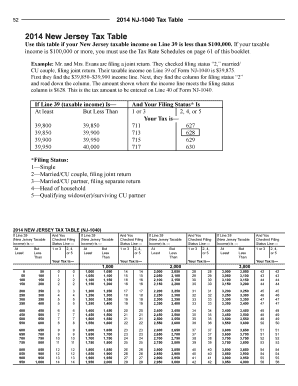

1040 Tax Table

What is 1040 tax table?

The 1040 tax table is a document provided by the Internal Revenue Service (IRS) that helps individuals determine how much tax they owe or the refund they are entitled to. It includes various tax brackets and corresponding tax rates based on a taxpayer's filing status and taxable income. By referring to the 1040 tax table, individuals can easily calculate their tax liability or refund amount without the need for complex calculations.

What are the types of 1040 tax table?

There are three main types of 1040 tax tables based on different filing statuses: single, married filing jointly, and head of household. Each table is divided into various income ranges and corresponding tax rates. It is essential to use the correct tax table based on your filing status to accurately determine your tax liability or refund.

How to complete 1040 tax table

Completing the 1040 tax table may seem daunting at first, but it can be straightforward if you follow these steps:

By using these steps, you can easily complete the 1040 tax table and ensure accurate tax calculations for your individual tax return. Furthermore, pdfFiller offers a powerful online platform that empowers users to create, edit, and share documents online. With unlimited fillable templates and robust editing tools, pdfFiller is the comprehensive PDF editor users need to efficiently handle their document needs.