Balance Sheet With Working Capital

What is Balance Sheet With Working Capital?

A balance sheet with working capital is a financial statement that provides a snapshot of a company's financial position at a specific point in time. It shows the company's assets, liabilities, and the difference between them, known as the working capital. Working capital represents the funds available for a company's daily operations and is an important indicator of its financial health and liquidity. By analyzing the balance sheet with working capital, investors and stakeholders can assess a company's ability to meet its short-term obligations and its overall financial stability.

What are the types of Balance Sheet With Working Capital?

There are two types of balance sheets with working capital: positive working capital and negative working capital. Positive working capital occurs when a company's current assets exceed its current liabilities. This indicates that the company has enough liquid resources to cover its short-term obligations while having some funds left over for operational expenses and investments. Positive working capital is generally seen as a favorable condition. Negative working capital, on the other hand, happens when a company's current liabilities exceed its current assets. This suggests that the company may struggle to meet its short-term obligations and may face financial difficulties. Negative working capital is often viewed as a red flag and may signal potential solvency issues.

How to complete Balance Sheet With Working Capital

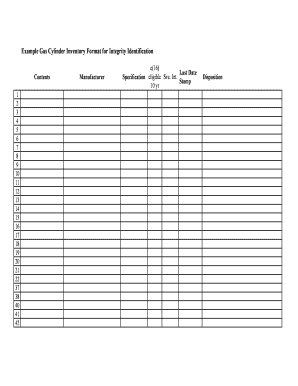

Completing a balance sheet with working capital involves several steps: 1. Gather financial information: Collect all relevant financial data, including current assets, current liabilities, and any other necessary financial statements. 2. Calculate current assets: Determine the value of all assets that are expected to be converted into cash or used up within one year. 3. Calculate current liabilities: Identify and total up all short-term obligations that the company needs to settle within one year. 4. Calculate working capital: Subtract the total current liabilities from the total current assets to arrive at the working capital. 5. Analyze the working capital: Assess the working capital amount in relation to the company's industry standards and financial goals. A positive working capital indicates good financial health, while a negative working capital may require further investigation and management attention. By following these steps, you can accurately complete a balance sheet with working capital and gain insights into a company's financial position.