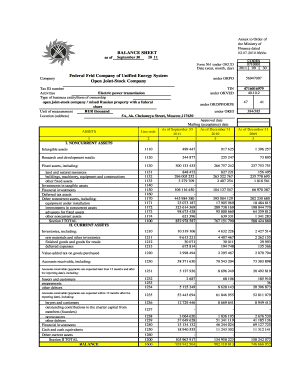

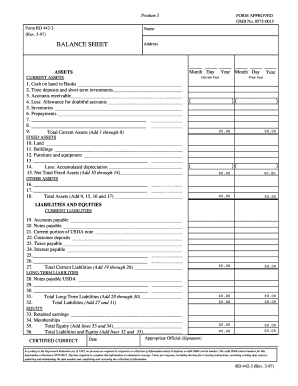

Basic Balance Sheet Template

What is Basic Balance Sheet Template?

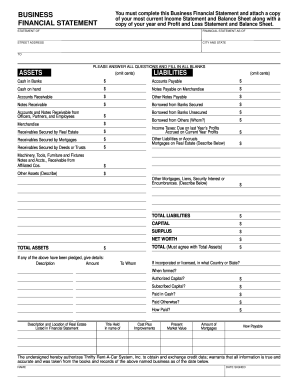

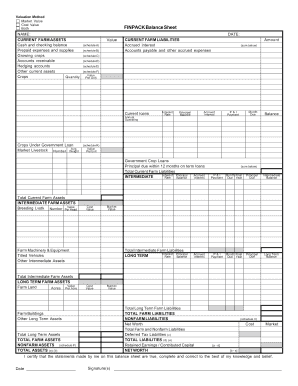

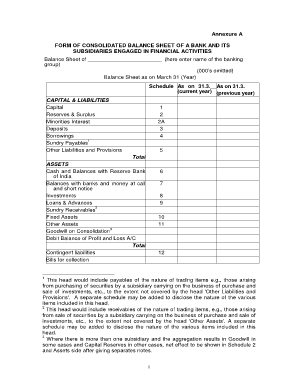

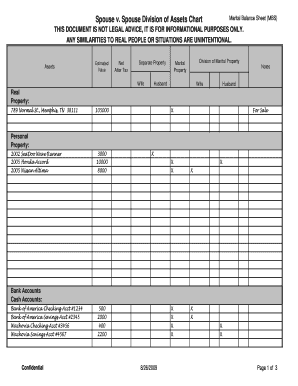

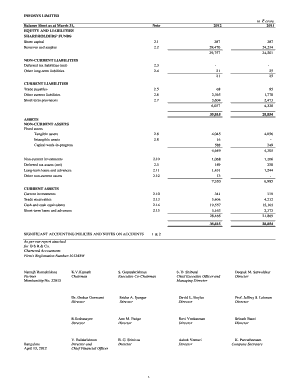

A Basic Balance Sheet Template is a financial statement that provides a snapshot of a company's financial position at a specific point in time. It shows the company's assets, liabilities, and shareholders' equity.

What are the types of Basic Balance Sheet Template?

There are two main types of Basic Balance Sheet Templates: the report form and the account form.

Report Form: This template lists company assets on the left side and liabilities and equity on the right side.

Account Form: This template lists assets on the left side and liabilities and equity on the right side with detail accounts.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

How to complete Basic Balance Sheet Template

Completing a Basic Balance Sheet Template is easy with the following steps:

01

Gather all financial information including assets, liabilities, and equity.

02

List the assets on the left side of the template and liabilities and equity on the right side.

03

Calculate the total assets and total liabilities & equity, and ensure they balance.

04

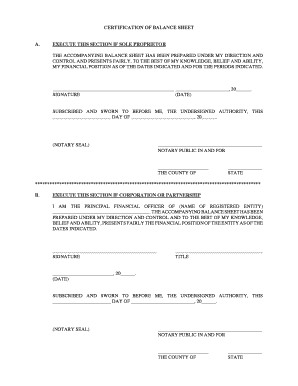

Review and double-check all information for accuracy.

05

Save or print the completed Balance Sheet for record-keeping purposes.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I create a balance sheet in Excel?

You can do that in Excel by clicking on File. Go to the New tab, then in the Search Bar, type Balance Sheet. After a quick search, Excel will give you at least three templates you can use. Alternatively, you can also visit Vertex42, FreshBooks, or Wise.com to download a template from their website.

How do you make a balance sheet worksheet?

You can do that in Excel by clicking on File. Go to the New tab, then in the Search Bar, type Balance Sheet. After a quick search, Excel will give you at least three templates you can use. Alternatively, you can also visit Vertex42, FreshBooks, or Wise.com to download a template from their website.

What is the formula used to create a balance sheet?

A balance sheet is calculated by balancing a company's assets with its liabilities and equity. The formula is: total assets = total liabilities + total equity. Total assets is calculated as the sum of all short-term, long-term, and other assets.

How do you write a basic balance sheet?

How to Prepare a Basic Balance Sheet Determine the Reporting Date and Period. Identify Your Assets. Identify Your Liabilities. Calculate Shareholders' Equity. Add Total Liabilities to Total Shareholders' Equity and Compare to Assets.

How do you make a balance sheet step by step?

How to make a balance sheet Invest in accounting software. Create a heading. Use the basic accounting equation to separate each section. Include all of your assets. Create a section for liabilities. Create a section for owner's equity. Add total liabilities to total owner's equity.

What is a balance sheet template?

This balance sheet template provides you with a foundation to build your own company's financial statement showing the total assets, liabilities, and shareholders' equity.

Related templates