Foreign Earned Income

Purchase the Foreign Earned Income package to get these templates

Get your paperwork done faster by managing documents in groups. Get the Foreign Earned Income forms package to simplify the process of submitting these forms, working with them at the same time.

All you need to do is open the Foreign Earned Income forms package. Then, find your document and start editing its content. pdfFiller is not only an extended document library but also a convenient PDF editing tool, which allows to complete and customize the template as much as you need. It features a range of features you can use to customize your document's layout and make it look professional. Select a specific option from the panel at the top of the page to insert new fillable fields, add or delete text, add image, signature, etc.

The form packages provided by pdfFiller, such as the Foreign Earned Income forms package, allow to reduce the amount of time it takes to submit an application, complete a tax form, sign a contract, and much more. Special template packages like the one listed above will come in use when you need to file various documents for a particular occasion, fast. Don't go another day to find your submissions rejected due to improper formatting - get the Foreign Earned Income forms package, fill in the required information, put a digital signature and send, all within a single platform.

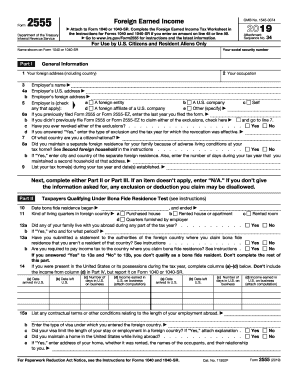

More In Forms and Instructions If you qualify, you can use Form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. You cannot exclude or deduct more than your foreign earned income for the year.

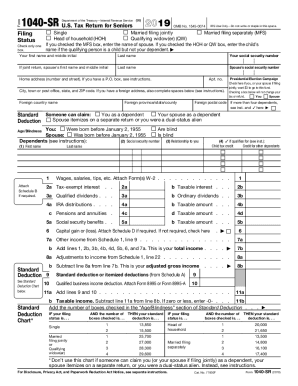

Form 1040-X is issued by the Internal Revenue Service (IRS) to taxpayers who need to amend their tax returns for any reason. A 1040-X form is necessary for an amended tax return that will change tax calculations, such as changes to filing status, number of dependents, or corrections to income credits or deductions.

Foreign Earned Income FAQs