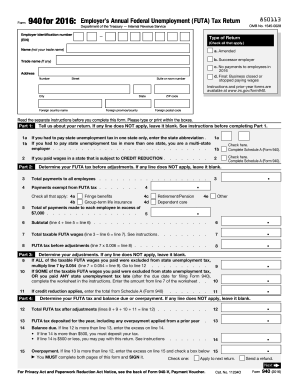

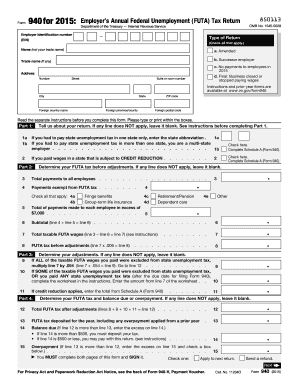

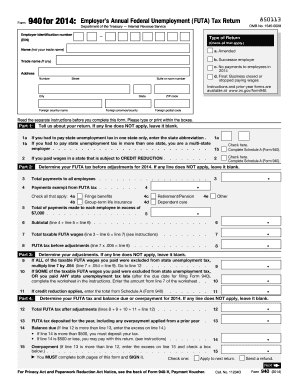

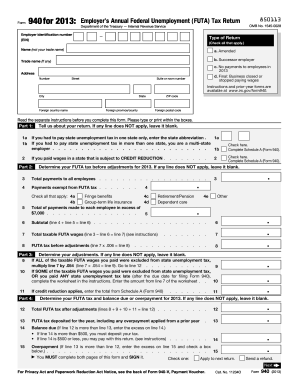

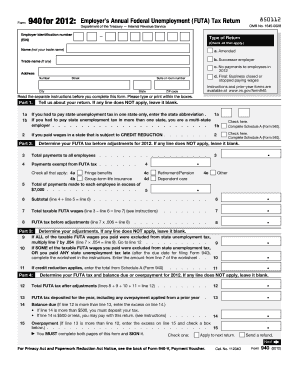

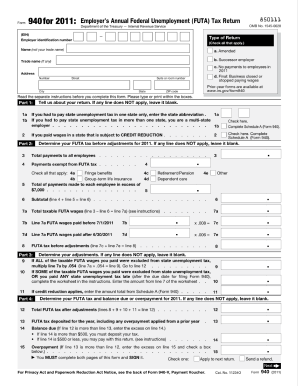

What is 940 Form?

The 940 Form is a federal tax document used by employers to report their annual federal unemployment tax liabilities. Employers are required to file this form to ensure compliance with the Internal Revenue Service (IRS) regulations. The form calculates the amount of unemployment taxes owed based on the wages paid to employees throughout the year.

What are the types of 940 Form?

There is only one type of 940 Form, which is the Employer's Annual Federal Unemployment (FUTA) Tax Return. This form is used by employers to report their federal unemployment tax liabilities for the year.

Employer's Annual Federal Unemployment (FUTA) Tax Return

How to complete 940 Form

Completing the 940 Form can be a straightforward process if you follow these steps:

01

Gather all necessary information, including the employer's identification number (EIN), the amount of wages paid to employees subject to federal unemployment tax, and any adjustments or credits.

02

Fill out the top section of the 940 Form, providing the employer's name, mailing address, and EIN.

03

Report the total wages subject to federal unemployment tax on line 3.

04

Calculate the amount of tax owed using the FUTA tax rate of 6% (subject to adjustments). Enter the tax amount on line 4.

05

Determine if any adjustments or credits apply, such as the FUTA tax credit for payments made to state unemployment programs. Enter any applicable amounts on lines 5 and 6.

06

Calculate the total FUTA tax due by subtracting any adjustments or credits from the tax amount on line Enter the result on line 7.

07

Check the information provided and ensure accuracy.

08

Sign and date the form, as required.

09

Submit the completed form to the appropriate IRS address.

10

Retain a copy of the form for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.