What is 1099 pay stub template?

A 1099 pay stub template is a document that provides essential information about an individual's earnings and taxes withheld. It is generally used by self-employed individuals, independent contractors, or freelancers who receive income from multiple sources. The template includes details such as the individual's name, address, Social Security number, earnings, deductions, and tax information. By using a 1099 pay stub template, individuals can accurately report their income and fulfill their tax obligations.

What are the types of 1099 pay stub template?

There are various types of 1099 pay stub templates available, each designed to cater to different needs and preferences. Some common types include:

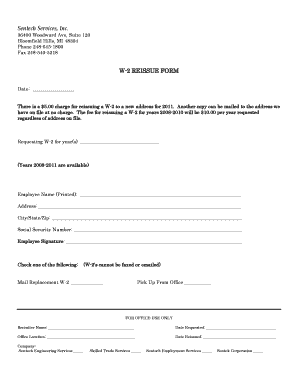

Basic 1099 pay stub template: This template provides the essential sections required for reporting income and taxes such as earnings, deductions, and tax withholdings.

Detailed 1099 pay stub template: This template offers more comprehensive sections to provide a detailed breakdown of earnings, expenses, and taxes. It is suitable for individuals with complex financial situations.

Simplified 1099 pay stub template: This template simplifies the reporting process by providing a condensed format with the main income and deduction categories.

Electronic 1099 pay stub template: This template is designed for digital use and allows individuals to fill out and submit their pay stub electronically.

Customizable 1099 pay stub template: This template provides flexibility for users to customize sections and fields according to their specific needs and preferences.

How to complete 1099 pay stub template

Completing a 1099 pay stub template is a straightforward process. Follow these steps to ensure accurate and complete information:

01

Download a suitable 1099 pay stub template from a trusted source or use a reliable online platform like pdfFiller.

02

Enter your personal information, such as your name, address, and Social Security number, in the designated sections.

03

Fill in the income details, including the amount earned from each source and any additional income.

04

Provide the necessary details for deductions, such as business expenses, healthcare costs, or retirement contributions.

05

Calculate and enter the tax withholdings accurately to ensure proper tax reporting.

06

Review the completed pay stub template for any errors or omissions.

07

Save and store the finalized pay stub for your records or share it with the relevant parties.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.