What is corporate guarantee definition?

A corporate guarantee definition refers to a legally binding agreement where one company assumes the responsibility for fulfilling the financial obligations of another company in case of default. It serves as a form of security or assurance for creditors and can enhance the creditworthiness of the company. By providing a guarantee, a company agrees to fulfill the obligations on behalf of the borrower if the borrower fails to do so.

What are the types of corporate guarantee definition?

There are several types of corporate guarantee definitions that companies can consider based on their specific requirements and the nature of the transaction. The common types include:

Performance Guarantee: This type of guarantee ensures that a contractor will fulfill their contractual obligations.

Payment Guarantee: It guarantees the payment of a certain amount by the company if the debtor fails to pay.

Financial Guarantee: This type of guarantee ensures that the company will fulfill its financial obligations, such as loans or credit facilities.

Demand Guarantee: It assures the beneficiary that they will receive immediate payment on demand.

Secured Guarantee: In this type, the guarantee is backed by some form of collateral or security.

How to complete corporate guarantee definition

Completing a corporate guarantee definition involves the following steps:

01

Identify the parties involved: Clearly mention the names and roles of the guarantor and the beneficiary.

02

Specify the obligations: Describe the obligations of the borrower that the guarantor will assume if the borrower defaults.

03

Determine the scope and limitations: Define the maximum liability of the guarantor, any exclusions, and the duration of the guarantee.

04

Include governing law and jurisdiction: Specify the laws that will govern the guarantee and the jurisdiction for dispute resolution.

05

Review and sign: Thoroughly review the guarantee document, making sure all the details are accurate and agreed upon before signing.

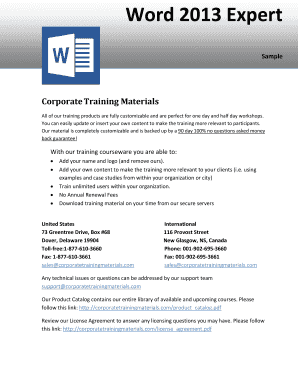

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.