Child Tax Credit Form

What is child tax credit form?

The child tax credit form is an official document used to determine the eligibility and amount of tax credit that a taxpayer can claim for their dependent child. This form requires detailed information about the child, including their age, relationship to the taxpayer, and social security number.

What are the types of child tax credit form?

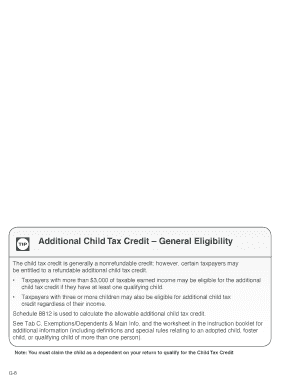

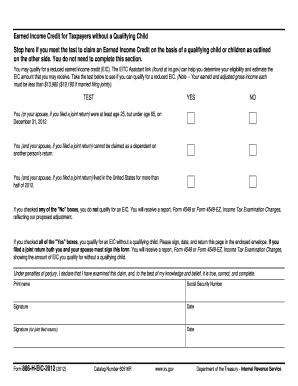

There are two main types of child tax credit forms: the Child Tax Credit (CTC) and the Additional Child Tax Credit (ACTC). The CTC is a non-refundable credit that can reduce the amount of federal income tax owed by the taxpayer, while the ACTC is a refundable credit that can provide a refund even if the taxpayer does not owe any tax.

How to complete child tax credit form

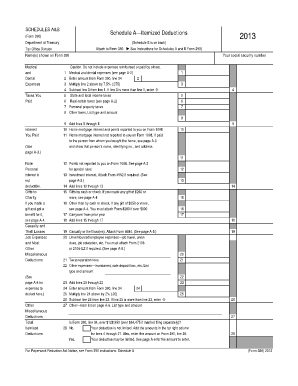

Completing the child tax credit form requires attention to detail and accurate information. Here is a step-by-step guide to help you complete the form:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.