Asset Purchase Agreement Vs Stock Purchase

What is asset purchase agreement vs stock purchase?

An asset purchase agreement and stock purchase are two different methods used in a business acquisition. In an asset purchase agreement, the buyer purchases the specific assets of a company, such as equipment, inventory, and intellectual property. On the other hand, a stock purchase involves buying the shares of a company, which means acquiring both the assets and liabilities of the company.

What are the types of asset purchase agreement vs stock purchase?

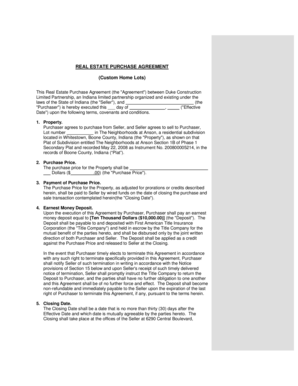

There are various types of asset purchase agreements and stock purchases available. Some common types of asset purchase agreements include bulk asset purchase agreements, intellectual property purchase agreements, and real estate purchase agreements. Similarly, different types of stock purchases include majority stock acquisitions, minority stock acquisitions, and cross-purchase agreements.

How to complete asset purchase agreement vs stock purchase

Completing an asset purchase agreement or stock purchase requires careful consideration and due diligence. Here are some steps to help you complete each process:

pdfFiller is an online platform that empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to efficiently complete your asset purchase agreements or stock purchases.