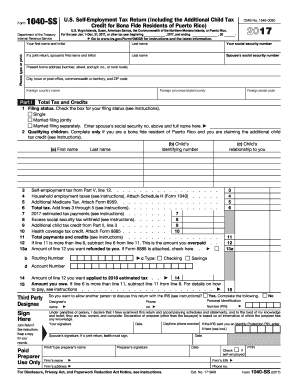

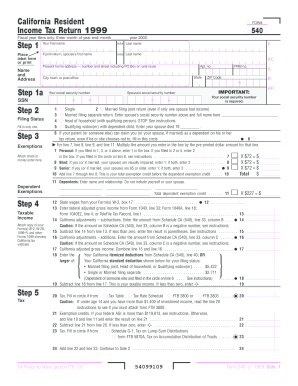

What is 2012 schedule ca 540 instructions?

2012 schedule ca 540 instructions refer to the guidelines provided by the California Franchise Tax Board (FTB) for individuals to fill out and submit their California Resident Income Tax Return. These instructions are specifically for the year 2012 and help taxpayers understand the requirements and procedures for properly reporting their income and claiming any applicable deductions and credits.

What are the types of 2012 schedule ca 540 instructions?

The types of 2012 schedule ca 540 instructions include:

General instructions: These provide an overview of the tax return form and provide guidance on eligibility criteria, filing status, and other general tax-related information.

Form and Credit Worksheets instructions: These help taxpayers determine the amount of various tax credits and deductions they may be eligible for.

Schedule CA instructions: This schedule is used to report adjustments to federal itemized deductions, California adjustments, and tax credits.

Tax Table instructions: These instructions provide the tax rates and brackets to determine the tax liability based on the taxable income.

How to complete 2012 schedule ca 540 instructions

To complete the 2012 schedule ca 540 instructions, follow these steps:

01

Gather all the necessary documents, such as W-2 forms, 1099 forms, and any other relevant income and deduction records.

02

Review the general instructions provided by the FTB to understand the filing requirements and eligibility criteria.

03

Complete the main form and provide accurate and updated information regarding your income, deductions, credits, and any other applicable details.

04

Use the appropriate worksheets to calculate the amount of tax credits and deductions you are eligible for.

05

Fill out the Schedule CA to report any adjustments to federal itemized deductions, California adjustments, and tax credits.

06

Refer to the tax table instructions to determine your tax liability based on the taxable income.

07

Double-check all the information provided and ensure its accuracy and completeness.

08

Sign and date the form before submitting it to the FTB.

pdfFiller empowers users to create, edit, and share documents online, including 2012 schedule ca 540 instructions. With unlimited fillable templates and powerful editing tools, pdfFiller is the all-in-one PDF editor that users can rely on to efficiently complete and manage their tax-related documents.