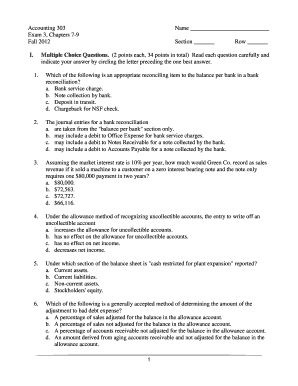

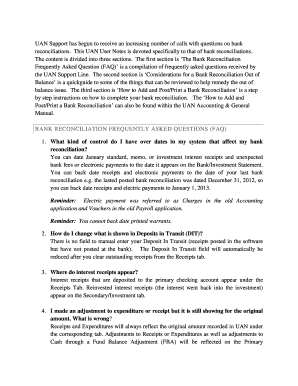

What is bank reconciliation questions?

Bank reconciliation questions refer to the process of comparing the transactions recorded in an organization's bank statement to those in their own accounting records. This is done to identify any discrepancies or errors that may have occurred during the recording or processing of transactions.

What are the types of bank reconciliation questions?

There are several types of bank reconciliation questions that can arise during the reconciliation process. Some common types include:

Missing transactions: These questions involve identifying transactions that are present in the organization's accounting records but are not reflected in the bank statement.

Outstanding checks: These questions arise when checks issued by the organization have not yet been presented for payment by the recipients.

Bank errors: These questions pertain to errors made by the bank, such as recording incorrect amounts or misplacing transactions.

Duplicate transactions: These questions involve identifying duplicate entries for the same transaction, which may have been recorded multiple times in the bank statement or accounting records.

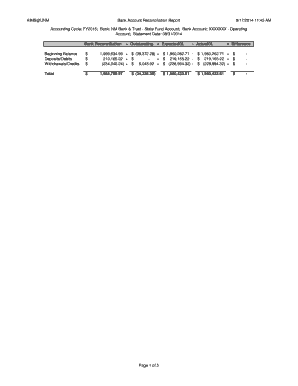

How to complete bank reconciliation questions

Completing bank reconciliation questions can be a straightforward process if you follow these steps:

01

Gather the necessary documents, including bank statements, accounting records, and any supporting documentation for transactions.

02

Compare the transactions listed in the bank statement to those in the accounting records, noting any discrepancies or errors.

03

Investigate the discrepancies or errors by reviewing source documents and contacting the bank if necessary.

04

Make any necessary adjustments in the accounting records to correct errors or reflect missing transactions.

05

Reconcile the final balances in the bank statement and accounting records, ensuring they match after considering all adjustments.

06

Document the reconciliation process and maintain records for future reference and audit purposes.

As you complete bank reconciliation questions, it is important to note that tools like pdfFiller empower users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently and effectively.