Chapter 7 Bankruptcy Forms Packet

What is chapter 7 bankruptcy forms packet?

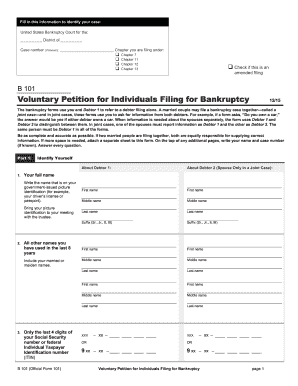

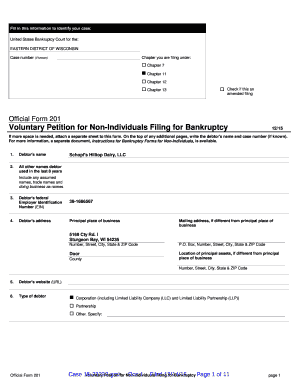

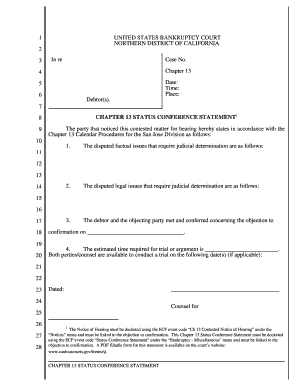

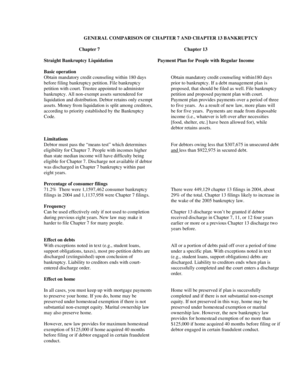

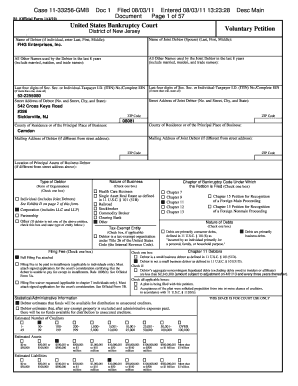

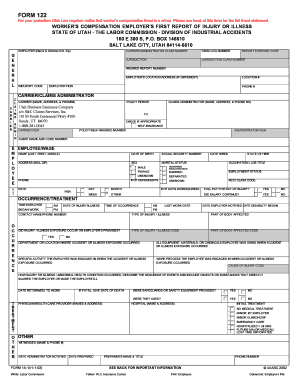

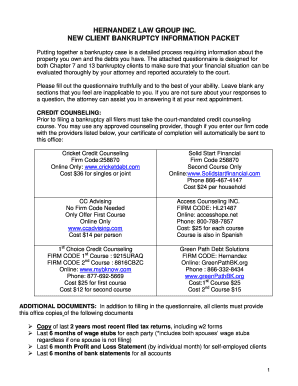

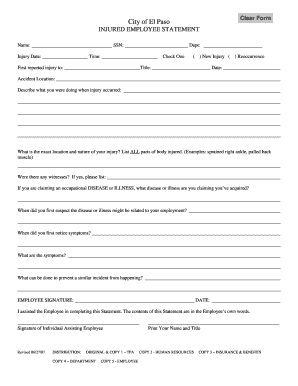

Chapter 7 bankruptcy forms packet refers to a collection of legal documents that individuals or businesses file when seeking relief from their debts through Chapter 7 bankruptcy. This packet typically includes forms such as the Voluntary Petition, Schedules A/B, C, and D, Statement of Financial Affairs, and more.

What are the types of chapter 7 bankruptcy forms packet?

The types of forms included in a chapter 7 bankruptcy forms packet may vary depending on the specific circumstances and jurisdiction. However, some common types of forms that are often included are:

How to complete chapter 7 bankruptcy forms packet

Completing a chapter 7 bankruptcy forms packet can be a complex process, but with careful attention to detail, it can be done effectively. Here are the steps you can follow to complete the packet:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.