Split Salary Format Kostenlos

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

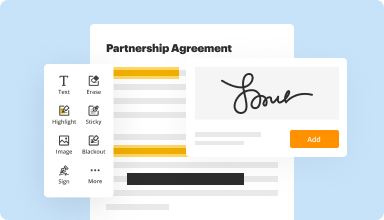

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

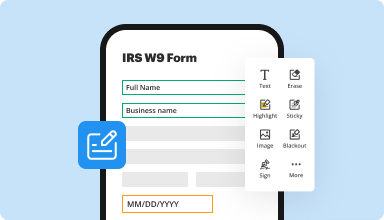

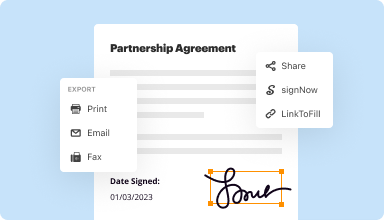

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

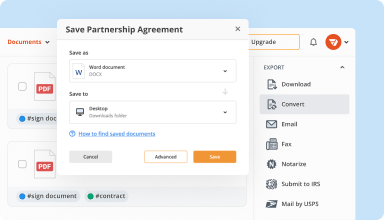

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

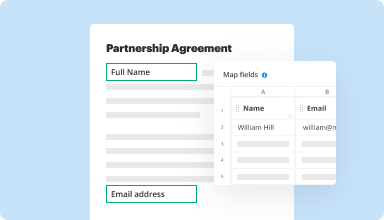

Collect data and approvals

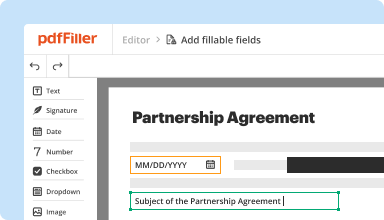

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

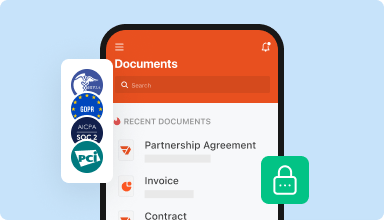

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

You need t tell people that if they enter numbers with commas, the IRS filing process does not work. After lots of time and trial/error, I stumbled across that as the cause of my problems.

2018-02-04

mostly quite a good thing. I would like to know how to move text after you've placed it on the page, though. That needs to be more intuitive if it's possible.

2018-05-14

Successful Chat Support

Kara helped me locate a document that I could not find after downloading it. What a relief!

I was extremely worried because personal information was on the document. Through the chat support feature, Kara guided me in locating the document in my account (which I didn't know I had), moving it to the Trash, and then permanently deleting it.

2023-06-26

RECOMMENDED

This app/website is really good. It is easier and it has some features that is really useful if you're dealing with pdf files all day long. The downside tho, it is quite pricey for me. But if you're okay with the price, consider subscribe to their service, very recommended.

2022-12-14

This morning my subscription to PdfFiller was automatically renewed. Once I realized it, I notified the company to cancel my subscription and to provide a refund. Within a short time, I received a response confirming that the subscription was canceled and that the charge was reversed. I would definitely recommend this company and would use them again if I had a need.TL

2022-04-15

It was smooth and easy to understand. My only question or concern is. When submitting my corrected 1099 to is IRS via your site. I was not sure which copy it was sending. It did not give me an option. I hope the correct copy was sent to the IRS.

2022-02-26

What do you like best?

PdfFiller is a user-friendly application that I often use in the classroom. It has worked well for parent forms and even creating worksheets. Documents are easy to upload and edit with no data or formatting loss.

What do you dislike?

I haven't yet found any CONs for this product and will continue to use and recommend it to others.

Recommendations to others considering the product:

I would definitely recommend giving pdfFiller a try. It doesn't have a steep learning curve, so is useable right away.

What problems are you solving with the product? What benefits have you realized?

Sending out paper forms wasn't an option this year, so it is easy to create forms that can be sent out and returned electronically. A huge plus is being able to get electronic signatures.

2021-12-19

I mislead them on my intentions for the service level that I required. Once I brought it to their attention, I answered 3 questions; and the matter was immediately resolved. Outstanding customer service comms. !!!

2020-08-27

I was just quickly looking for a template and bought the trial package and was fully refunded 2 days later.

I was also able to cancel my subscription without any hassles.

Keep up the good work !

2025-03-09

Split Salary Format Feature

The Split Salary Format feature allows you to divide salaries into multiple components. This helps in better management of payroll and enhances transparency for employees regarding how their salaries are structured.

Key Features

Easily divide salaries into fixed and variable components

Customize salary structures based on employee roles

Generate clear reports for payroll insights

Integrate with existing payroll systems seamlessly

Ensure compliance with financial regulations

Potential Use Cases and Benefits

Companies looking to enhance payroll clarity for employees

Organizations that need to manage variable pay effectively

HR teams aiming to streamline payroll processes

Finance departments wanting to track salary distributions

Businesses focused on improving employee satisfaction and retention

By using the Split Salary Format feature, you can solve the common issues of payroll confusion and lack of transparency. Your employees will appreciate a clear breakdown of their earnings, leading to higher trust and engagement. You’ll also gain better control over your payroll operations, making it easier to adapt to changing business needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do you divide salary structure?

In a nutshell, Net Salary = Basic Salary + Allowances Income Tax/ TDS Employer's Provident Fund Professional Tax. Add the allowances to the basic salary, and you arrive at the gross salary. This amount is calculated before the application of taxes and other deductions.

How do you create a salary structure?

Establish your compensation philosophy. Each employer needs a policy which outlines their desired market position. Gather market data. Identify benchmark jobs. Measure your market position. Calculate the comparative. Check your budget. Start allocating. Final adjustments.

How do you create a pay structure?

Establish your compensation philosophy. Each employer needs a policy which outlines their desired market position. Gather market data. Identify benchmark jobs. Measure your market position. Calculate the comparative. Check your budget. Start allocating. Final adjustments.

What is a salary structure definition?

A salary structure, or pay scale, is a system that employers use to determine an employee's compensation. A standard salary structure takes into account things like merit, length of employment, and pay compared to similar positions. Create a minimum and maximum salary within the structure.

How do I set a salary?

Set your upper salary limit by what a particular job is worth to you. Know the market to determine the least you'll pay. Match jobs whose value comes with hours to hourly pay. Match jobs whose value comes in insight or skill to salaried pay.

How do you divide gross income?

Step 1: Calculate gross salary. Gross Salary = CTC (EPF + Gratuity) Step 2: Calculate taxable income. Step 3: Calculate income tax** Step 4: Calculating in-hand/take home salary.

How do I calculate my gross income?

Calculating gross monthly income if you're paid hourly First, to find your yearly pay, multiply your hourly wage by the number of hours you work each week, and then multiply the total by 52. Now that you know your annual gross income, divide it by 12 to find the monthly amount.

How do I calculate my gross daily income?

To calculate an employee's gross pay, start by identifying the amount owed each pay period. Hourly employees multiply the total hours worked by the hourly rate plus overtime and premiums dispersed. Salary employees divide the annual salary by the number of pay periods each year. This number is the gross pay.

#1 usability according to G2

Try the PDF solution that respects your time.