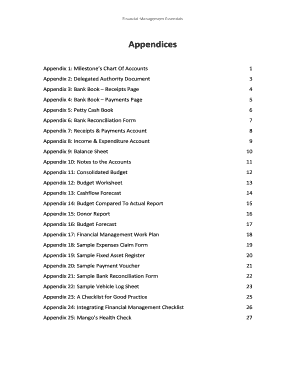

What is bank reconciliation questions and answers pdf?

Bank reconciliation questions and answers pdf refers to a document that contains a series of questions and corresponding answers related to the process of bank reconciliation. This document is usually in PDF format, making it convenient for users to access and read. It serves as a comprehensive guide that helps individuals gain a deeper understanding of bank reconciliation and address any queries they may have.

What are the types of bank reconciliation questions and answers pdf?

Bank reconciliation questions and answers pdf covers various types of bank reconciliation processes. Some common types of bank reconciliation questions you may find in such a document include:

Matching transactions: This type of reconciliation involves comparing the transactions recorded in the bank statement with those in the company's books to identify any discrepancies.

Bank errors: These questions address situations where the bank has made errors in recording transactions, resulting in discrepancies during the reconciliation process.

Timing differences: These questions explore cases where transactions are recorded in different periods by the bank and the company, causing discrepancies during reconciliation.

Outstanding checks and deposits: This type of reconciliation involves questions related to checks or deposits that have not yet cleared the bank, leading to discrepancies during the reconciliation process.

Bank fees and charges: These questions focus on reconciling any bank fees or charges recorded in the bank statement with the company's records to ensure accuracy in financial reporting.

How to complete bank reconciliation questions and answers pdf

To complete bank reconciliation questions and answers pdf successfully, follow these steps:

01

Gather necessary documents: Collect bank statements, company records, and any supporting documents for transactions.

02

Compare transactions: Match transactions recorded in the bank statement with those in the company's records, noting any discrepancies.

03

Identify errors: Analyze discrepancies and determine if they are due to bank errors, timing differences, outstanding checks or deposits, or bank fees and charges.

04

Make adjustments: Update the company's records to reflect the correct transactions and resolve any discrepancies.

05

Reconcile balances: Calculate the adjusted balance for both the bank statement and the company's records, ensuring they match.

06

Document findings: Keep a record of the reconciliation process, including any adjustments made and explanations for discrepancies.

07

Verify accuracy: Review the completed bank reconciliation to ensure accuracy and take necessary steps to address any remaining discrepancies, if applicable.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.