Federal Employer Identification Number

What's included in the Federal Employer Identification Number forms package

Get your paperwork done faster by managing documents in bulk. Get the Federal Employer Identification Number package by pdfFiller to simplify the process of submitting these forms, doing them at the same time.

Forget about searching for the document or application you need. Within pdfFiller, templates are categorized and organized into packages. The Federal Employer Identification Number forms package, like other packages available, offers a pack of templates you can submit and send out unlimited number of times. Use the PDF editor provided by pdfFiller to customize the content or structure of any of the documents included. Depending on what procedure you wish to perform, pdfFiller features separate panels with a range of editing tools. Once the first document has been completed, click Done to save changes and proceed to the next document in the package.

pdfFiller’s form bundles allow to reduce the amount of time it takes to submit an application, complete a tax form, sign a contract, and more. Special template bundles like the Federal Employer Identification Number package will come in use for you when you need to file various documents for a particular occasion, fast. Don't go another day to find your submissions rejected due to improper formatting - get the Federal Employer Identification Number package, fill in the required information, put an electronic signature and send, all within a single platform.

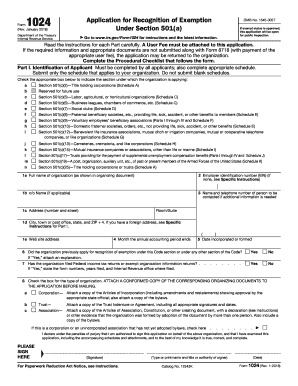

Form 1023 is a United States IRS tax form, also known as the Application for Recognition of Exemption Under 501(c)(3) of the Internal Revenue Code. It is filed by nonprofits to get exemption status.

1024 is a power of two: 210 (2 to the tenth power). It is the nearest power of two from decimal 1000 and senary 100006 (decimal 1296). 1024 is the smallest number with exactly 11 divisors (but note that there are smaller numbers with more than 11 divisors; e.g., 60 has 12 divisors) (sequence A005179 in the OEIS).

Form SS-4, Application for Employer Identification Number, is used by businesses wishing to be assigned a tax identification number that identifies them as an employer. ... If approved, the IRS will then issue an employer identification number (EIN) that the business will use with their tax returns.

Federal Employer Identification Number FAQs