Convert On Wage Record Kostenlos

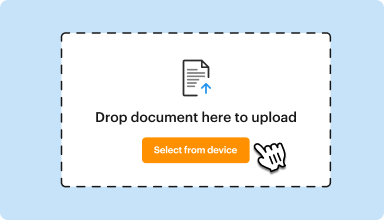

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

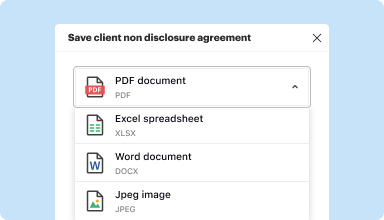

Edit, manage, and save documents in your preferred format

Convert documents with ease

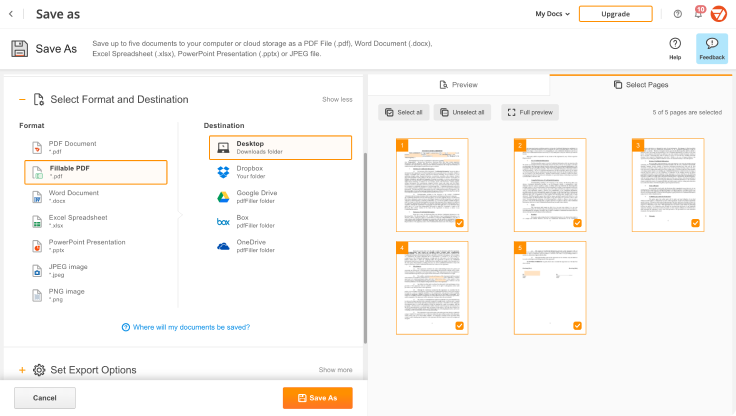

Convert text documents (.docx), spreadsheets (.xlsx), images (.jpeg), and presentations (.pptx) into editable PDFs (.pdf) and vice versa.

Start with any popular format

You can upload documents in PDF, DOC/DOCX, RTF, JPEG, PNG, and TXT formats and start editing them immediately or convert them to other formats.

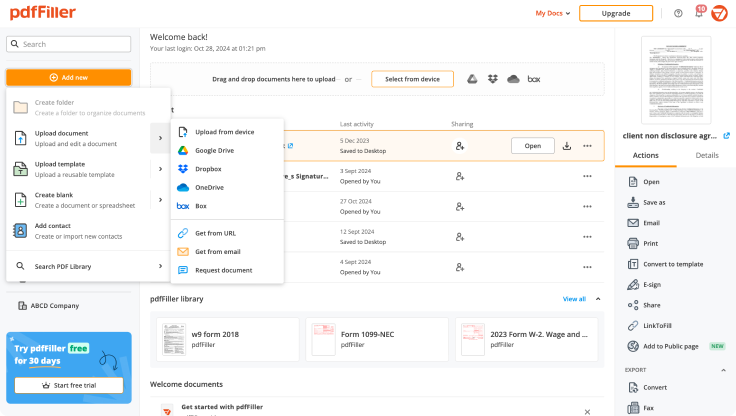

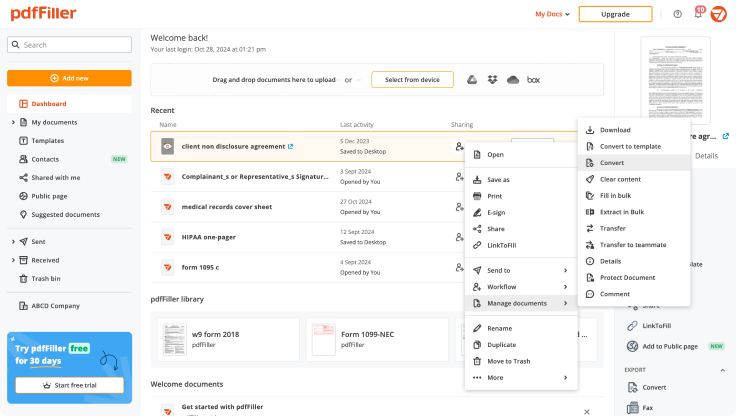

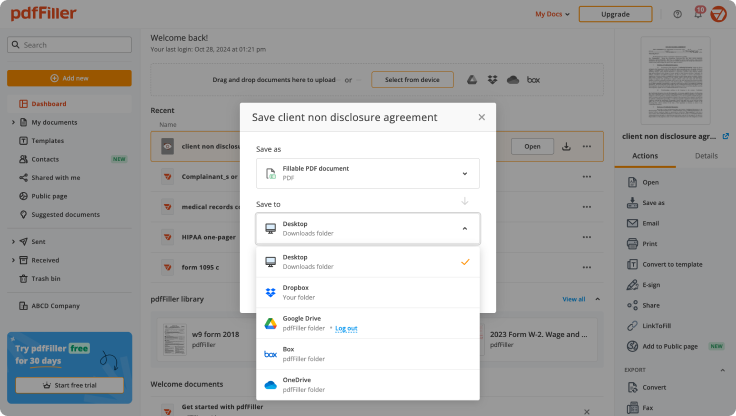

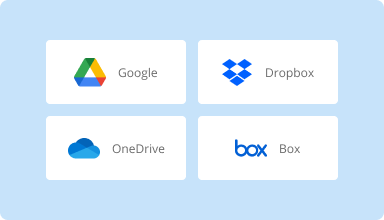

Store converted documents anywhere

Select the necessary format and download your file to your device or export it to your cloud storage. pdfFiller supports Google Drive, Box, Dropbox, and OneDrive.

