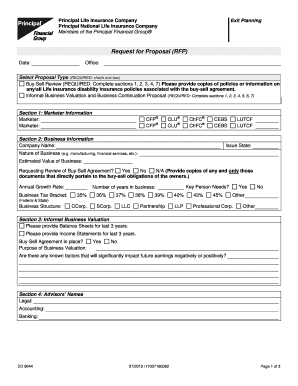

Buy Sell Agreement Life Insurance

What is buy sell agreement life insurance?

Buy sell agreement life insurance is a type of insurance policy that is commonly used by business partners or shareholders to protect their business interests in the event of the death or incapacitation of one of the partners. This type of insurance provides a financial payout to the remaining partners, which can be used to buy out the deceased or incapacitated partner's share of the business.

What are the types of buy sell agreement life insurance?

There are two main types of buy sell agreement life insurance:

Cross-purchase agreement: In this type of agreement, each partner takes out a life insurance policy on the other partners. In the event of a partner's death, the surviving partners use the insurance payout to buy the deceased partner's share of the business.

Entity purchase agreement: In this type of agreement, the business itself takes out a life insurance policy on each partner. If a partner passes away, the business uses the insurance payout to buy the deceased partner's share.

How to complete buy sell agreement life insurance

Completing a buy sell agreement life insurance involves several steps:

01

Assess the value of the business: Determine the fair market value of the business, as this will help determine the amount of insurance needed.

02

Choose the type of agreement: Decide whether a cross-purchase agreement or entity purchase agreement is more suitable for your business.

03

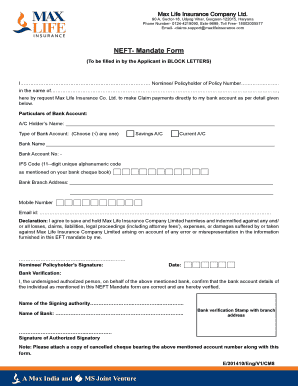

Select the insurance policy: Work with an insurance agent to find the right life insurance policy that meets your needs.

04

Set up the funding: Determine how the insurance premiums will be paid and who will be responsible for paying them.

05

Draft the agreement: Consult with an attorney to draft a comprehensive and legally binding buy sell agreement that outlines the terms and conditions of the insurance policy.

06

Review and update regularly: Periodically review and update the buy sell agreement and ensure that the insurance coverage adequately reflects the value of the business.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out buy sell agreement life insurance

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are the four ways life insurance buy sell agreements are structured?

There are four common buyout structures: Traditional cross purchase plan. Each owner who is left in the business agrees to purchase the co-owner's shares if that individual dies or leaves the business. Entity redemption plan. One-way buy sell plan. Wait-and-see buy sell plan.

How do you write a buy-sell agreement?

Here is how buy-sell agreements work: Determine which events invoke a triggered buyout. Establish who has rights and purchase obligations. Identify the names and address of the purchasers. Set a purchase price or valuation with applicable discounts. Establish payment terms as well as their intervals.

Are buy-sell agreements funded with a life insurance policy?

One common question we receive when discussing key person benefits is “What is a buy/sell agreement?” A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or

What are the four types of buy sell agreements?

There are four common buyout structures: Traditional cross purchase plan. Each owner who is left in the business agrees to purchase the co-owner's shares if that individual dies or leaves the business. Entity redemption plan. One-way buy sell plan. Wait-and-see buy sell plan.

Who owns the life insurance policy in a buy-sell agreement?

The business owners individually own the policies insuring each other's lives. When a business owner dies, the proceeds are paid to those surviving owners who hold one or more policies on the deceased owner, and these surviving owners buy the shares from the deceased owner's personal representative.

How are buy sell agreements structured?

A buy/sell agreement is generally structured in one of two ways — as a cross-purchase agreement or as a redemption agreement. A cross-purchase agreement is an agreement between individual members. In a funded cross-purchase agreement, each member purchases a life insurance policy on the life of every other member.

Related templates