Buy Sell Agreement - Page 2

What is Buy Sell Agreement?

A Buy Sell Agreement is a legally binding contract between co-owners of a business that sets out rules and procedures for the future sale or transfer of ownership interest in the event of certain triggering events, such as death, disability, retirement, or disagreement.

What are the types of Buy Sell Agreement?

There are several types of Buy Sell Agreements, including:

Cross-purchase agreement

Entity purchase agreement

Wait-and-see agreement

One-way buyout agreement

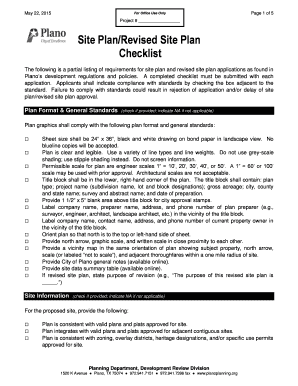

How to complete Buy Sell Agreement

Completing a Buy Sell Agreement involves the following steps:

01

Identify the triggering events that will activate the Buy Sell Agreement

02

Determine the valuation method for the business

03

Establish the terms and conditions for the sale or transfer of ownership

04

Draft the agreement with the help of legal counsel

05

Review and negotiate the terms with all co-owners

06

Execute the agreement and keep copies for all parties involved

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Buy Sell Agreement

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How are buy sell agreements structured?

A buy/sell agreement is generally structured in one of two ways — as a cross-purchase agreement or as a redemption agreement. A cross-purchase agreement is an agreement between individual members. In a funded cross-purchase agreement, each member purchases a life insurance policy on the life of every other member.

How do you write a buy-sell agreement?

Here is how buy-sell agreements work: Determine which events invoke a triggered buyout. Establish who has rights and purchase obligations. Identify the names and address of the purchasers. Set a purchase price or valuation with applicable discounts. Establish payment terms as well as their intervals.

What happens if you don't have a buy-sell agreement?

Having a buy-sell agreement establishes a clear plan to handle any of these events. Without one, a company could face major tax hassles down the road, as well as other financial and legal difficulties.

What are the four types of buy sell agreements?

There are four common buyout structures: Traditional cross purchase plan. Each owner who is left in the business agrees to purchase the co-owner's shares if that individual dies or leaves the business. Entity redemption plan. One-way buy sell plan. Wait-and-see buy sell plan.

What should a buy-sell agreement include?

What Should Be Included in a Buy and Sell Agreement? a list of triggering buyout events, including death, permanent disability, bankruptcy or retirement, etc. a list of partners or owners involved and their current equity stakes. a recent valuation of the company's overall equity.

What is the benefit of buy-sell agreement?

A buy/sell agreement gives employers peace of mind knowing that their business is in capable hands should they no longer be able or want to manage it. It also: Provides money to create a fair market value exchange. Promotes equitable and orderly transfer of wealth, ownership and management.

Related templates