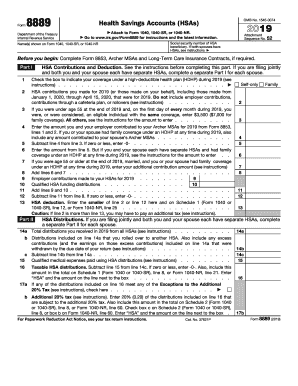

Health Savings Accounts (HSAs)

Purchase the Health Savings Accounts (HSAs) package to get these templates

Fill out and share the Health Savings Accounts (HSAs) package online with pdfFiller. From now on, you don’t have to search every form separately to organize them in your dashboard - they’re gathered in one place to save you time. Choose one or several separate forms from a bundle if needed.

On pdfFiller you can find the form packages manually chosen to match a wide range of common paperwork cases, such as tax submission, filing for fees deduction, certification request, etc. The documents included in the Health Savings Accounts (HSAs) package have no limits for filling out and you can use them for numerous practices. Proceeding to the pdfFiller's editing tool, you can complete the required document, sign it, and securely send out - in your browser window..

To start working on the Health Savings Accounts (HSAs) forms package, click Fill Now on one of the forms - you will be navigated to the editing tool. In order to make the submission process faster, follow the Wizard tool's suggestions. This tool guides you through the document and displays the information you need to fill in. Thus, you will never miss something and save time on resubmissions and amends. After you finish a form, click Done and proceed with other forms in the deal.

The purpose of the form is to report your deductible contributions, calculate the deduction, report the distributions you take to pay medical expenses and to calculate the tax you must pay on withdrawals you make for non-medical related purposes. ...

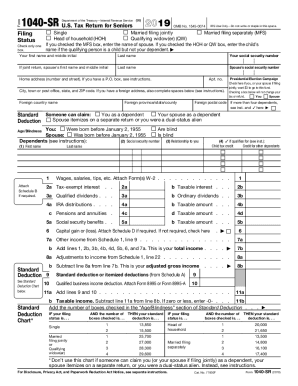

Form 1040NR is a version of the IRS income tax return that nonresident aliens may have to file if they engaged in business in the United States during the tax year or otherwise earned income from U.S. sources throughout the year.

Health Savings Accounts (HSAs) FAQs