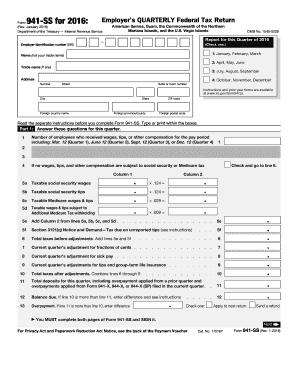

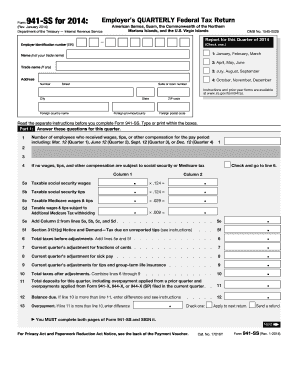

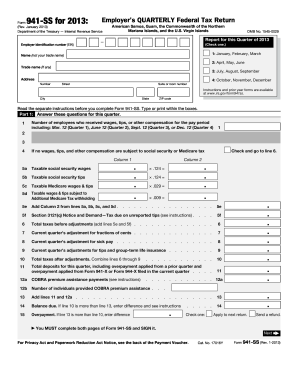

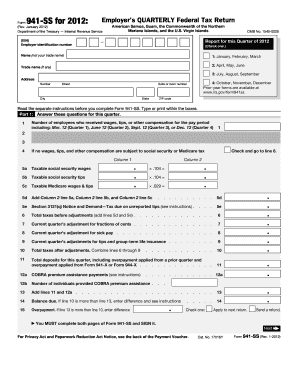

941-SS Form

What is 941-SS Form?

The 941-SS Form is a tax form used by employers who operate in U.S. territories such as American Samoa, Guam, Puerto Rico, the U.S. Virgin Islands, and the Commonwealth of the Northern Mariana Islands. It is specifically designed for employers who have employees subject to Social Security and Medicare taxes under the Federal Insurance Contributions Act (FICA), but are not required to withhold federal income tax.

What are the types of 941-SS Form?

There are two types of 941-SS Form that employers may need to file: quarterly and annual. The quarterly form, also known as Form 941-SS, is used to report the employer's share of Social Security and Medicare taxes for each quarter. The annual form, known as Form 944-SS, is an alternative to filing quarterly returns and is used by employers with an annual liability of $1,000 or less for Social Security and Medicare taxes.

How to complete 941-SS Form

Completing the 941-SS Form is a straightforward process. Here's a step-by-step guide on how to complete it:

By following these steps, you can easily complete the 941-SS Form and fulfill your tax obligations. If you need assistance or want a convenient online solution, consider using pdfFiller. With pdfFiller, you can create, edit, and share documents online, including unlimited fillable templates. Its powerful editing tools make it the ultimate PDF editor for all your document needs.