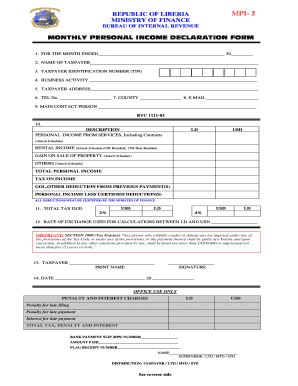

What is Business Budget Template 3 Monthly?

Business Budget Template 3 Monthly is a financial planning tool that helps businesses track their income and expenses over a three-month period. It is designed to provide a comprehensive overview of the company's financial performance and help make informed decisions regarding budget allocation and resource management.

What are the types of Business Budget Template 3 Monthly?

There are several types of Business Budget Template 3 Monthly available, each catering to different business needs. Some common types include:

Sales and Revenue Budget Template: Focuses on projecting sales and revenue figures for the next three months.

Expense Budget Template: Helps businesses track and plan their expenses, including operational costs, marketing expenses, and employee salaries.

Cash Flow Budget Template: Aims to manage and monitor the inflows and outflows of cash within the business.

Capital Expenditure Budget Template: For businesses planning to invest in assets or equipment, this template helps estimate and track the capital expenses over three months.

How to complete Business Budget Template 3 Monthly

Completing the Business Budget Template 3 Monthly is a straightforward process. Here are the steps to follow:

01

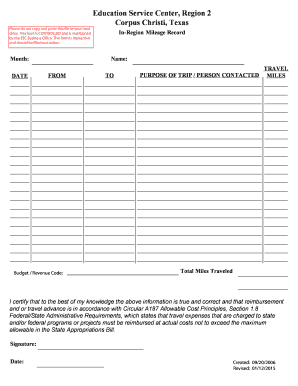

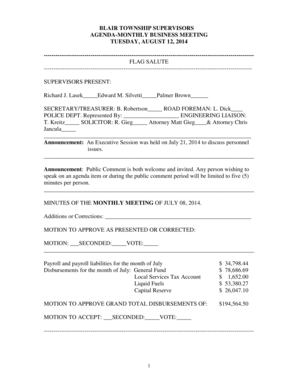

Gather all relevant financial information, including income statements, expense reports, and cash flow statements.

02

Start by entering the projected income for each month in the designated section of the template.

03

Next, input all the anticipated expenses, categorizing them appropriately for better analysis.

04

Calculate the net income by subtracting the total expenses from the total income for each month.

05

Review the budget for any discrepancies or areas of improvement.

06

Make necessary adjustments or modifications to ensure the budget aligns with the business's goals and objectives.

07

Share the budget with relevant stakeholders and discuss any potential changes or strategies based on the analysis.

08

Regularly update and review the budget throughout the three-month period to track the actual performance against the projected figures.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.