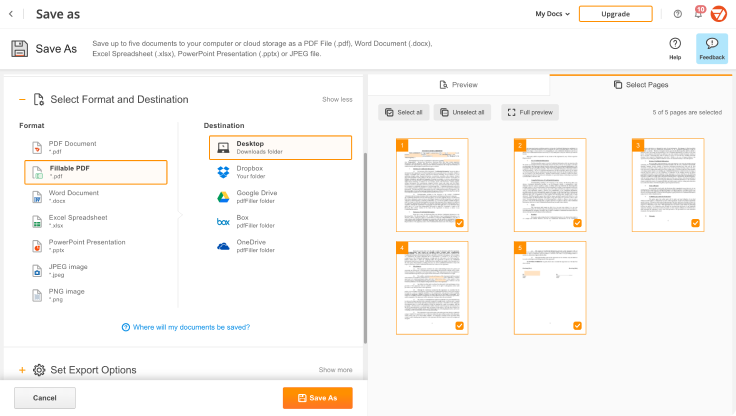

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

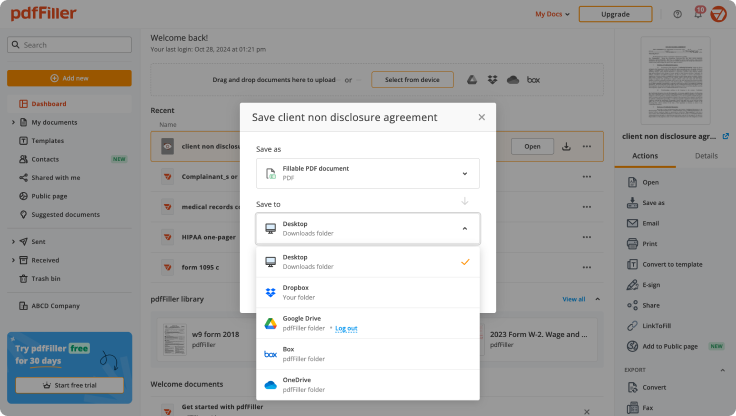

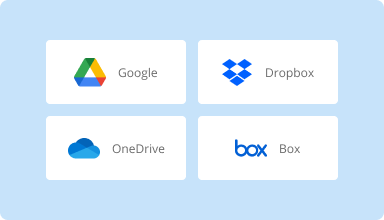

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

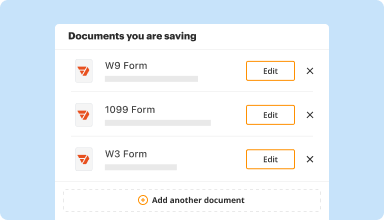

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

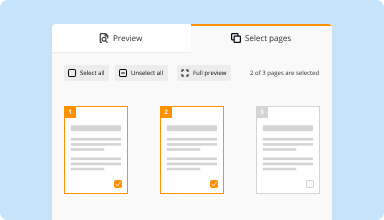

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

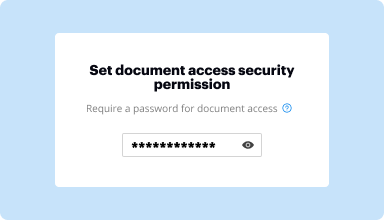

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

great, but i must stress you should have a one off payment for a single transaction sometimes people dont want a monthly subscription so please giver option for one off fair payment option. thamks

2014-05-10

As a beginner, I would like to learn and practice some other functions. My favorite part of PDFfiller is I can sign the document either by type in my name or just tip my finger.

2015-03-25

Just started so not a lot of feedback yet. It would be nice to be able to review who I sent documents for e-signatures too, so that if I can determine whether or not I made a mistake and have to redo the whole document, or if I have to tell the client to look in their spam folder, or what. Thanks!

2016-06-14

THIS PROGRAM IS VERY USER FRIENDLY. THE ONLY THING THAT I DONT UNDERSTAND IS THAT WHEN YOU RESAVE THE DOCUMENT IT DOES NOT UPDATE THE TIME OF YOUR MOST RECENT CHANGE.