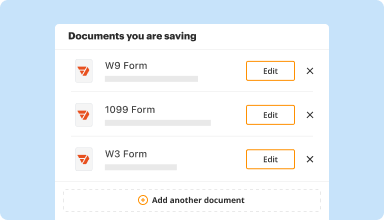

Convert documents in batches

Bundle multiple documents into a single package and convert them all in one go—no need to process files individually.

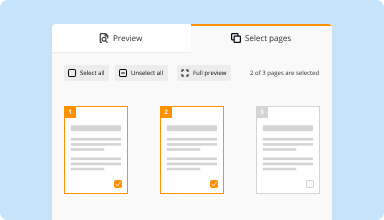

Preview and manage pages

Review the documents you are about to convert and exclude the pages you don’t need. This way, you can compress your files without losing quality.

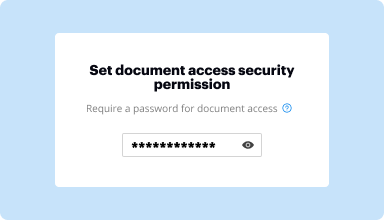

Protect converted documents

Safeguard your sensitive information while converting documents. Set up a password and lock your document to prevent unauthorized access.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I have had a wonderful experience with PDF filler thus far. I was able to connect with help very quickly when I had difficulty printing the document. Thanks very much!

2016-05-06

The billing is bogus and felt dishonest, but customer service fixed my problems after an email. These save well as pdfs but not as docs. I think the service should be less expensive, given apps with similar functionality.

2017-03-10

This service was extremely helpful when I was in a pinch for an assignment for work! Loved being able to combine multiple PDF's into one cohesive document, as well as edit, add text, and highlight on my existing PDF. Easy to use and user-friendly!

2019-03-08

I think the learning curve is a little steep. Also, at times the app seems a little counter-intuitive. It's not always easy to find forms you have worked on previously.

2019-10-27

I spoke with Nathan who was very…kind

I spoke with Nathan who was very helpful and kind. I was charged 75$ from my account and was told pdffiller was the ones who charged me. Nathan did everything he could do to help me solve these charges and said he would get back with me as soon as I sent a screen shot of bull. Within minutes Nathan contacted me back and explained where the charges came from. He was more helpful than the ones who charged me . I wish everyone was as kind, respectful and helpful as Nathan was.

2023-07-29

PDFfiller has made editing PDFs much easier than the Acrobat PDF. The editing features are laid out in an understandable manner. I would definitely recommend this product.

2021-12-16

great app

Its a great app to use and super easy to understand.the best it has everything you need i the app. its with you 24/7anywhere you go in the world :)

2021-04-16

I needed this for school had everything that was neccesary

Nothing special in my opinion but it did what it was supposed to do without any problems so 5 star :D

2021-04-04

Recommended for easy and trustworthy service

I was searching for a safe and efficient way to convert a few PDF file on the internet when I came across pdffiller.com and next thing i did was get a subscription since the tools I used was so helpful and seamless. The customer service is fast, reliable and helpful especially Mr. SAM who helped me with my subscription and account details. Kudos and keep up the great work pdffiller team.

2020-08-08

Convert On Wage Record Feature

The Convert On Wage Record feature simplifies the process of converting wage records for businesses. This tool allows you to efficiently manage employee payroll details, ensuring accuracy and timeliness.

Key Features

Automated conversion of wage data

User-friendly interface for easy navigation

Integration with existing payroll systems

Real-time updates and notifications

Secure data handling to protect employee information

Potential Use Cases and Benefits

Streamline payroll processing for HR departments

Reduce errors in employee payment calculations

Enhance compliance with wage regulations

Provide clear records for audits and reviews

Improve employee satisfaction through accurate payments

This feature addresses common challenges in payroll management by reducing manual work and preventing costly mistakes. By automating wage record conversions, you save time, enhance accuracy, and focus on other important aspects of your business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do you calculate salary or hourly?

This salary is divided by the number of pay periods in the year, as set by your company, to determine the salary for each pay period. If salaried employees are paid monthly, this employee would receive $1666.67 a month ($20,000 divided by 12). Example: An hourly employee is paid $9.62 an hour.

How do you convert minutes into payroll?

To calculate minutes for payroll, you must convert minutes worked to decimal form. Do this by dividing the minutes by 60. Then, multiply your answer by the employee's hourly rate to get the amount you need to pay for those minutes. Next, multiply the hours worked by the pay rate.

How do you calculate 30 minutes payroll?

Once converted, you can simply multiply employee (time worked * wage) to determine gross pay. For example, if an employee works 8:30 minutes, this is 8.5 hours when converted to decimal, multiply it by their hourly wage. This results in a gross wage amount.

How do you calculate payroll minutes?

To calculate minutes for payroll, you must convert minutes worked to decimal form. Do this by dividing the minutes by 60. Then, multiply your answer by the employee's hourly rate to get the amount you need to pay for those minutes. Next, multiply the hours worked by the pay rate.

How do I convert minutes to payroll in Excel?

Click on cell “A1” and enter the first of your payroll times. Enter the time as “xx:by” where “xx” is the number of hours worked, and “by” is the number of minutes worked. Press Enter and Excel will automatically select cell A2. Enter your next payroll time in A2.

How do you calculate hours and minutes for payroll?

You do this by dividing the minutes worked by 60. You then have the hours and minutes in numerical form, which you can multiply by the wage rate. For example, if your employee works 38 hours and 27 minutes this week, you divide 27 by 60. This gives you 0.45, for a total of 38.45 hours.

How do I do payroll in Excel?

0:23 11:49 Suggested clip Microsoft Excel 01 Payroll Part 1 — How to enter data and create YouTubeStart of suggested client of suggested clip Microsoft Excel 01 Payroll Part 1 — How to enter data and create

#1 usability according to G2

Try the PDF solution that respects your time.