IRS tax return information forms package

The documents you get with the IRS tax return information package

Obtain the IRS tax return information forms package by pdfFiller to add the documents in the above list to your paperwork right away, and save money with special package deals. Save time on document searching and sorting - you now have all the forms you need at hand. It's also possible to opt out the forms you don't need from the bundle, to cut the costs even more.

pdfFiller gets you covered with bundles for every situation. Here, you can find form bundles by category, ensure you get the documents you need, and quickly and accurately submit them. pdfFiller offers you a robust document editor, electronic signatures, and complies with industry-leading security standards.

Click the Fill Now button to start working on your form with the full-featured editing tool. Insert your information in the fillable fields. Use the Wizard tool so you don’t miss any important sections. The arrows will guide you through the document, showing which field is active, and the tips will tell you which information to add. Also, take advantage of the fields list to be sure that all of them are completed. Once you fill and sign every document you needed from the IRS tax return information forms package, you're all set.

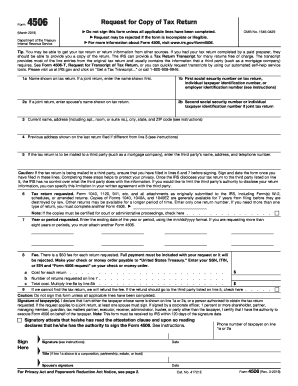

Use Form 4506-T to request tax return information. Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year) must file Form 4506-T to request a return transcript. ... Full financial and tax information, such as wages and taxable income, are shown on the transcript.

Form 433D Installment Agreement is used to finalize an IRS Installment Agreement and IRS Payment Plans for both individuals and businesses. It is also used to set up Automatic Direct Debit installment payments from your bank account.

The IRS Form 941 for 2019, officially titled as “Employer's QUARTERLY Federal Tax Return” is used to file and report the total amount of tax an employer withholds from employees.

Form 8962 is used to estimate the amount of premium tax credit for which you're eligible if you're insured through the Marketplace. You only need to complete Form 8962 if you received advance payments of premium tax credits for health insurance premiums paid.

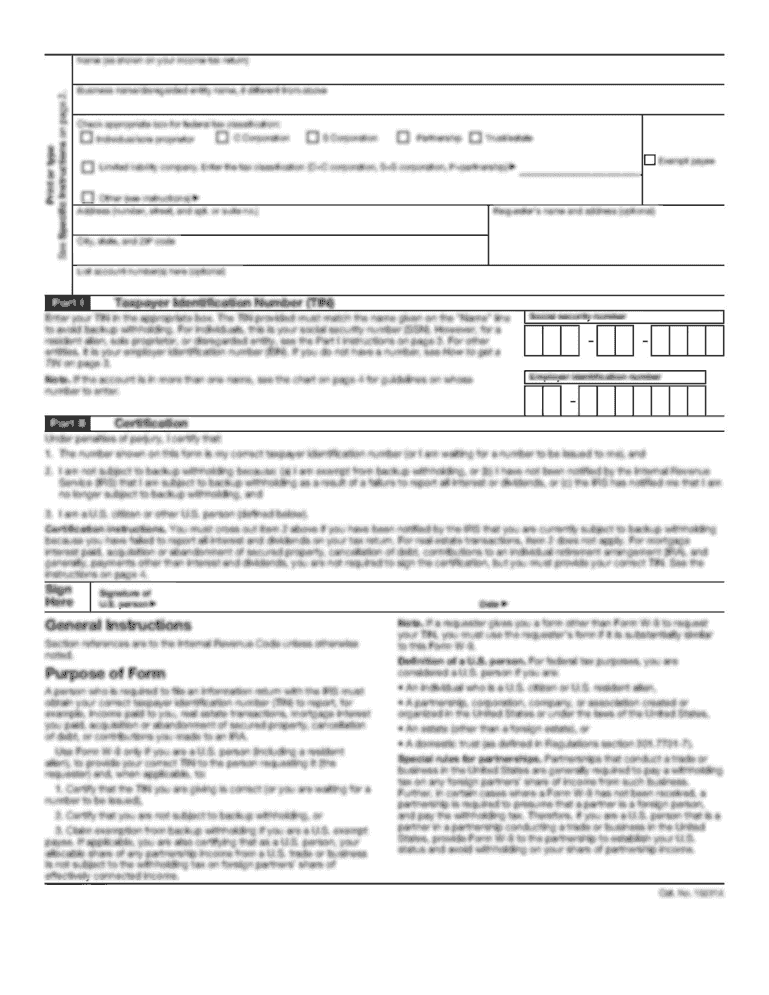

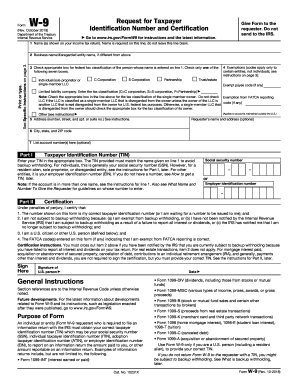

Form W-9 is used in the United States income tax system by a third party who must file an information return with the Internal Revenue Service. It requests the name, address, and taxpayer identification information of a taxpayer.

IRS tax return information forms package FAQs