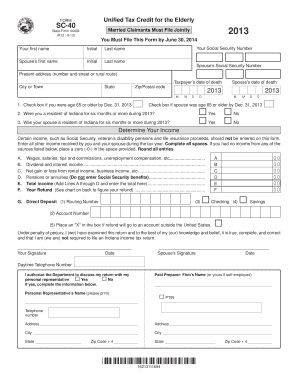

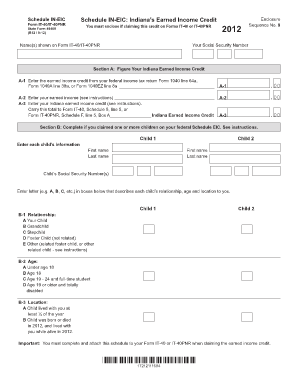

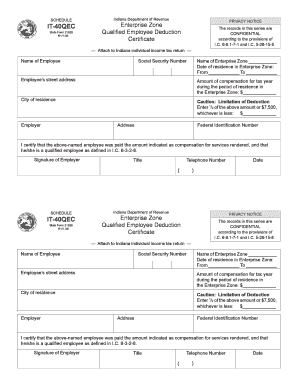

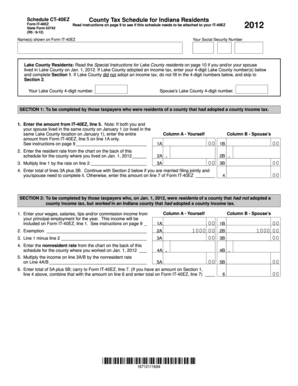

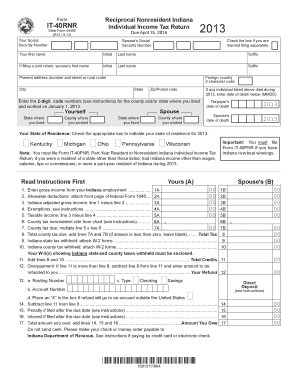

What is 2012 Form It-40?

The 2012 Form It-40 is a tax form used by individuals in Indiana to report their state income tax for the year 2012. It is specifically designed to collect information about a taxpayer's income, deductions, and tax credits for that particular year. By filling out this form accurately, taxpayers can ensure that they are meeting their tax obligations and avoid potential penalties.

What are the types of 2012 Form It-40?

The 2012 Form It-40 comes in different types based on the filing status of the taxpayer. The common types include:

Single: This is for unmarried individuals who are not eligible for any other filing status.

Married Filing Jointly: This is for married couples who want to file their taxes together.

Married Filing Separately: This is for married couples who want to file their taxes separately.

Head of Household: This is for individuals who are unmarried but have dependents.

Qualifying Widow(er): This is for individuals who are widowed and have a dependent child.

How to complete 2012 Form It-40

Completing the 2012 Form It-40 is a straightforward process. Here is a step-by-step guide:

01

Gather all necessary documents, such as W-2 forms, 1099 forms, and any other relevant income and deduction records.

02

Enter your personal information, including your name, address, social security number, and filing status.

03

Report your income accurately, including wages, salaries, tips, and any other taxable income.

04

Claim any deductions you are eligible for, such as mortgage interest, medical expenses, and education expenses.

05

Calculate your tax liability using the provided tables or the tax computation worksheet.

06

If you have any tax credits, apply them to reduce your tax liability.

07

Complete the payment section if you owe any additional taxes.

08

Sign and date the form.

09

Make a copy of the completed form for your records and submit it to the appropriate tax authority.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.