Split Identification Format Kostenlos

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

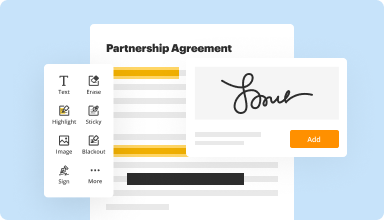

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

Fill out & sign PDF forms

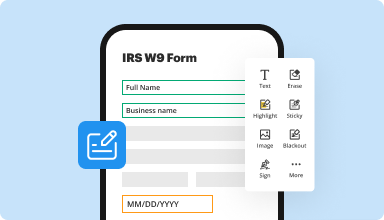

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

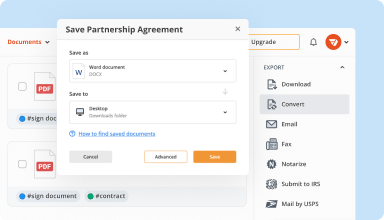

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

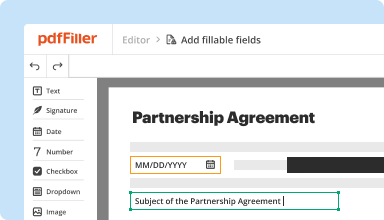

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

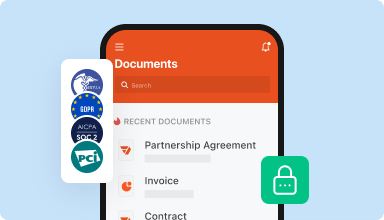

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

Taking a while to learn how to do this, but it is great. Questions: (1) Tell me how to transmit this electronically to you. (2) May I use the same form to register different Scripture we publish? Most elements in this first registration will apply to all that we register. (3) How do we handle the fee for registrations, and what do you need in addition to this and a fee? (4) I have a hearing problem, and need to be in e-mail contact with you (life3@gmx.com). Leon Taylor, Chairman of Vietnamese Bible, Inc.

2016-12-07

THERE IS A REAL PROBLEM WHEN TRYING IN FORMS THAT YOU IMPORT YOURSELF. IF YOU TRY TO MAKE A CHANGE FROM ONE SECTION TO NEXT IT AUTO FILLS ON ITS OWN AND I HAVE NOT FOUND A SOLUTIONS FOR IT

2018-12-01

I loved using the program. It helped on saving paper while allowing to update documents without having to print, use white out, and scan the updated document. It was really the only feature I used, but i know there was so much more to the program. I would love if they created a pay option that was cheaper than basic or reduced the price of basic for those of us who just need it for one or two functions. It was very easy to use and i wish i needed it for other things. Overall still a great program and i would recommend it to anyone. I am only giving it 4 stars due to me just not needing it for a whole lot.

2020-03-31

What do you like best?

I love to be a neat freak and this program lets me do that!!! Easy to use!!!

What do you dislike?

Nothing! I love PDFfiller! Easy to use and makes me look professional!

Recommendations to others considering the product:

I love it!

What problems are you solving with the product? What benefits have you realized?

Some days my handwriting is messy and this helps me have neat paperwork!

I love to be a neat freak and this program lets me do that!!! Easy to use!!!

What do you dislike?

Nothing! I love PDFfiller! Easy to use and makes me look professional!

Recommendations to others considering the product:

I love it!

What problems are you solving with the product? What benefits have you realized?

Some days my handwriting is messy and this helps me have neat paperwork!

2019-05-22

Great experience!

I was able to get the rental applications done for my house rental.

Super easy to use. Clear instructions, I found enjoyable to use this software. I'm not that good with computers but I was able to use it without much difficulties.

I can't think of anything that I didn't like. I had to take a little more time to find out how to get confirmation of my forms I sent, other than that it was fast and easy.

2017-11-14

Pauline took care of my concerns in a…

Pauline took care of my concerns in a timely, polite and expeditious manner. I wish more customer service representatives were like here. She is a boon to her company.

2024-09-20

I had a Subscription for PDF filler It…

I had a Subscription for PDF filler It worked well. Easy to use very user-friendly. Unfortunately, my financial circumstances are such. I had to cancel my subscription on the day it had renewed. I sent an email. Sara could not have been more helpful. My subscription was canceled, and I received an immediate return of the fee. Very happily satisfied.

2024-07-09

Got done what I needed although the…

Got done what I needed although the interface was less intuitive than I hoped and instructions via hlp boxes wasnt there.

2022-01-05

It works!

The application is relatively intuitive to use. It was the only one that offered the full PDF fillable experience under a free trial to really test it. I recommend this program over others I have tried.

2025-05-18

Split Identification Format Feature

Discover the Split Identification Format feature, designed to simplify data handling and improve accuracy in various applications. This feature allows you to easily organize and differentiate identification data, making it a valuable tool for businesses and individuals alike.

Key Features

Efficient data organization

Customizable identification formats

Seamless integration with existing systems

User-friendly interface

Enhanced data accuracy

Potential Use Cases and Benefits

Streamlining identification processes in customer databases

Improving accuracy in data entry tasks

Facilitating better reporting and analysis of identification data

Simplifying the integration of identification data from various sources

Increasing accessibility of identification information for team members

By implementing the Split Identification Format feature, you can effectively address common challenges associated with identification data management. This solution reduces errors, saves time, and enhances overall productivity, enabling you to focus on what really matters – your business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Do I have to report a gift of $15000?

Even if you gift someone more than $15,000 in one year, you will not have to pay any gift taxes unless you go over that lifetime gift tax limit. You will still need to report gifts over the annual exclusion to the IRS via Form 709.

Do you have to report a gift to the IRS?

The person who receives your gift does not have to report the gift to the IRS or pay gift or income tax on its value. You make a gift when you give property, including money, or the use or income from property, without expecting to receive something of equal value in return.

How does the IRS know if you give a gift?

Self-Reporting the IRS Gift Tax Gift taxes are only assessed on gifts given above a certain dollar amount (the “exclusion” amount), per recipient, per year, that total more than the exemption amount. Furthermore, you are required by law to report the gift, and if you don't, it could come out in an audit.

What happens if I don't file a gift tax return?

If you fail to file the gift tax return, you'll be assessed a gift tax penalty of 5 percent per month of the tax due, up to a limit of 25 percent. If your filing is more than 60 days late (including an extension), you'll face a minimum additional tax of at least $205 or 100 percent of the tax due, whichever is less.

Do I have to report gifts?

The CRA does not tax most gifts and inheritances. However, there are some exceptions to this rule. If your employer gives you a cash gift, you are required to report it as income. However, the individual who gifted you the property may owe capital gains taxes.

Do you have to report gifts under 14000?

If you give less than $14,000 to any individual in a year, you do not have to file a 709. And the answer to your second question is simply that anything under $14,000 does not get subtracted from your lifetime exclusion.

Do cash gifts need to be reported?

Cash gifts are never considered income to the person receiving them, so cash gifts do not need to be reported to the Internal Revenue Service (IRS) by the recipient. The person making the gift, however, must file a gift tax return and might have to pay a gift tax if the gift is large enough.

How much money can you give someone without being taxed?

Annual gift tax limitations Most presents to friends and family will fall below the annual threshold for taxable gifts. In 2016 and 2017, a taxpayer could give up to $14,000 per person per year without being taxed on the gift (that rises to $15,000 in 2018).

#1 usability according to G2

Try the PDF solution that respects your time.