2012 Ca Tax Rate Schedule

What is 2012 ca tax rate schedule?

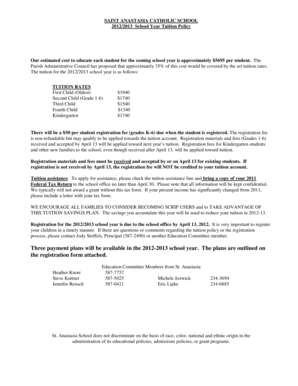

The 2012 California tax rate schedule refers to the predetermined tax rates that individuals in California had to pay for their income earned in the year 2012. These rates were based on a progressive tax system, where higher income earners were required to pay a higher percentage of their income as tax.

What are the types of 2012 ca tax rate schedule?

There were different tax brackets or types of tax rate schedules in 2012 in California. The specific type of tax rate schedule an individual fell into depended on their income level. The tax brackets ranged from the lowest income earners to the highest income earners, with corresponding tax rates.

How to complete 2012 ca tax rate schedule

Completing the 2012 ca tax rate schedule can be done by following these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.