What is 2014 form 1040 instructions?

The 2014 form 1040 instructions are a set of guidelines and explanations provided by the Internal Revenue Service (IRS) to help taxpayers understand and complete their 2014 tax returns. These instructions provide detailed information on how to fill out the specific sections of the form, what documents are needed, and any special rules or exemptions that apply.

What are the types of 2014 form 1040 instructions?

The 2014 form 1040 instructions can be categorized into different types based on the specific sections of the form they address. Some of the key types of instructions include:

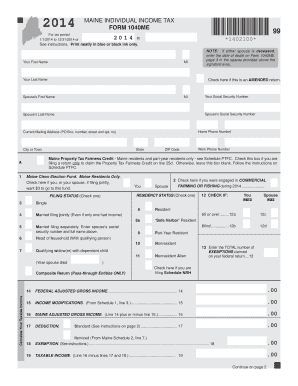

General instructions: These provide an overview of the form and its purpose, along with basic information on how to fill it out.

Income instructions: These focus on reporting various sources of income, including wages, investments, self-employment income, and rental income.

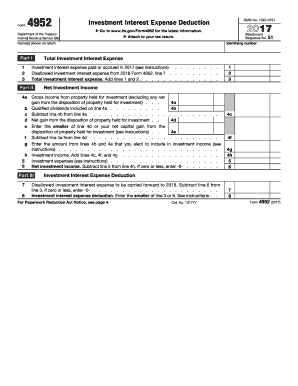

Deduction instructions: These explain the different types of deductions that can be claimed, such as student loan interest, mortgage interest, and medical expenses.

Credit instructions: These cover the different tax credits available, such as the child tax credit, education credits, and energy-efficient home credits.

Payment instructions: These explain how to calculate and pay any tax owed or request a refund.

Additional instructions: These provide guidance on specific situations, such as filing for an extension, reporting foreign income, or claiming dependents.

How to complete 2014 form 1040 instructions

Completing the 2014 form 1040 instructions can seem daunting, but by following these steps, you can ensure accurate and timely filing of your tax return:

01

Gather all necessary documents, such as W-2s, 1099s, and any relevant receipts.

02

Read the instructions carefully and familiarize yourself with the different sections of the form.

03

Enter your personal information accurately, including your name, Social Security number, and filing status.

04

Report your income in the appropriate sections, making sure to include all sources of income.

05

Calculate your deductions and credits, ensuring you meet the eligibility criteria for each.

06

Accurately calculate your tax liability or refund using the provided tax tables or the IRS tax calculator.

07

Double-check all entries and calculations for accuracy and completeness.

08

Sign and date the form before submission.

09

Keep a copy of your completed tax return and supporting documents for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.