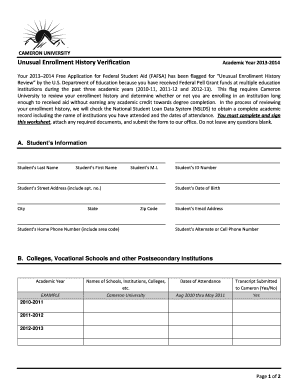

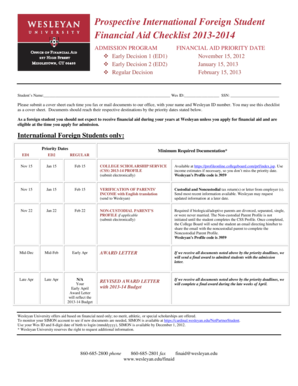

2013-2014 Free Application For Federal Student Aid

What is 2013-2014 Free Application For Federal Student Aid?

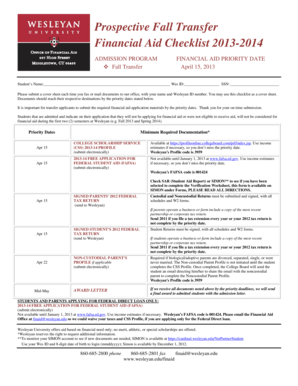

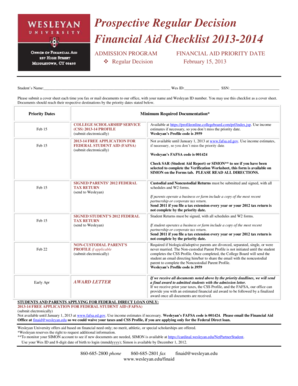

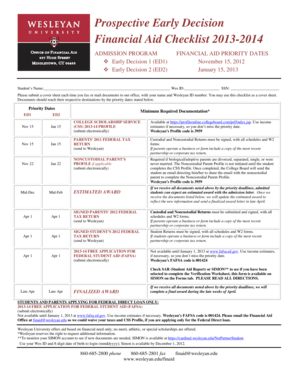

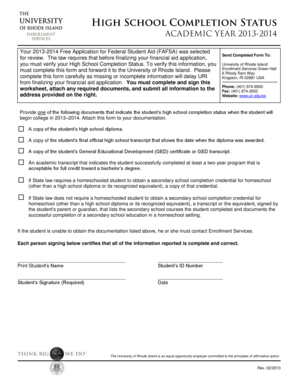

The 2013-2014 Free Application For Federal Student Aid (FAFSA) is a form that students in the United States can fill out to apply for financial aid from the federal government to help pay for their college education. It is a crucial step in the college application process and determines the amount of aid a student is eligible for. The FAFSA takes into account factors such as family income, assets, and the number of family members attending college. By completing the FAFSA, students have access to grants, scholarships, and student loans.

What are the types of 2013-2014 Free Application For Federal Student Aid?

There are several types of aid available through the 2013-2014 Free Application For Federal Student Aid (FAFSA). These include:

How to complete 2013-2014 Free Application For Federal Student Aid

Completing the 2013-2014 Free Application For Federal Student Aid (FAFSA) can seem daunting, but with the following steps, it can be a straightforward process:

pdfFiller is here to help! With its unlimited fillable templates and powerful editing tools, pdfFiller empowers you to effortlessly create, edit, and share your documents online. Whether you're completing the FAFSA or any other important form, pdfFiller is the go-to PDF editor that ensures your documents are done with ease and professionalism.