Employee Payroll Change Form

What is employee payroll change form?

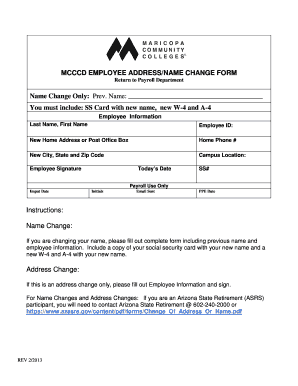

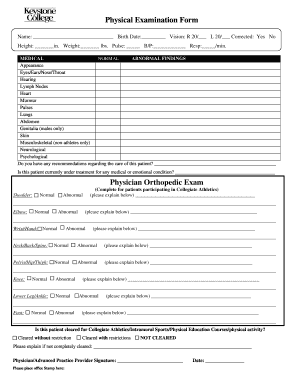

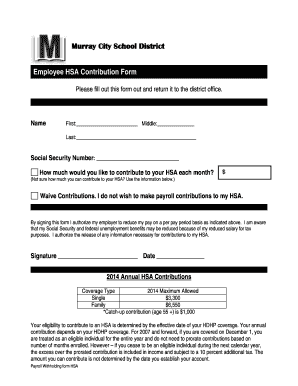

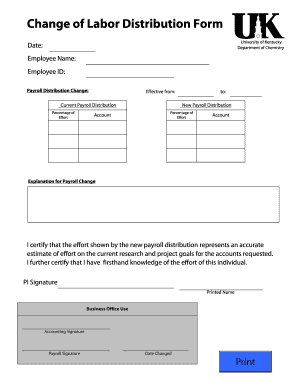

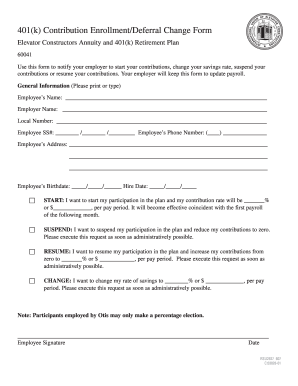

An employee payroll change form is a document used by organizations to record and process any changes in an employee's payroll information. It allows employers to update details such as salary, deductions, tax withholding, and other relevant information. This form is essential for maintaining accurate and up-to-date employee records and ensuring timely and accurate payroll processing.

What are the types of employee payroll change form?

There are several types of employee payroll change forms depending on the specific change being made. Some common types include:

How to complete employee payroll change form

Completing an employee payroll change form is a straightforward process. Follow these steps:

With pdfFiller, completing employee payroll change forms becomes even easier. Empowering users to create, edit, and share documents online, pdfFiller offers unlimited fillable templates and powerful editing tools. It is the only PDF editor users need to efficiently handle their document-related tasks.