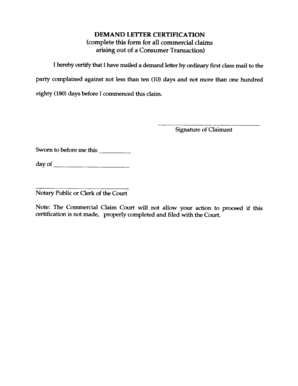

Demand Letter To Insurance Company

What is a demand letter to the insurance company?

A demand letter to the insurance company is a formal written document that outlines a claimant's request for compensation or reimbursement for damages or losses incurred. It is a crucial step in the insurance claim process and serves to communicate the claimant's expectations to the insurance company.

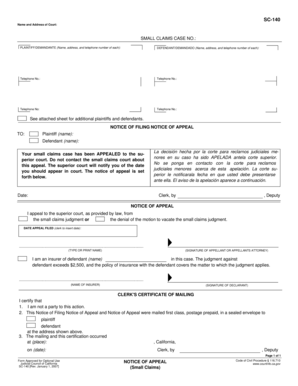

What are the types of demand letters to the insurance company?

There are several types of demand letters that can be sent to an insurance company depending on the nature of the claim. Some common types include:

Demand for Personal Injury Compensation

Demand for Property Damage Compensation

Demand for Medical Expenses Reimbursement

Demand for Lost Wages Compensation

How to complete a demand letter to the insurance company

Completing a demand letter to the insurance company can be done following these steps:

01

Introduce yourself and provide your contact information

02

Clearly state the purpose and intention of the letter

03

Describe the incident or accident in detail

04

Outline the damages or losses suffered

05

Provide supporting evidence, such as medical bills or repair estimates

06

State the amount of compensation or reimbursement requested

07

Set a deadline for a response from the insurance company

08

Thank the recipient for their attention and express your willingness to cooperate further

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out demand letter to insurance company

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you write a strong demand letter?

Frequently Asked Questions (FAQ) Type your letter. Concisely review the main facts. Be polite. Write with your goal in mind. Ask for exactly what you want. Set a deadline. End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand. Make and keep copies.

How do you write a good demand letter?

Frequently Asked Questions (FAQ) Type your letter. Concisely review the main facts. Be polite. Write with your goal in mind. Ask for exactly what you want. Set a deadline. End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand. Make and keep copies.

How long does an insurance company have to respond to you?

Generally, insurance companies are required to acknowledge and respond to any communication you attempt to make within 14 days of your claim.

What happens if insurance company doesn't respond to demand letter?

If an insurance company has still not responded to your demand letter, the next step may be to contact a legal representative and file a lawsuit. Be sure to understand the statute of limitations for your case. Once those run out, you could lose the right to sue.

What happens after you send a demand letter?

There's generally no set length of time to reach a settlement after a demand letter is sent. The sender gives the recipient a deadline. This is the time by which they expect the recipient to respond. Both parties can come to the table to form an agreement and settle the issue after the original demand letter is sent.

How long does it take for an insurance company to respond to a demand letter?

In the best-case scenario, the insurance company will respond to your demand letter within 30 days. However, you generally have to wait anywhere from a few weeks to a couple of months because no law sets a deadline.

Related templates