Protected Approve Settlement Kostenlos

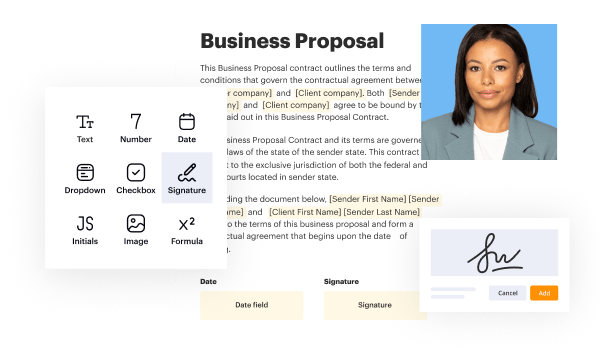

Create a legally-binding electronic signature and add it to contracts, agreements, PDF forms, and other documents – regardless of your location. Collect and track signatures with ease using any device.

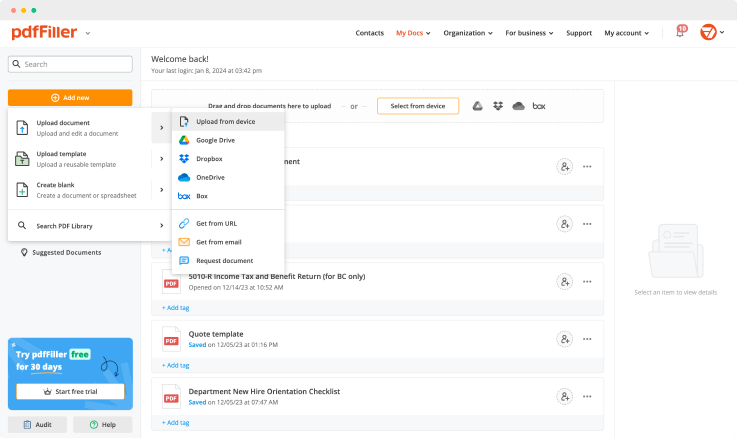

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

Upload a document

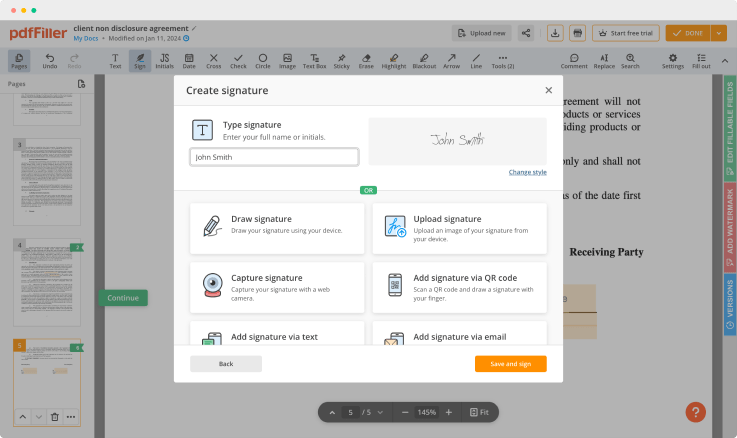

Generate your customized signature

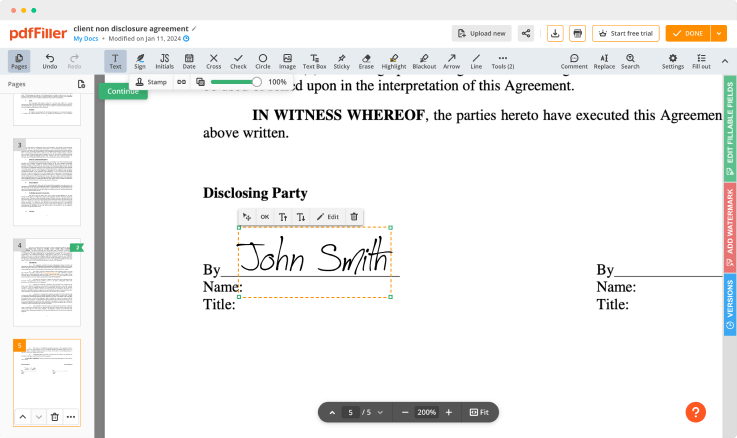

Adjust the size and placement of your signature

Download, share, print, or fax your signed document

Join the world’s largest companies

Employees at these companies use our products.

How to Add a Signature to PDF (and Send it Out for Signature)

Watch the video guide to learn more about pdfFiller's online Signature feature

pdfFiller scores top ratings in multiple categories on G2

4.6/5

— from 710 reviews

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Upload your document to pdfFiller and open it in the editor.

Unlimited document storage

Generate and save your electronic signature using the method you find most convenient.

Widely recognized ease of use

Resize your signature and adjust its placement on a document.

