Balance Sheet Templates

What are Balance Sheet Templates?

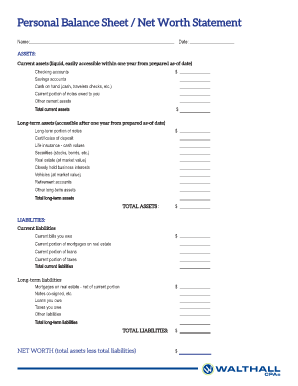

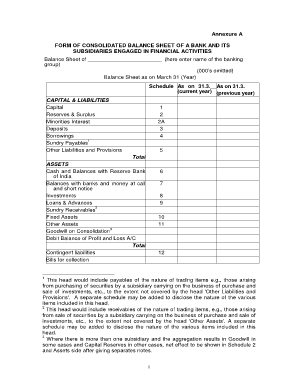

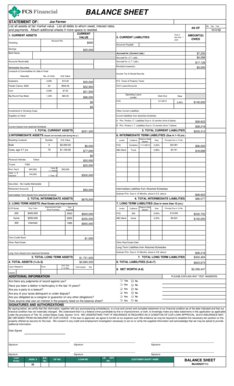

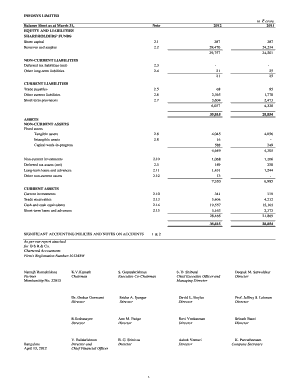

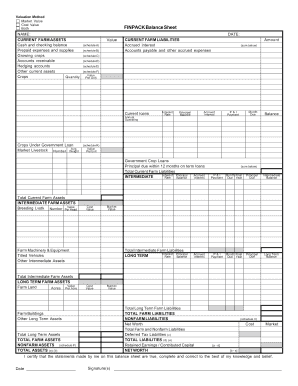

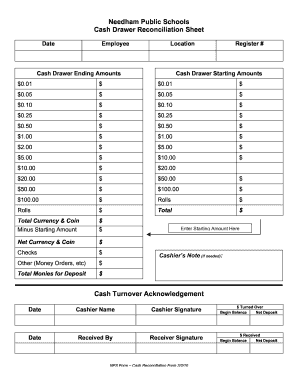

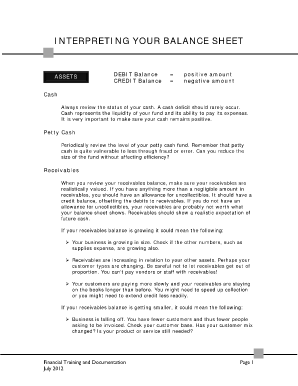

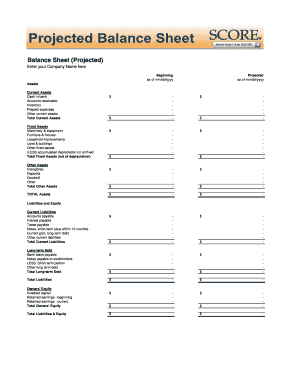

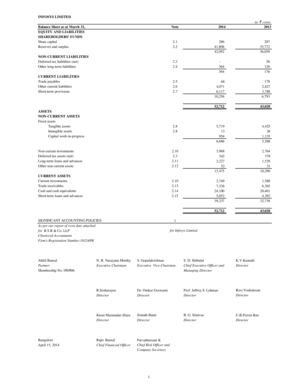

Balance Sheet Templates are predefined documents that provide a structured format for presenting and organizing financial information. Primarily used by businesses, these templates help to summarize a company's assets, liabilities, and equity at a specific point in time. They serve as a valuable tool for financial analysis, budgeting, and decision-making.

What are the types of Balance Sheet Templates?

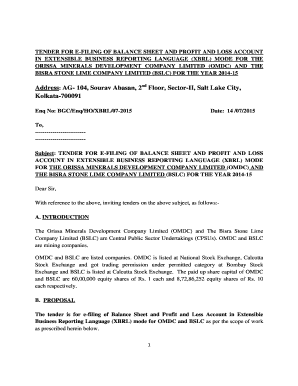

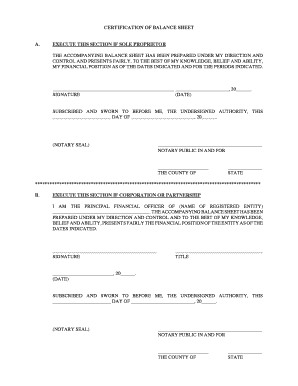

There are various types of Balance Sheet Templates available to cater to different business needs. Some common types include:

How to complete Balance Sheet Templates

Completing a Balance Sheet Template may seem complex at first, but with the right guidance, it becomes easier. Here are the steps to follow:

By using pdfFiller, you can easily create, edit, and share Balance Sheet Templates online. With unlimited fillable templates and powerful editing tools, pdfFiller simplifies the process of completing and organizing financial documents. Empower yourself with pdfFiller, the comprehensive PDF editor that ensures efficiency and accuracy in document management.