2016-10-25

I absolutely LOVE PDFiller! That is the honest truth.

I truly do. You have no idea. It's easy to use. It does and has everything you might possible need to do to a document. It's amazing to say the least.

2019-05-06

The software is easy to navigate and user friendly.

Not paying the Adobe prices.

The software is very intuitive which is reduces time determining and understanding feature sets about the tool.

Some features require a different level of membership which cost more and should be included with the basic package.

2017-11-14

I love the product just don't have the need to justify a full subscription. I enjoyed the trial period and had great Customer Service when needed. Very prompt with replies. I would recommend this product.

2020-10-02

I mislead them on my intentions for the service level that I required. Once I brought it to their attention, I answered 3 questions; and the matter was immediately resolved. Outstanding customer service comms. !!!

2020-08-27

There are some minor things I have not figured out how to do. Not sure yet if they are just missing features, or just not readily available in a way that I was expecting.

2020-06-15

Convert On Subsidize Certificate Feature

The Convert On Subsidize Certificate feature empowers users to easily manage and convert subsidies into certificates. This feature streamlines operations, enhances financial tracking, and supports easier compliance with subsidy regulations.

Key Features

Simple conversion process for subsidies to certificates

User-friendly interface that requires minimal training

Real-time updates to ensure accurate tracking

Compliance support for various subsidy regulations

Customizable reports to meet specific business needs

Potential Use Cases and Benefits

Companies needing to track subsidy allocations efficiently

Organizations requiring accurate reporting for audits

Businesses looking to reduce administrative workload

Non-profits managing diverse funding sources

Government agencies ensuring compliance with subsidy programs

This feature addresses the common difficulties related to subsidy management. By automating and simplifying the conversion process, users can save time and reduce errors. It fosters better financial oversight, helping you stay organized while meeting regulatory requirements. With this tool, you can focus on your core business operations instead of worrying about complex subsidy management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do I get my MCC certificate?

If your application for an MCC is accepted, you should receive a physical copy of the certificate from your local government office. This certificate should include your specific MCC number, which is unique to your particular application and will be used for all tax-related documentation.

How do I get a mortgage credit certificate?

Apply for an MCC with an approved lender and receive a commitment from VEDA prior to closing. Sign the Mortgage Credit Certificate Homebuyer Application and Fact Sheet and give to your Lender.

Do I have mortgage credit certificate?

A Mortgage Credit Certificate (MCC) is a tax credit given by the IRS to low and moderate income homebuyers. Generally the program is only available to first time homebuyers. Terms differ by state. The credit can be used for each future tax year in which the mortgage is held that the homeowner has a tax liability.

How do I apply for a mortgage credit certificate?

Select the Federal Taxes tab. Select the Deductions & Credits tab, then select I'll choose what I work on Scroll down to the Home section, then select Start or Update — Mortgage Interest Credit Certificate. Answer Yes to Do You Have a Mortgage Credit Certificate and select Continue

How are mortgage credit certificates calculated?

The credit is calculated by multiplying three numbers: the total amount of a homeowner's mortgage, the mortgage interest rate and a special MCC tax credit percentage. The percentage varies by state but is generally between 20% and 40%.

Who qualifies for mortgage certificate?

Generally speaking, homebuyers who wish to obtain an MCC must meet certain minimum guidelines: Buyers must not have lived in a home that they owned in the previous three years. Buyers must meet income and purchase price restrictions. Buyers must intend to use the new home as a primary residence.

How do I apply for MCC tax credit?

Select the Federal Taxes tab. Select the Deductions & Credits tab, then select I'll choose what I work on Scroll down to the Home section, then select Start or Update — Mortgage Interest Credit Certificate. Answer Yes to Do You Have a Mortgage Credit Certificate and select Continue

How do I claim my MCC on my taxes?

Select the Federal Taxes tab. Select the Deductions & Credits tab, then select I'll choose what I work on Scroll down to the Home section, then select Start or Update — Mortgage Interest Credit Certificate. Answer Yes to Do You Have a Mortgage Credit Certificate and select Continue

#1 usability according to G2

Try the PDF solution that respects your time.