Deposit Number License Kostenlos

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

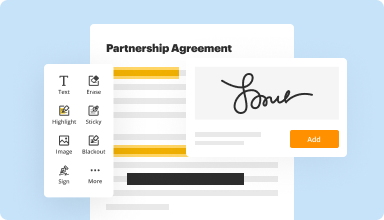

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

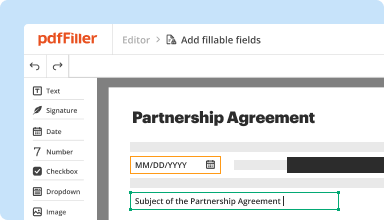

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

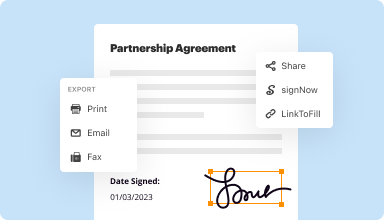

Fill out & sign PDF forms

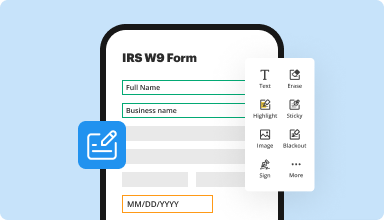

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

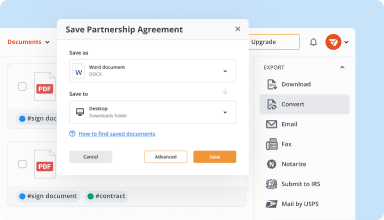

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

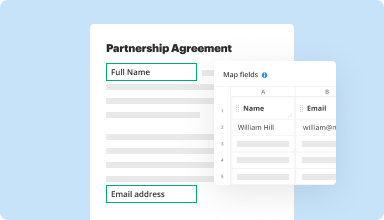

Collect data and approvals

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

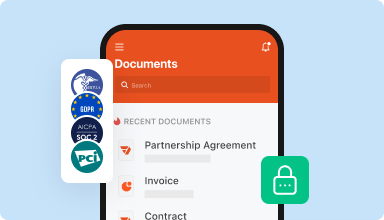

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I am pleased that I can resend my document to a recipient because I initially documented the recipient's email address incorrectly. I was able to find out how to do this with all the helpful tabs and support information

2015-11-30

I'm impressed with PDFfiller but I think there could be more options of background colours of the textbox, including different shades within each color.

2017-06-06

Did not know what to expect at first, this being my first time to use online PDF forms. But, after I got the hang of it, it's working out awesome and exactly what I was looking for.

2017-10-26

The forms are very easy to fill out. I was unable to comments in a few places where I ran out of room for heirs and needed to include a comment to refer to an additional page.

2018-01-17

What do you like best?

We have been using PDF filler since 2015 I believe. We love it! Its very user friendly and affordable.

What do you dislike?

The customization when sending e-signature documents is very limited.

Recommendations to others considering the product:

Go for it. Very easy to use and more affordable the other comparable solutions.

What problems are you solving with the product? What benefits have you realized?

great way to get documents signed digitally

We have been using PDF filler since 2015 I believe. We love it! Its very user friendly and affordable.

What do you dislike?

The customization when sending e-signature documents is very limited.

Recommendations to others considering the product:

Go for it. Very easy to use and more affordable the other comparable solutions.

What problems are you solving with the product? What benefits have you realized?

great way to get documents signed digitally

2019-05-28

Best way to keep organized

Overall, it can really make your life easier and more organized, highly recommended!

This is such a great tool for keeping track of your pdf flies while categorizing them to fit your preferences. As a student, I've used this for many different reasons and have always found it extremely convenient for filing and organizing my files. From school assignments to the official paper work, it provides a user friendly platform for easy usage and proper description. Must have for the student to the average daily worker!

It can be a little tricky to figure out how it functions properly at first, but their are some good tutorials out there that I highly recommend, such google them. Also, it doesn't really have a customer support system, which is a down side.

2019-09-12

IT WAS A GREAT SOFTWARE BUT I HOPE YOU…

IT WAS A GREAT SOFTWARE BUT I HOPE YOU CAN HAVE PESO CURRENCY TO PURCHASE THIS PREMIUM SINCE I AM STILL AT TRIAL USE.

