Keep Wage Log Kostenlos

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

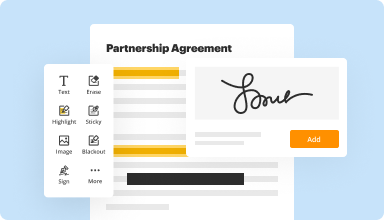

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

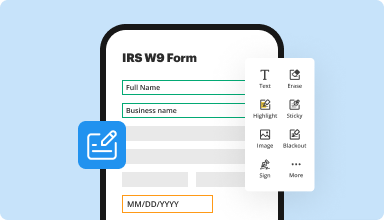

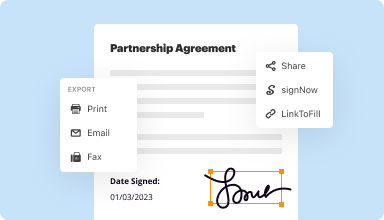

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

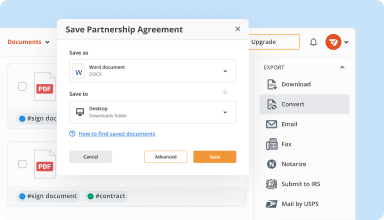

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

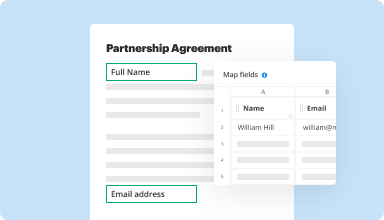

Collect data and approvals

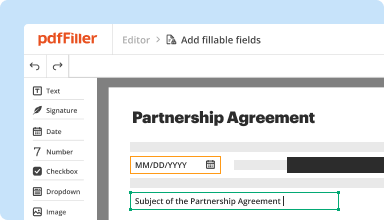

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

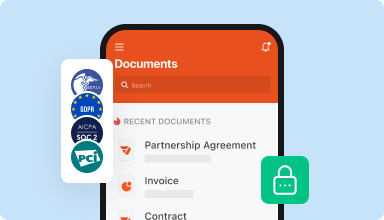

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

I really love this program - saves me SO much time because I can merge documents or remove pages, along with making changes and corrections. SO much better than rescanning documents!

2017-06-22

This was a great tool to use as I have suffered a horrible arm injury which made it very difficult to hand write. Your program was a life savior as I had numerous pages of medical documents to file.

2019-07-17

Great For PDF

Easy access for my customer to fill out any paperwork.

Enjoy using this software because I can type my invoices as word and then save them as PDF, and nobody can modify them. w

As of now I really enjoy this software everything looks very neat when either im emailing any document or receiving.

2019-10-08

Very effective tool that enables me to upload and mark students PDF assessments. I would love to learn more to speed up the process further and have some questions re adding colour to symbols i.e. tick symbol

2024-05-04

This morning my subscription to PdfFiller was automatically renewed. Once I realized it, I notified the company to cancel my subscription and to provide a refund. Within a short time, I received a response confirming that the subscription was canceled and that the charge was reversed. I would definitely recommend this company and would use them again if I had a need.TL

2022-04-15

this was very helpful making legal forms, a lot of options to navigate. I would definitely recommend this product to others.

The price is more than I would like to pay, so I probably will use temporarily but I'm sure I will return.

2022-01-12

Great customer service

Great customer service, and the software allowed me to edit documents that I needed to sign and scan without access to anpronter

2021-02-22

Excellent and very useful

Excellent and very useful. And good customer service! I was confirmed a refund quickly after contacting them (although I still have to wait for the transfer)

2020-11-16

All I needed was to fill in 5 W2 2024 forms for church staff, and pdfiller was easy to use. Since I won't be needing it for anything else, I don't want the charge on my card. I will remember pdfiller should a future need arise.

2025-02-10

Keep Wage Log Feature

The Keep Wage Log feature helps you track and manage employee wages efficiently. With this tool, you can maintain an organized record of payments, ensuring accuracy and transparency in your payroll system.

Key Features

Track wages for multiple employees

Record payments with dates and notes

Generate detailed reports on wage history

Export data for easy integration with accounting software

Set reminders for payment due dates

Use Cases and Benefits

Small business owners can streamline payroll management

Employers can ensure compliance with labor laws

Employees can view their payment history for better financial planning

HR departments can easily access wage data for audits

Freelancers can track payments from clients efficiently

By using the Keep Wage Log feature, you reduce the chances of errors in payroll, promote fair practices, and foster trust with your team. This tool addresses the common challenge of managing payment records effectively, allowing you to focus on other vital aspects of your business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How long do you have to keep certified payroll records?

Payroll Records Retention Certified payroll reports and supporting documentation are retained by the contractor for three years. In turn, payroll records are retained for seven to 10 years. In the event of a government certified payroll audit, the contractor will be asked to provide these records to the auditor.

How long do we need to keep employee records?

You are required by law to keep records of all employees Tax and National Insurance contributions. You must keep them for three years from the end of the tax year they relate to. HM Revenue & Customs (HMRC) has the right to check your records.

How long do you have to save employee records?

The Equal Employment Opportunity Commission says employers should keep all employment records for at least one year from the employee's date of termination. The federal age-bias law requires that you retain payroll records for three years.

How long do you have to keep garnishment records?

Fair Labor Standards Act Records that employers are required to maintain for at least three years include personal information about the employee, including Social Security number, sex, position and title, wages earned, pay rate and overtime earnings.

How long do you have to keep payroll tax returns?

Keep all records of employment taxes for at least four years after filing the 4th quarter for the year. These should be available for IRS review. Records should include: Your employer identification number.

How long do you have to keep 941 returns?

Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return. Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.

How long does an employer have to keep W 2?

The IRS orders business owners to keep these documents on file for up to four years. Many employers choose to keep them longer just in case, but the federal requirement when it comes to Copy D (employer copy) W-2 forms, the general rule is a minimum of four years.

Is there any reason to keep old tax returns?

You probably learned that you should keep a tax return for at least three years after filing it. The reason for the three-year answer is that the IRS has up to three years to audit you and assess additional taxes. The IRS can go back six years when more than 25% of income was omitted from the tax return.

#1 usability according to G2

Try the PDF solution that respects your time.