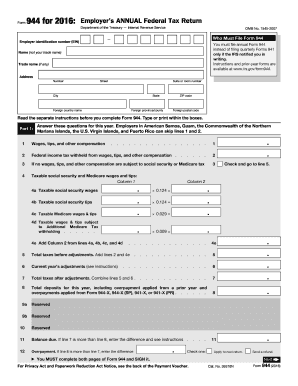

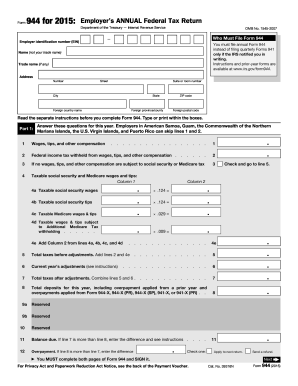

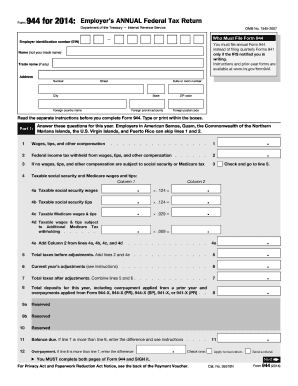

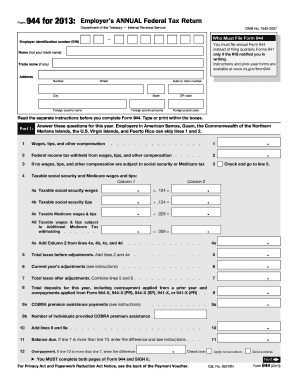

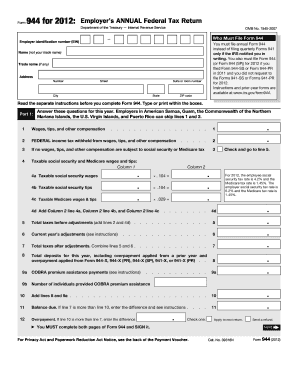

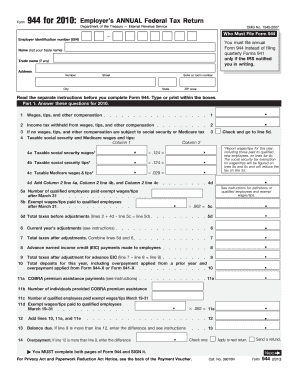

944 Form

What is 944 Form?

The 944 Form is a tax form that is used by small businesses to report their annual payroll taxes to the Internal Revenue Service (IRS). It is specifically designed for businesses that have an annual payroll tax liability of $1,000 or less. By using the 944 Form, small businesses can simplify their tax reporting process and avoid the need to file quarterly payroll tax returns.

What are the types of 944 Form?

There is only one type of 944 Form, which is the Annual Federal Tax Return for Small Businesses. This form is used to report the employer's annual payroll tax liability, including federal income tax withheld from employees' wages, social security and Medicare taxes, and any additional taxes such as the Additional Medicare Tax and/or the Credit for Paid Family and Medical Leave.

How to complete 944 Form

Completing the 944 Form can be done in a few simple steps. Here's how:

pdfFiller is a powerful online tool that can help you easily complete and file your 944 Form. With pdfFiller, you can create, edit, and share documents online, including fillable templates. Its advanced editing tools make it the perfect PDF editor for all your document needs.