What is a donation receipt letter template?

A donation receipt letter template is a pre-designed document that helps organizations and individuals create a personalized receipt for a donation received. It serves as proof of the contribution made, providing the donor with a record for tax purposes and acknowledging their generosity.

What are the types of donation receipt letter templates?

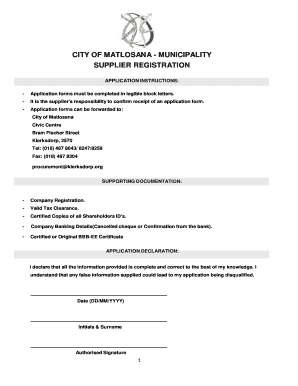

There are various types of donation receipt letter templates available to cater to different needs. Some common types include:

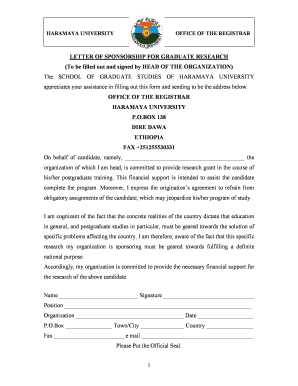

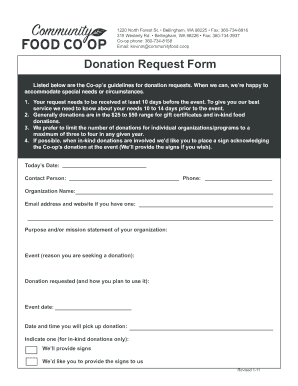

Standard donation receipt template: A basic template that can be customized with the organization's logo and details.

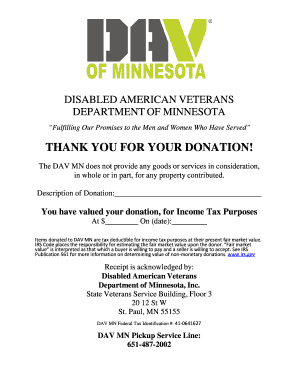

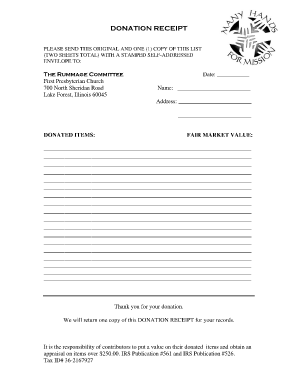

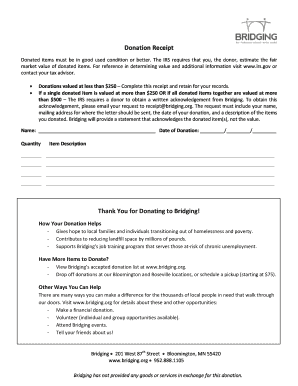

In-kind donation receipt template: Specifically designed for acknowledging non-cash items donated, such as goods or services.

Tax-deductible donation receipt template: Meets the requirements set by tax authorities to ensure donors can claim deductions on their taxes.

Event-specific donation receipt template: Tailored for specific fundraising events or campaigns, providing details about the event and its purpose.

Recurring donation receipt template: Ideal for acknowledging recurring or monthly donations, outlining the donor's commitment to sustainable giving.

How to complete a donation receipt letter template

Completing a donation receipt letter template is a straightforward process. Here are the steps to follow:

01

Start by opening the donation receipt letter template in a compatible software or online platform.

02

Replace the placeholder text with your organization's name, contact information, and logo.

03

Enter the donor's details, including their name, address, and contact information.

04

Specify the donation amount or description of the donated items.

05

Include the date of the donation and the intended purpose or project it will support.

06

Personalize the letter by expressing gratitude and highlighting the impact of the donor's contribution.

07

Review and proofread the completed letter to ensure accuracy.

08

Save the completed donation receipt letter as a PDF or print it for physical distribution.

09

Consider sending a digital copy via email to the donor for convenience.

At pdfFiller, we empower our users to easily create, edit, and share their documents online. With our unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor you need to efficiently manage and process your donation receipt letters.