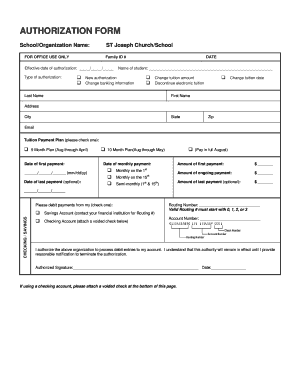

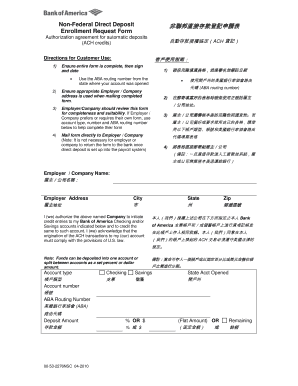

Ach Authorization Form Template

What is ach authorization form template?

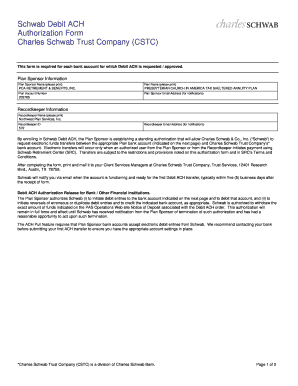

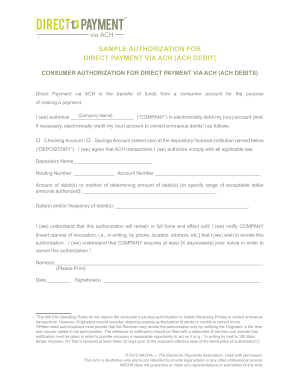

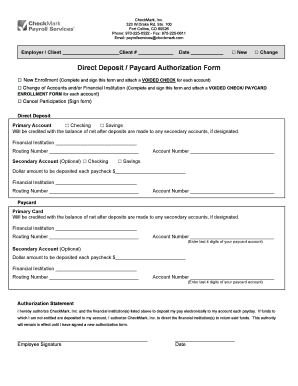

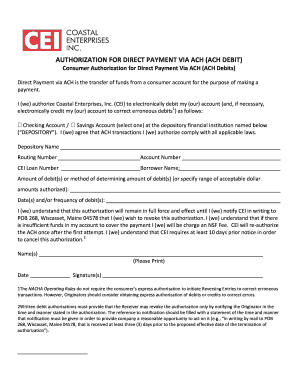

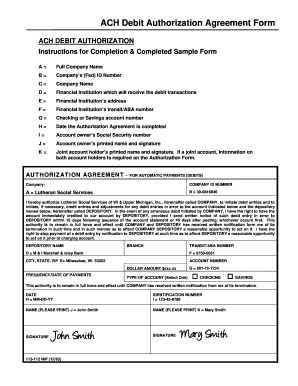

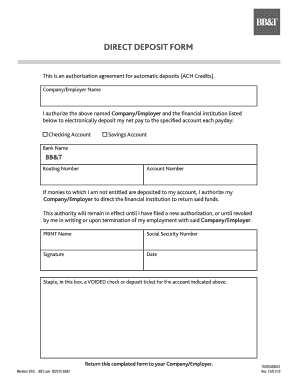

An ach authorization form template is a pre-made document that allows individuals or organizations to authorize the transfer of funds electronically through the Automated Clearing House (ACH) network. This form specifies the account details, authorization terms, and other relevant information needed to initiate the transaction.

What are the types of ach authorization form template?

There are various types of ach authorization form templates available, depending on the specific transaction or purpose. Some common types include: 1. Direct Deposit Authorization Form: Used by employers to authorize the direct deposit of employees' paychecks into their bank accounts. 2. Recurring Payment Authorization Form: Allows a person or organization to set up recurring payments to be automatically deducted from their bank account. 3. Pre-Authorized Debit (PAD) Agreement: Authorizes a company or organization to debit funds from a customer's bank account for a specified purpose.

How to complete ach authorization form template

To complete an ach authorization form template, follow these steps: 1. Download or access the desired ach authorization form template. 2. Fill in your personal or organization details, including name, address, and contact information. 3. Provide the necessary bank account details, such as account number and routing number. 4. Read and understand the authorization terms and conditions. 5. Sign and date the form to validate your authorization. 6. Keep a copy of the completed form for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.