Direct Debit Request - Page 2

What is Direct Debit Request?

A Direct Debit Request is a financial authorization given by a customer to allow a company or organization to deduct funds automatically from their bank account. It is a convenient and hassle-free way to make payments, as it eliminates the need for manual transactions or remembering payment due dates.

What are the types of Direct Debit Request?

There are two main types of Direct Debit Requests:

Standard Direct Debit Request: This type of Direct Debit Request allows a company to collect fixed or variable amounts from a customer's bank account on a regular basis, such as monthly rent or utility bills.

Advance Notice Direct Debit Request: This type of Direct Debit Request requires the company to provide the customer with advance notice of the amount and date of each payment. This is commonly used for variable or irregular payments, such as mortgage repayments or insurance premiums.

How to complete Direct Debit Request

Completing a Direct Debit Request is a simple process that involves the following steps:

01

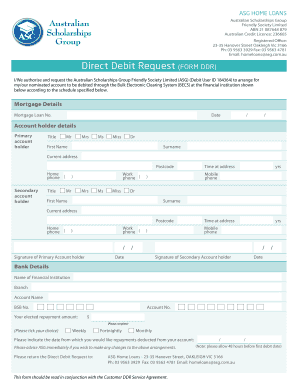

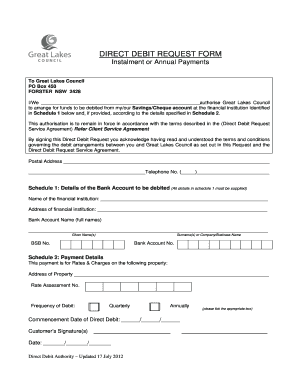

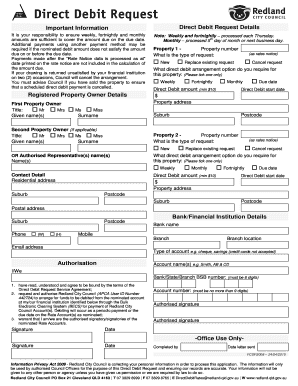

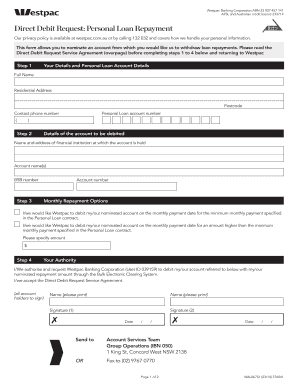

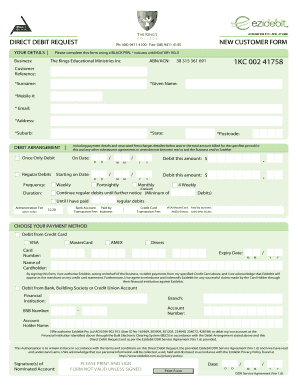

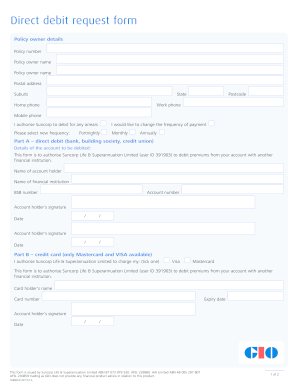

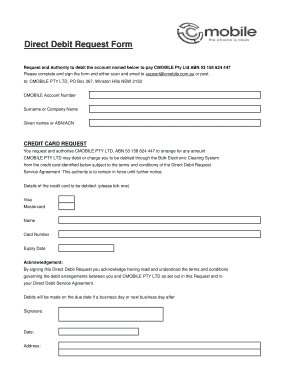

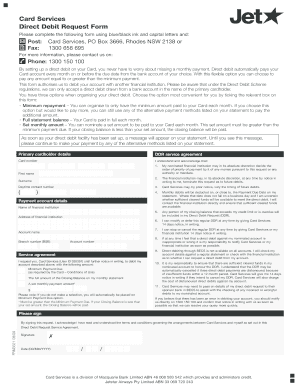

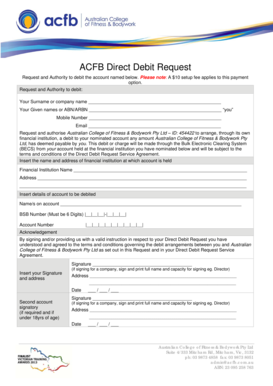

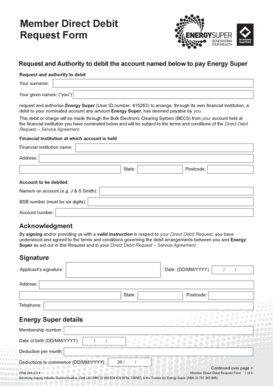

Fill out the Direct Debit Request form provided by the company or organization.

02

Provide your personal and bank account details accurately.

03

Read and understand the terms and conditions of the Direct Debit Request.

04

Sign and date the form to authorize the company or organization to initiate Direct Debit transactions from your bank account.

By using pdfFiller, you can easily create, edit, and share your Direct Debit Request form online. With unlimited fillable templates and powerful editing tools, pdfFiller ensures a seamless document management experience for all your financial needs.

Video Tutorial How to Fill Out Direct Debit Request

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a Direct Debit request form?

Things you should know. • By submitting a Direct Debit Request, you authorise and request us to arrange for funds to be debited from your nominated account.

How does Direct Debit request work?

A Direct Debit Request (DDR) is an authorisation from your customer to collect future payments from their bank account. Details of each authorisation are standardised and must include the following information: Future payments are authorised so you can collect set or variable amounts from your customer.

How does a Direct Debit instruction work?

A Direct Debit mandate gives service providers written permission to take payments from their customers bank accounts. Payments cannot be collected until the mandate has been signed and agreed by the customer. Direct Debits are the safest and most trusted method of collecting recurring payments.

How do I set up a Direct Debit to pay someone?

Usually, you fill in a form and send it to them, or set it up online or over the phone. They'll let your bank know. You can cancel a Direct Debit at any time by contacting your bank – you can sometimes do this through online banking.

How far in advance is a Direct Debit request?

Even though the customer has given permission for your business to take payments from them via Direct Debit, you still have to give “Advance Notice”. This is normally 10 working before a payment is to be taken, although you can agree shorter notice periods with the customer and your bank.

Can someone set up a Direct Debit with my bank details?

No. Only the account holder can set up the Direct Debit Instruction. In this instance the organisation concerned would forward a paper Direct Debit Instruction to you for authorisation.

Related templates