Creditdebit Memo

What is Credit/Debit Memo?

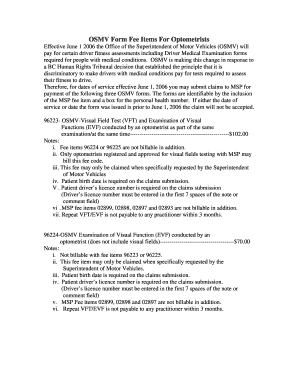

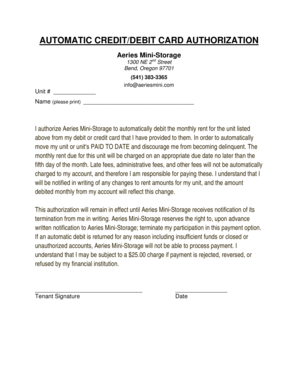

A Credit/Debit Memo is a document used in financial transactions to correct errors in billing or to record the adjustment of amounts owed by one party to another. It serves as a formal notification of the change in the payment terms or amount due.

What are the types of Credit/Debit Memo?

Credit/Debit Memos can be categorized into two main types:

Credit Memo: Issued by a seller to a buyer, typically to refund an overpayment or provide a credit for returned products.

Debit Memo: Issued by a buyer to a seller, usually to request a reduction in the amount owed due to issues like damaged goods or pricing discrepancies.

How to complete Credit/Debit Memo

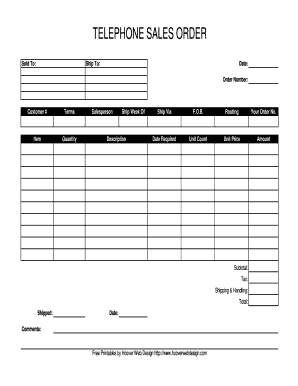

Completing a Credit/Debit Memo involves the following steps:

01

Fill in the details of the transaction, including the date, parties involved, and reason for the adjustment.

02

Specify whether it is a Credit Memo or Debit Memo and provide supporting documentation if necessary.

03

Calculate the correct amount to be adjusted and include any applicable taxes or fees.

04

Review the completed memo for accuracy before submitting it for approval.

05

Share the finalized Credit/Debit Memo with the respective party and keep a copy for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Creditdebit Memo

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you write a debit memo?

Creating a Debit Memo Customer's name, address, and communication details. Your Company's name, address, and communication details. Tax Details of your company as well as the other company. Item Description, Quantity, Rate per unit, Total Taxable value. Invoice Number and Invoice date. Details of the transactions.

What is debit memo?

Debit memos, also called debit notes, are corrections to invoices. If you accidentally submit an invoice that's too low, you can send a debit memo to correct it and increase the invoice after it's sent. The customer can then use the memo to adjust their books, as well.

What does credit memo mean?

A credit memo is an official written acknowledgement that money is owed back to a customer. When you need to create a refund for a client, you can create a credit memo, which is basically an invoice with a negative amount.

What is an example of a credit memo?

Example of a Credit Memo Assume that Seller Company had issued a sales invoice for $400 for 50 units of product that it shipped to Buyer Company at a price of $4 each. Buyer company informs Seller company that one of the units is defective. Seller company will then issue a credit memo for $4.

Is a debit memo a credit?

Debit Memorandum vs. A debit memorandum and a credit memorandum both notify customers about a change in their account status. A debit memo informs customers (or buyers) about why their account balance declined or why they owe more. Credit memos are the opposite: They note changes that increase an account balance.

How do you account for a credit memo?

In a seller's double-entry accounting system, a credit memo is recorded as a debit under the appropriate Revenue account and a credit under Accounts Receivable, which is the exact opposite of the original sales entry as the memo reduces the balance that the seller is now owed by the buyer.

Related templates