Income tax return forms package

Purchase the Income tax return forms package to get these templates

Complete and send out the Income tax return package online using pdfFiller. Now, you don’t need to search every form separately and get them organized - they are already gathered in one place for your convenience.Opt out the templates you won't need if it's the case.

Form packages in pdfFiller are manually categorized and contain the most popular paperwork cases such as tax submission, various applications, and agreements. The templates from the Income tax return package and other deals have no limits for filling out so you can use them for a number of purposes. Easily complete them in the full-featured editor, e-sign electronically, and stay compliant with industry-leading security standards.

Click Fill Now to start working on your form in the full-featured editor. Insert your information in the fillable fields. Follow the Wizard tool's guidelines to know what steps you should take to do the completion procedure as designed. It highlights the required fields one after another, suggesting the information you should input. If you're not convenient with scanning the whole template in search of missing fields, use the list from the panel above - it contains every piece of the form you should interact with. Repeat the same process with each form in the Income tax return package and send them out at the same time.

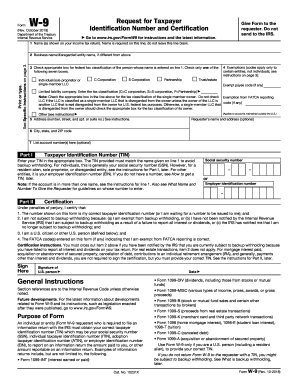

Form W-9 is used in the United States income tax system by a third party who must file an information return with the Internal Revenue Service. It requests the name, address, and taxpayer identification information of a taxpayer.

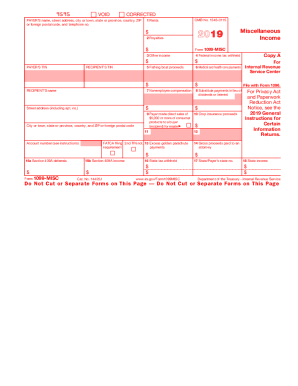

Internal Revenue Service tax forms are forms used for taxpayers and tax-exempt organizations to report financial information to the Internal Revenue Service of the United States.

File Form 1099-MISC for each person to whom you have paid during the year: At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

The CMS-1500 form is the standard claim form used by a non-institutional provider or supplier to bill Medicare carriers and durable medical equipment regional carriers (DMERCs) when a provider qualifies for a waiver from the Administrative Simplification Compliance Act (ASCA) requirement for electronic submission of ...

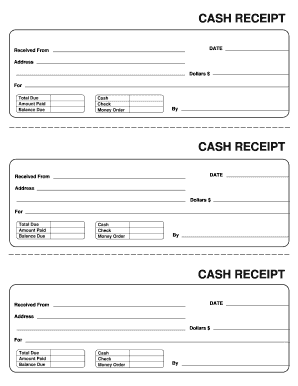

A receipt lists the transaction details as proof that an invoice has been paid, partially or in-full. ...

Income tax return forms package FAQs