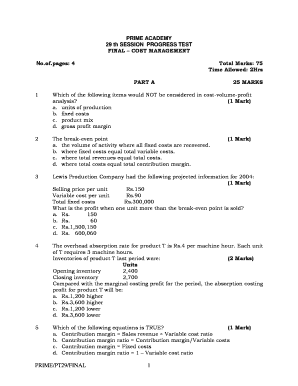

What is Break-even Analysis?

Break-even analysis is a financial tool used by businesses to determine the point at which their revenue equals their expenses, resulting in neither profit nor loss. It helps businesses make informed decisions regarding pricing, production volume, and sales targets. By analyzing fixed costs, variable costs, and selling price per unit, break-even analysis provides valuable insights into a company's financial health and profitability.

What are the types of Break-even Analysis?

There are three main types of break-even analysis:

Simple Break-even Analysis: This type considers only one product or service and calculates the break-even point based on its fixed and variable costs.

Break-even Analysis with Multiple Products: In this type, businesses with multiple products or services determine their overall break-even point by incorporating the sales mix and contribution margin of each product.

Break-even Analysis with Multiple Revenue Streams: For companies with different revenue streams, such as sales, subscriptions, and advertisements, this type analyzes the break-even point by considering the contribution margin of each revenue stream.

How to complete Break-even Analysis

To complete a break-even analysis, follow these steps:

01

Identify fixed costs: Determine the costs that remain constant regardless of production or sales volume, such as rent, salaries, and insurance.

02

Calculate variable costs: Determine the costs that change based on production volume, such as raw materials, direct labor, and sales commissions.

03

Determine selling price per unit: Set the price at which each unit of product or service will be sold.

04

Calculate the contribution margin per unit: Subtract variable costs from the selling price per unit.

05

Calculate the break-even point: Divide the total fixed costs by the contribution margin per unit to determine the number of units that need to be sold to break even.

06

Analyze profitability: Compare the break-even point with projected sales volume to assess profitability and make informed business decisions.

Whether you are a small business owner or a financial professional, conducting break-even analysis is essential for understanding your company's financial performance. With pdfFiller, you can easily manage your financial documents and access powerful editing tools. Discover unlimited fillable templates and streamline your document workflow with pdfFiller, the all-in-one PDF editor you need.