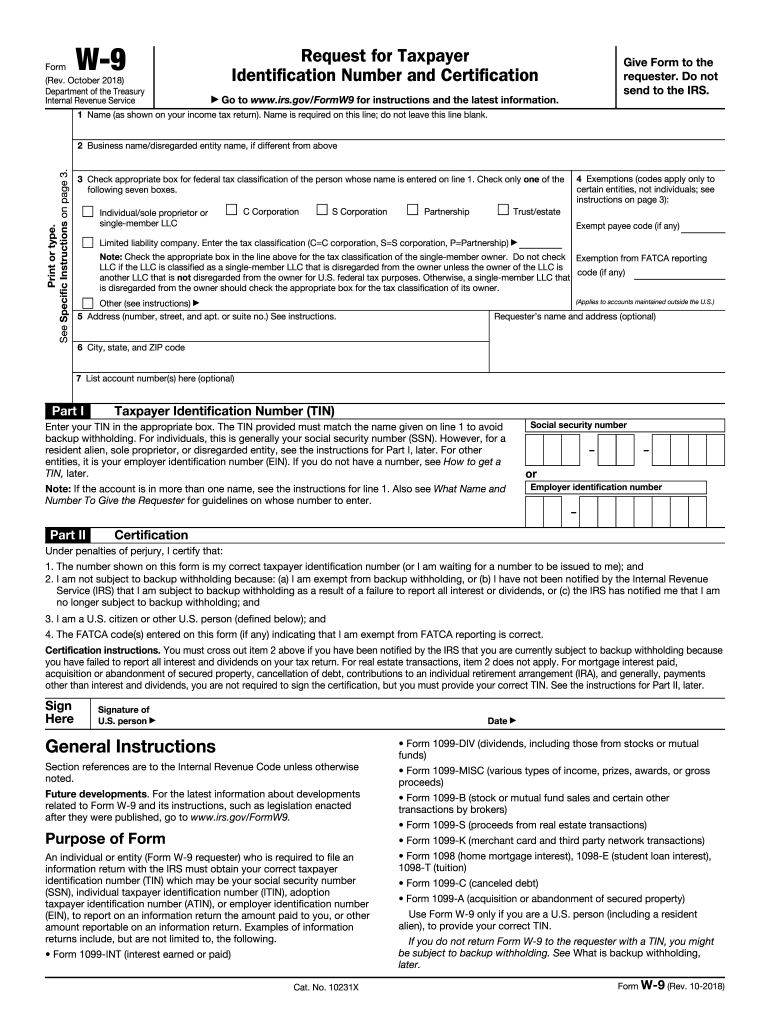

IRS W-9 2018 free printable template

Instructions and Help about IRS W-9

How to edit IRS W-9

How to fill out IRS W-9

About IRS W-9 2018 previous version

What is IRS W-9?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

FAQ about IRS W-9

What should I do if I realize I made a mistake on my IRS W-9 after submitting it?

If you discover an error on your IRS W-9 after submission, you may need to provide a corrected form to the requester. It's essential to communicate the mistake as soon as possible and confirm whether they require a new W-9. Keep records of your communications and any corrections for your legal safety.

How can I verify if my IRS W-9 has been processed by the requesting entity?

To track the status of your IRS W-9, reach out directly to the organization or individual who requested it. They should be able to inform you of its receipt and processing status. Make sure to ask about any common e-file rejection codes that could have affected your submission.

Are e-signatures acceptable on the IRS W-9 form, and what are the implications for privacy?

Yes, e-signatures are generally acceptable on the IRS W-9 form. When using e-signatures, ensure that you are using a secure method to protect your personal information. It's important to maintain privacy and security throughout the submission process, as disclosing sensitive information can lead to identity theft.

What should I do if I'm a foreign payee filling out the IRS W-9?

If you are a foreign payee, you may not need to fill out the IRS W-9 as it is primarily for U.S. citizens and residents. Instead, you might be required to fill out forms like the W-8 series. Always check with a tax professional for guidance tailored to your specific situation.

What are some common errors that filers make when submitting an IRS W-9?

Common errors when filing the IRS W-9 include providing incorrect taxpayer identification numbers, failing to sign the form, or omitting required information. Carefully review your form before submission to avoid these issues, which can lead to delays or rejections in processing.

See what our users say