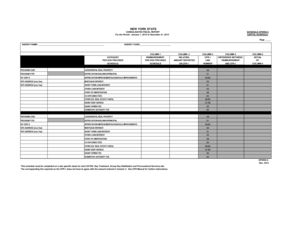

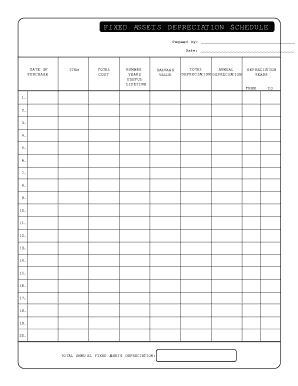

Amortization Schedule Template

What is Amortization Schedule Template?

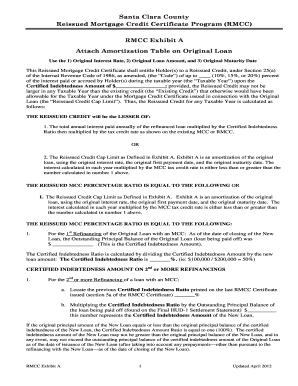

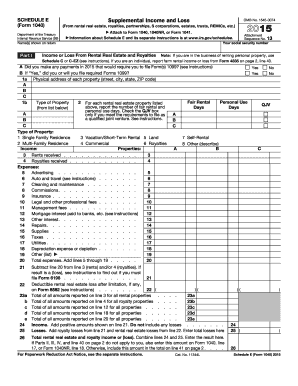

An Amortization Schedule Template is a tool used to determine the schedule of loan payments over time. It helps individuals and businesses understand how much principal and interest they will be paying each month, as well as how long it will take to pay off the loan completely. This template is invaluable for financial planning and budgeting purposes, allowing users to visualize the breakdown of payments and make informed decisions.

What are the types of Amortization Schedule Template?

There are several types of Amortization Schedule Templates available, depending on the specific needs of the user. Some common types include:

How to complete Amortization Schedule Template

Completing an Amortization Schedule Template is a straightforward process. Follow these steps:

With pdfFiller, creating, editing, and sharing Amortization Schedule Templates becomes incredibly easy and convenient. pdfFiller offers unlimited fillable templates and powerful editing tools, making it the ideal PDF editor for all your document needs. Empower yourself with pdfFiller and streamline your financial planning today!