2024-02-13

What do you like best?

I like being able to sign and edit PDF documents

What do you dislike?

I cannot think of anything I dislike about pdfFiller

What problems are you solving with the product? What benefits have you realized?

It helps me sign documents. I am use the product to fill in tax related forms. It has increased productivity for my business

2022-02-07

I thought it was a bit difficult to get a form completed. All I wanted was a statement that I paid my neighbor for a dent in his car. I had to hunt for a form that would allow me to enter that statement.

2021-06-05

Deposit Number License Feature

The Deposit Number License feature streamlines the process of managing your deposit transactions. With this tool, you gain visibility and control over your deposits, ensuring compliance and accuracy.

Key Features

Unique identification for each deposit transaction

Enhanced tracking and reporting capabilities

Seamless integration with existing financial systems

User-friendly interface for easy access and management

Real-time updates to maintain accurate records

Potential Use Cases and Benefits

Financial institutions can enhance transaction monitoring

Businesses can easily reconcile their deposit records

Accountants and auditors can simplify their reporting processes

Companies can ensure compliance with regulatory requirements

Organizations can reduce the risk of errors in deposit handling

This feature addresses the common problem of managing multiple deposit transactions. By providing clear identification and easy access to your deposit data, it helps you maintain accuracy and efficiency. Ultimately, the Deposit Number License feature empowers you to manage your finances with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How much cash are you allowed to deposit in a bank?

Under the Bank Secrecy Act, banks and other financial institutions must report cash deposits greater than $10,000. But since many criminals are aware of that requirement, banks also are supposed to report any suspicious transactions, including deposit patterns below $10,000.

How much cash can you deposit in a bank?

Millions of people make regular deposits into their savings or checking accounts to pay bills, build up their savings and prepare for their retirement. There is nothing illegal about depositing large sums of cash in the bank account. However, deposits over $10,000 have to be reported to the IRS.

What is the maximum amount of cash you can deposit in a bank?

The Law Behind Bank Deposits Over $10,000 The Bank Secrecy Act is officially called the Currency and Foreign Transactions Reporting Act, started in 1970. It states that banks must report any deposits (and withdrawals, for that matter) that they receive over $10,000 to the Internal Revenue Service.

How much cash can you deposit before it is reported to the IRS?

When do banks report deposits to IRS? Banks and credit unions are required to report a cash deposit of $10,000 or larger. In addition, if two transactions within a 12-month period seem related and their total exceeds $10,000 they must be reported.

How much cash can you deposit without raising suspicion?

All you have to do to capture the IRS' attention is make multiple large deposits that are less than $10,000 in your account. Banks that get deposits of more than $10,000 have to report those deposits to the federal government.

What happens when you deposit over $10000?

If you deposit $10,000 or more in cash at a bank, no one is going to swoop in and put you in handcuffs. Large transactions are perfectly legal. The bank just takes down your identification and uses it to file a form called a Currency Transaction Report, which it sends to the IRS.

How much cash can I deposit before the bank reports?

Banks and credit unions are required to report a cash deposit of $10,000 or larger. In addition, if two transactions within a 12-month period seem related and their total exceeds $10,000 they must be reported.

How much money can you deposit before the bank reports?

Under the Bank Secrecy Act, banks and other financial institutions must report cash deposits greater than $10,000. But since many criminals are aware of that requirement, banks also are supposed to report any suspicious transactions, including deposit patterns below $10,000.

Does the bank have to report large deposits?

The Law Behind Bank Deposits Over $10,000 It states that banks must report any deposits (and withdrawals, for that matter) that they receive over $10,000 to the Internal Revenue Service. For this, they'll fill out IRS Form 8300. This begins the process of Currency Transaction Reporting (CTR).

What happens if you deposit over 10000 cash?

If you deposit $10,000 or more in cash at a bank, no one is going to swoop in and put you in handcuffs. Large transactions are perfectly legal. The bank just takes down your identification and uses it to file a form called a Currency Transaction Report, which it sends to the IRS.

#1 usability according to G2

Try the PDF solution that respects your time.