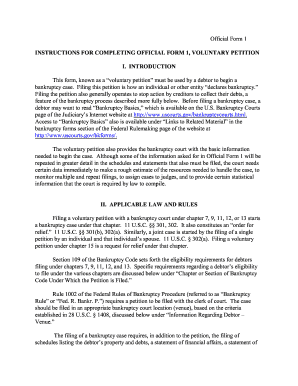

What is Bankruptcy Form?

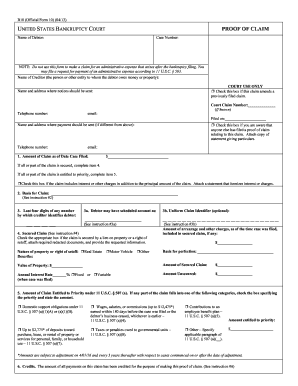

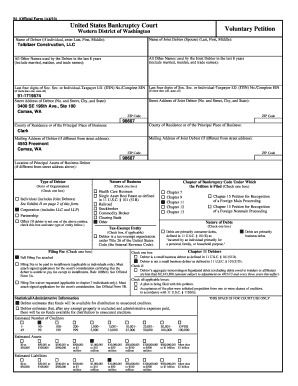

Bankruptcy Form is a legal document that is used in bankruptcy cases to provide information about the debtor's financial situation. It includes details about the debtor's assets, liabilities, income, and expenses. This form is necessary for the bankruptcy process as it helps the court determine the best course of action for the debtor's financial situation.

What are the types of Bankruptcy Form?

There are several types of Bankruptcy Forms, each designed for specific bankruptcy cases. The most common types of Bankruptcy Forms include:

Chapter 7 Bankruptcy Form: Also known as the 'Liquidation Bankruptcy Form,' it is used by individuals or businesses to eliminate their debts and liquidate their non-exempt assets.

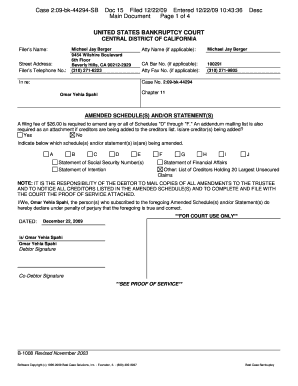

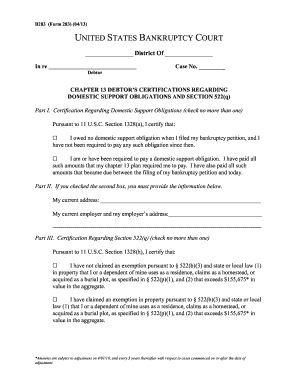

Chapter 13 Bankruptcy Form: This form is used by individuals with a regular income to create a repayment plan to pay off their debts over a period of three to five years.

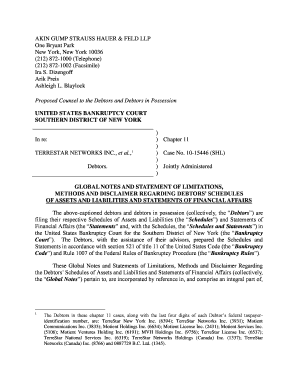

Chapter 11 Bankruptcy Form: Primarily used by businesses, this form allows them to reorganize their debt and continue their operations while repaying their creditors.

Chapter 12 Bankruptcy Form: Specifically designed for family farmers and fishermen, this form helps them reorganize their debts and develop a repayment plan.

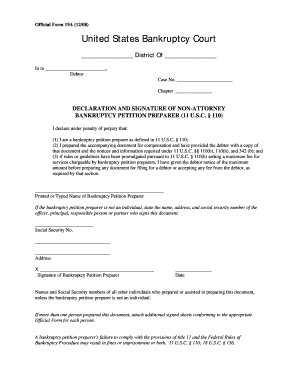

How to complete Bankruptcy Form

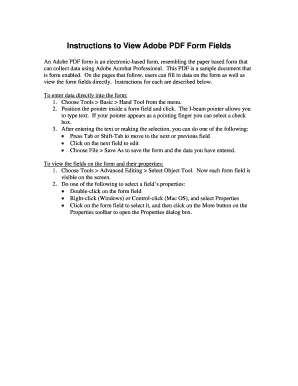

Completing a Bankruptcy Form can be a complex process, but with proper guidance, it can be done effectively. Here are the steps to complete a Bankruptcy Form:

01

Gather all the necessary financial documents, including bank statements, tax returns, pay stubs, and a list of assets and liabilities.

02

Fill out the personal information section, including your name, address, and social security number.

03

Provide detailed information about your income, expenses, assets, and liabilities.

04

Follow the instructions carefully and answer all the questions accurately.

05

Review the completed form for any errors or omissions.

06

Sign and date the form.

07

Keep a copy of the form for your records.

08

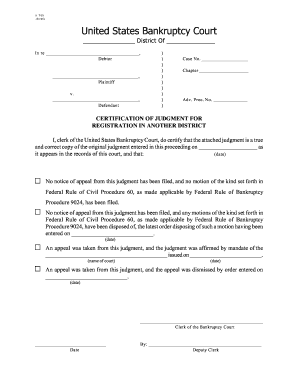

Submit the form to the appropriate court or trustee.

09

Attend any required hearings or meetings as scheduled.

10

Follow any further instructions provided by the court or trustee.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.