Reusable templates & forms library

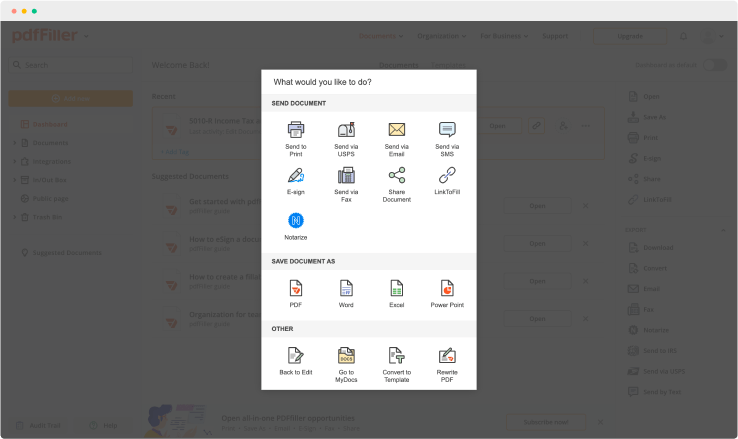

Save a signed, printable document on your device in the format you need or share it via email, a link, or SMS. You can also instantly export the document to the cloud.

The benefits of electronic signatures

Bid farewell to pens, printers, and paper forms.

Efficiency

Enjoy quick document signing and sending and reclaim hours spent on paperwork.

Accessibility

Sign documents from anywhere in the world. Speed up business transactions and close deals even while on the go.

Cost savings

Eliminate the need for paper, printing, scanning, and postage to significantly cut your operational costs.

Security

Protect your transactions with advanced encryption and audit trails. Electronic signatures ensure a higher level of security than traditional signatures.

Legality

Electronic signatures are legally recognized in most countries around the world, providing the same legal standing as a handwritten signature.

Sustainability

By eliminating the need for paper, electronic signatures contribute to environmental sustainability.

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

Regulates the use and holding of personal data belonging to EU residents.

SOC 2 Type II Certified

Guarantees the security of your data & the privacy of your clients.

PCI DSS certification

Safeguards credit/debit card data for every monetary transaction a customer makes.

HIPAA compliance

Protects the private health information of your patients.

CCPA compliance

Enhances the protection of personal data and the privacy of California residents.

Protected Approve Settlement Feature

The Protected Approve Settlement feature enhances your settlement process by providing an additional layer of security and control. This tool is designed to ensure that your financial transactions are both safe and efficient.

Key Features

Real-time transaction monitoring

User-friendly interface for easy navigation

Customizable settings to meet specific needs

Integration with existing systems for seamless operation

Comprehensive reporting tools for better insights

Potential Use Cases and Benefits

Protect sensitive transactions in high-stakes environments

Streamline the approval process for quicker transaction times

Reduce the risk of fraud with enhanced security measures

Improve financial reporting accuracy with detailed analytics

Easily adapt to regulatory requirements by customizing workflows

By implementing the Protected Approve Settlement feature, you can address common challenges in transaction security and efficiency. This solution helps you minimize risks, ensure compliance, and enhance overall operational effectiveness, giving you peace of mind in your financial dealings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Can my lawsuit settlement be garnished?

Money awarded in personal injury settlements in California is technically “exempt” under the law. That means that creditors cannot legally garnish that money (take it from your bank accounts). In cases like this, your settlement money essentially gets taken by mistake.

Can settlement money be garnished?

Protecting a Workers' Compensation Settlement In most cases, workers' comp settlements are exempt from garnishment as are other settlement types. Debt collectors cannot garnish them, except certain government agencies.

Can the IRS take my settlement money?

The IRS is authorized to levy, or garnish, a substantial portion of your wages. To seize real and personal property you own, such as your home and your automobiles and even take money that's owed to you. However, the IRS cannot take your workers' compensation settlement for several reasons.

Can a settlement be garnished for child support?

Garnishing Accident Settlement Payments With few exceptions, any regular income received by a parent can be garnished for child support. Accident settlements that are paid out periodically can generally be garnished for child support in those states that count them as income.

Is your spouse entitled to your settlement?

California Equitable Division Laws All assets and debts (including settlements) either party acquired during the marriage will split in half during a divorce one-half for each spouse. However, your spouse will only have a right to certain parts of your settlement.

Can debt collectors take your settlement?

Money awarded in personal injury settlements in California is technically “exempt” under the law. That means that creditors cannot legally garnish that money (take it from your bank accounts). When creditors file suit against you, a court may order you to pay.

What percentage of debt will collectors settle for?

If you decide to offer a lump sum, understand that no general rule applies to all collection agencies. Some want 75%80% of what you owe. Others will take 50%. Those that have given up on you may settle for one-third or less.

Can the IRS take my Personal Injury Settlement?

If you receive a settlement for personal physical injuries or physical sickness and did not take an itemized deduction for medical expenses related to the injury or sickness in prior years, the full amount is non-taxable. Do not include the settlement proceeds in your income.

Ready to try pdfFiller's? Protected Approve Settlement Kostenlos

Upload a document and create your digital autograph now.